Introduction to OpenFuture World

The financial world is going through big changes. Traditional systems, which used to rely on banks and financial institutions, are being replaced by a new wave of technology-driven services. This change is called OpenFuture World, a term that highlights the growing trend of openness in finance. OpenFuture World is reshaping the way we interact with money, manage payments, and handle financial services. It allows for more collaboration between different financial players and gives customers more control over their own data.

Understanding OpenFuture World

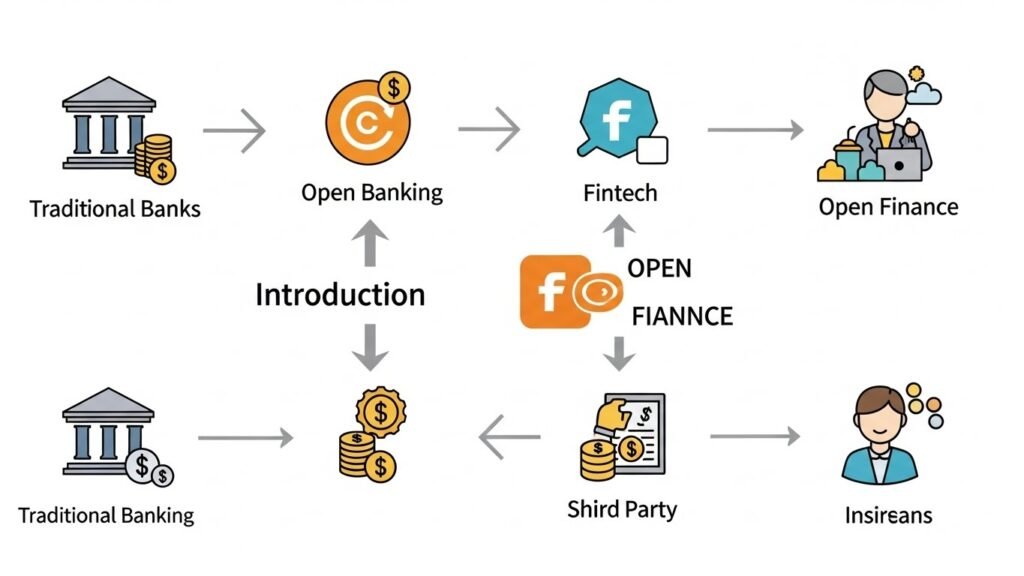

In the past, financial services were controlled by a few large banks and institutions. They had all the power over your personal data, payments, and savings. But now, with OpenFuture World, things are changing. Open Banking and Open Finance are two major concepts that are making this possible.

What is OpenFuture World?

OpenFuture World is about breaking down the walls between traditional financial systems and new technologies. By using open APIs (Application Programming Interfaces), different financial services can share data and work together. This means that you can use multiple services from different providers seamlessly. You no longer need to rely on just one bank for everything.

The Evolution of Open Banking

Open Banking is the first step towards OpenFuture World. It allows third-party services to access your banking data, but only if you give permission. For example, an app can check your bank account to offer better savings plans or help you make payments more efficiently. This evolution makes the financial world more connected and responsive to your needs.

Fintech and Open Banking Definition

Fintech refers to financial technology, which includes all the tools and services that use technology to make financial services easier and more accessible. Open Banking, a subset of fintech, allows third-party services to access banking data to create innovative solutions for consumers.

The Shift in Financial Systems

The shift from traditional banking systems to OpenFuture World is driven by a desire for more efficiency, better customer experiences, and innovative financial services. With new technologies like blockchain and data portability, the financial sector is becoming more decentralized, which helps reduce costs and increase trust.

The Expansion to Open Finance

While Open Banking focuses mainly on banks, Open Finance expands this concept to other financial services, such as insurance, pensions, and investments. Open Finance allows for a broader range of data sharing across different sectors, helping to create a more connected financial ecosystem.

The Role of Open Finance in the Global Economy

Open Finance plays a major role in the global economy by giving consumers and businesses more choices. By increasing transparency and allowing greater access to financial data, Open Finance promotes competition, drives innovation, and helps to lower costs for customers. It enables people to manage all their financial services in one place, making life simpler.

Embedded Finance and Data Portability

How Embedded Finance is Transforming Traditional Models

Embedded finance is a key part of OpenFuture World. It refers to financial services that are integrated into non-financial products. For example, when you buy something online and have the option to pay later, that’s embedded finance. This makes financial services more accessible and convenient by allowing them to be part of your everyday experiences.

Data Portability

Data portability means that you can take your financial data from one provider to another easily. This allows you to move your information without any hassle, which can help you get better deals or more personalized services. Data portability is a key feature in OpenFuture World, as it gives consumers more control over their financial information.

OpenFuture World’s Impact on Global Finance

OpenFuture World is changing the way the global financial system works. By breaking down barriers between different services and allowing more collaboration, it’s creating a more inclusive, transparent, and secure financial environment. This transformation affects banks, tech companies, regulators, and consumers alike.

Open Banking and Open Finance

Together, Open Banking and Open Finance create a more connected financial world. Open Banking shares data between banks and third-party providers, while Open Finance includes all types of financial services. Together, they offer more choice, better services, and greater transparency to customers.

Differences Between Open Banking and Open Finance

While Open Banking primarily focuses on banks and their data, Open Finance is broader and includes all types of financial services. Open Finance connects not just banks but also insurance companies, investment firms, and pension providers. It allows for a complete view of a person’s financial situation, helping them make better decisions.

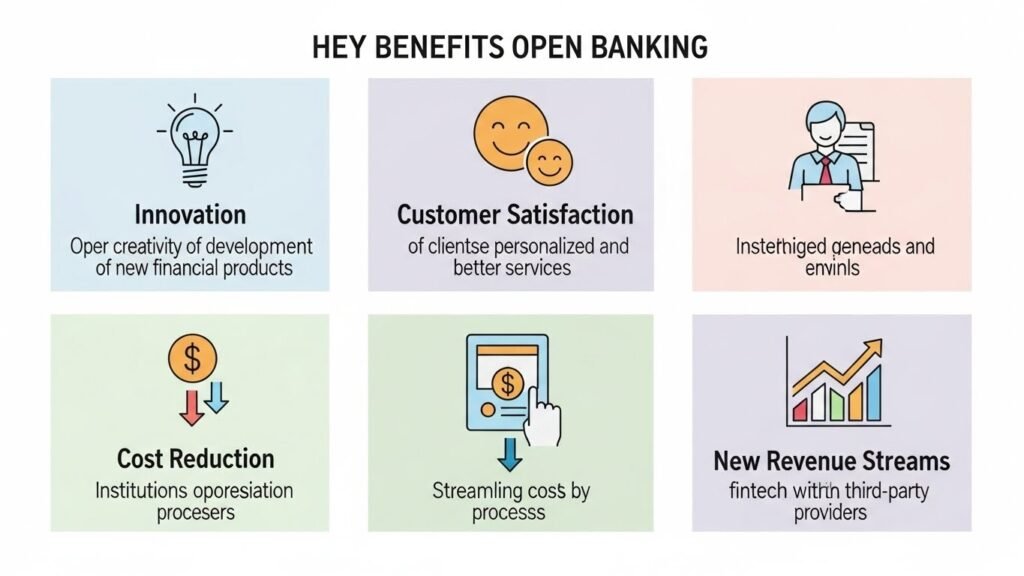

Benefits of Open Banking to Financial Institutions

Open Banking brings many benefits to financial institutions. By allowing third-party providers to access banking data, it encourages innovation and the development of new services. Financial institutions can also reduce costs, improve customer satisfaction, and access a larger customer base by partnering with tech companies.

Global Reach and Coverage

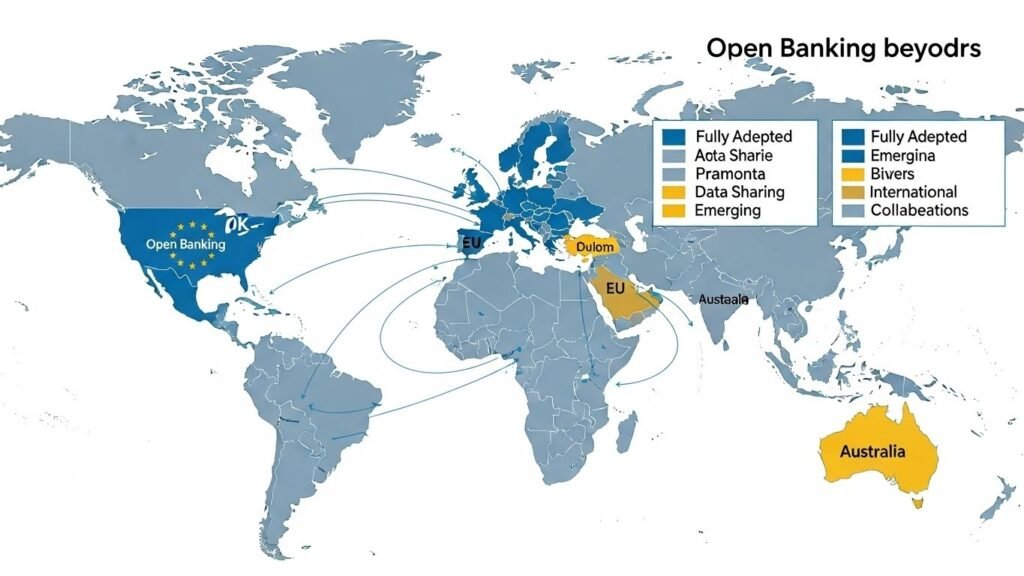

Expanding Open Banking Beyond Borders

Open Banking is not just a trend in one country; it’s a global movement. Many countries, such as the UK and European Union, have already adopted Open Banking standards. The goal is to create a global ecosystem where financial data can be shared seamlessly across borders. This will help improve financial services and create more opportunities for international trade and investment.

Regional Variations in Open Banking Models

While the concept of Open Banking is global, its implementation varies from country to country. Different regions have different regulations, which affect how Open Banking operates. For example, the European Union has strict rules around data protection, while other regions may have more relaxed policies.

Strategic Partnerships and Collaborations

The growth of Open Banking depends on collaboration between banks, fintech companies, and regulators. By working together, they can create a secure and efficient financial ecosystem. Partnerships between these groups help bring new ideas and services to market quickly.

INVYO: Making Data Actionable

INVYO is one of the companies making data actionable in OpenFuture World. By using data aggregation and analytics, INVYO helps financial institutions make better decisions. It provides tools that allow financial services to use data more effectively, making them smarter and more responsive to customer needs.

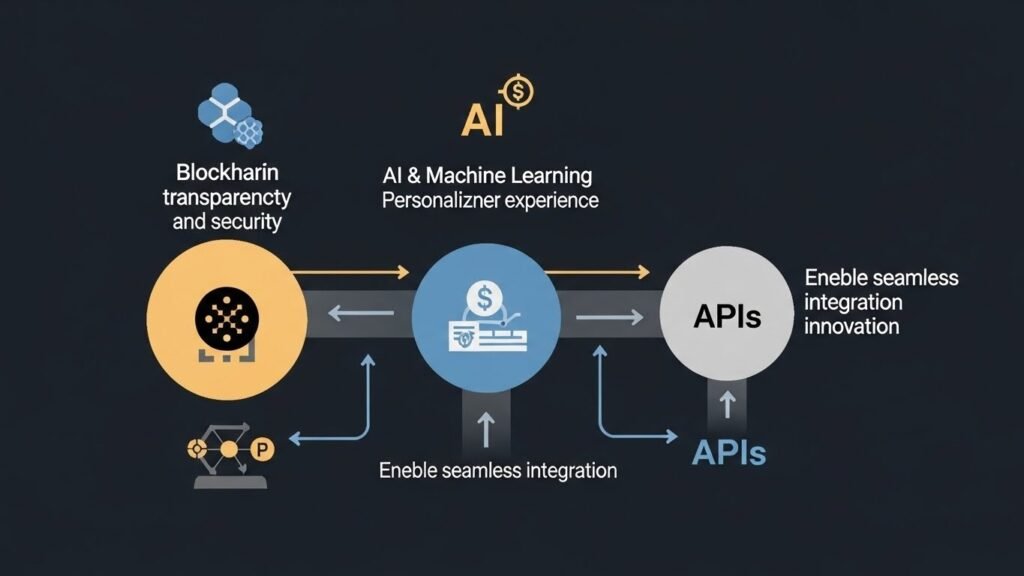

Smarter Contracts: Securing Consent with Blockchain

Blockchain technology is playing an important role in OpenFuture World. One of the key uses of blockchain is in creating smarter contracts. These contracts automatically execute actions when certain conditions are met, without the need for human intervention. Blockchain also provides a secure way to share data, which is crucial for protecting privacy in financial services.

FDATA: Driving Global Progress

FDATA (Financial Data and Technology Association) is an important organization in OpenFuture World. It advocates for open data standards and works with regulators and financial institutions to drive progress in Open Banking. FDATA’s efforts are helping shape the future of Open Finance by ensuring that data sharing is done in a secure and compliant way.

Why OpenFuture World Matters for Financial Services

OpenFuture World is not just about new technology; it’s about transforming the entire financial services industry. It’s changing the way consumers interact with financial products and services, giving them more control over their money and data. It also helps financial institutions provide better services and compete in an ever-changing global market.

A Shift in Global Perspective

The traditional view of banking and finance was all about institutions having control over financial services. OpenFuture World is shifting this perspective. It focuses on making financial services more open, collaborative, and accessible. By using technology and open standards, it allows consumers to control their financial data and decide how they want to use it.

How Open Banking is Shaping Global Finance

Open Banking is a key part of this shift. It allows consumers to share their banking data with third-party providers, giving them access to a wider range of services. This openness is leading to the development of new financial products and services that are better suited to the needs of modern consumers. It also encourages innovation, as more players enter the market and compete to offer better solutions.

Building Bridges Across Borders

One of the most exciting aspects of OpenFuture World is its potential to create cross-border financial collaboration. As more countries adopt open banking and open finance, the global financial system becomes more connected. This can lead to greater financial inclusion, as people in different parts of the world can access the same financial services and products, regardless of where they live.

Key Trends and Players Shaping the Open Banking Ecosystem

There are several trends and players that are driving the Open Banking revolution. Technology companies, fintech startups, and traditional banks are all playing a part. The rise of challenger banks, like Revolut and Monzo, shows how new players are pushing the boundaries of traditional banking. These companies are using Open Banking to offer consumers more flexible, digital-first services.

Role of Technology in Open Banking Transformation

Technology is at the heart of Open Banking. With the help of APIs, cloud-based platforms, and decentralized networks like blockchain, financial services can now be offered more efficiently. These technologies help streamline processes, reduce costs, and improve customer experience. Additionally, with the rise of AI and machine learning, financial institutions can now offer more personalized services to customers.

Leading Financial Technology Providers

There are several major players in the fintech space that are helping shape the future of Open Banking. Companies like Plaid, TrueLayer, and Mastercard are leading the way in offering open API platforms that connect consumers to a wide range of financial services. These companies are working with banks and fintech startups to create a seamless ecosystem that benefits everyone involved.

Driving Innovation Through Open Technology

Open technology is driving innovation across all sectors of the financial industry. By making financial services more accessible and easier to integrate, open technologies help to bring new ideas to market faster. Open APIs allow for the rapid development of new applications and services, leading to better options for consumers.

The Power of Decentralization

Decentralization is a key principle in OpenFuture World. By moving away from centralized control by banks and governments, Open Banking and Open Finance allow for more peer-to-peer interactions. This helps reduce the risk of monopolies and gives consumers more choices. It also enables better competition, which drives innovation and improves financial products and services.

Decentralized Finance (DeFi) and Its Influence on Open Banking

DeFi is a movement that is revolutionizing financial services by using blockchain technology. It allows people to borrow, lend, and trade financial assets without intermediaries like banks. DeFi is influencing Open Banking by encouraging financial services to become more transparent and decentralized. As more people adopt DeFi, traditional financial services will need to adapt or risk being left behind.

Open Standards and Interoperability

For Open Banking to succeed, there needs to be a common set of standards that all players can follow. Open standards allow different financial institutions and tech companies to work together more effectively. Interoperability, which refers to the ability of different systems to communicate with each other, is also essential. By ensuring that different platforms can work together seamlessly, consumers can access a wider range of services, no matter which provider they choose.

Ensuring Seamless Integration Across Platforms

One of the biggest challenges in Open Banking is making sure that all the different platforms and services can work together. Open standards and interoperability are key to solving this problem. By using common protocols and technologies, Open Banking can ensure that data flows smoothly between different financial institutions and third-party providers. This makes it easier for consumers to manage their finances across different services.

The Role of Community in Shaping the Future

In OpenFuture World, the role of the community is more important than ever. Consumers are no longer just passive users of financial services—they are active participants in the ecosystem. By sharing their data and using different services, they help shape the future of financial technology. Financial institutions also need to listen to their customers and respond to their needs in real-time, creating a truly customer-driven ecosystem.

From Users to Stakeholders

As OpenFuture World evolves, consumers are becoming stakeholders in the financial ecosystem. By using their data to access better financial services, they have more influence on the market. Financial institutions and tech companies must focus on delivering value to consumers in order to build trust and loyalty.

The Increasing Role of Consumers in Financial Innovation

Consumers are playing a major role in driving financial innovation. As they demand more control over their financial data and services, companies are responding by creating more flexible and personalized products. The increasing role of consumers in the innovation process is helping to create a financial ecosystem that is more responsive to their needs.

Education and Empowerment

For OpenFuture World to succeed, it’s crucial to educate consumers about how these new systems work and how they can benefit from them. By empowering consumers with knowledge, they will be more likely to adopt these new services. Financial literacy programs and educational resources can help consumers understand the benefits and risks of Open Banking and Open Finance, leading to more widespread adoption.

How Educating Consumers Drives Adoption

Educating consumers is key to driving the adoption of Open Banking and Open Finance. When people understand how these systems work and how they can benefit from them, they are more likely to trust and use them. By providing clear, easy-to-understand information about these technologies, financial institutions can help their customers make informed decisions.

The Future of OpenFuture World and Open Finance

As we look toward the future, OpenFuture World is expected to continue growing, driving more innovation, and transforming the financial industry. The potential for Open Banking and Open Finance is vast, and their influence on the global financial ecosystem will only increase. With the right regulations, technology, and collaborations, OpenFuture World will create a more accessible, efficient, and customer-friendly financial system.

Vision for the Next Decade

In the next decade, we can expect Open Banking and Open Finance to become the norm across the globe. Financial services will be more personalized, accessible, and secure. Technologies like artificial intelligence, blockchain, and machine learning will continue to improve, enabling financial services to be even more tailored to individual needs. By leveraging data and technology, financial institutions will be able to offer new, innovative services that were once unimaginable.

Predictions for the Growth of Open Finance

As Open Banking expands into Open Finance, we will see an increase in the variety of financial services available. Insurance, pensions, and investment services will become part of the open financial ecosystem, making it easier for consumers to manage all their financial needs in one place. The rise of fintech companies and challenger banks will continue to push traditional banks to innovate and offer better services. Open Finance will also promote financial inclusion, allowing people from all backgrounds to access affordable financial products.

Key Drivers of Change in the Financial Industry

There are several key drivers that will continue to push the financial industry toward OpenFuture World. These drivers include advancements in technology, changing customer expectations, and the need for greater transparency and security in financial services. Let’s explore these factors in more detail.

Technology Advancements

The rapid development of new technologies, such as blockchain, AI, and machine learning, is one of the biggest drivers of change in the financial industry. These technologies make financial services more efficient, secure, and accessible. Blockchain, for example, ensures that transactions are transparent and secure, while AI can help personalize services and improve customer experience.

Changing Customer Expectations

Customers today expect more from their financial services. They want convenience, personalization, and control over their data. OpenFuture World addresses these expectations by giving consumers more power in managing their financial information and providing them with better, more personalized services. As customers demand more flexible options, financial institutions must adapt to remain competitive.

Need for Greater Transparency and Security

As financial services become more open and connected, there is an increasing need for strong security measures to protect consumers’ personal and financial data. With the rise of digital banking and data sharing, ensuring privacy and security has become a top priority. Blockchain and advanced encryption methods, such as TLS and OAuth 2.0, are helping to enhance the security of Open Banking systems.

Challenges on the Road Ahead

While OpenFuture World offers many benefits, there are still challenges that must be addressed before its full potential can be realized. These challenges include balancing openness with security, overcoming privacy concerns, and ensuring adoption by both traditional banks and customers.

Balancing Openness with Security

One of the biggest challenges in OpenFuture World is ensuring that data sharing remains secure. Open Banking allows third-party providers to access banking data, but this also creates risks related to fraud and unauthorized access. Financial institutions and regulators must work together to create secure systems that protect consumers’ personal information while still enabling the openness that Open Banking offers.

Addressing Privacy and Cybersecurity Concerns

With the increasing amount of personal data being shared across financial services, privacy and cybersecurity concerns are at the forefront. It’s essential that regulators, fintech companies, and financial institutions ensure compliance with privacy laws and security standards. Strong encryption, multi-factor authentication, and consent management tools are necessary to protect consumers from data breaches and fraud.

Adoption and Awareness

One of the key factors to the success of OpenFuture World is the widespread adoption of Open Banking and Open Finance. However, traditional banks, consumers, and even fintech companies face barriers to adoption.

Overcoming Barriers to Adoption in Traditional Banks

Traditional banks may be hesitant to adopt Open Banking due to concerns about security, competition, and the costs of implementing new technology. To overcome these barriers, banks will need to see the long-term benefits of Open Banking, such as increased customer loyalty, new revenue streams, and improved customer experiences. Collaboration with fintech companies and embracing innovation will be crucial for traditional banks to remain relevant.

Raising Consumer Awareness

For OpenFuture World to thrive, consumers need to be aware of the benefits of Open Banking and Open Finance. Many people are still unfamiliar with these concepts, and without education, they may be reluctant to share their data or try new financial services. Financial institutions, fintech companies, and regulators must work together to raise awareness and educate consumers about the advantages of these new systems.

Conclusion: A Future Built Together

OpenFuture World is creating a more inclusive, innovative, and transparent financial ecosystem. By embracing Open Banking and Open Finance, we are building a future where consumers have more control over their financial data and can access better services. Collaboration between banks, fintech companies, and regulators will be key to overcoming the challenges ahead and ensuring the continued success of OpenFuture World.

Collaborative Growth and Global Transformation

The transformation to OpenFuture World will not happen overnight. It will require collaboration across industries and borders. By working together, we can create a financial ecosystem that is more inclusive, secure, and responsive to the needs of consumers. The future of finance is open, and with the right approach, we can ensure that it benefits everyone.

Preparing for the Next Era of Open Banking

As we prepare for the next era of Open Banking and Open Finance, it’s important to focus on the drivers of change, the challenges ahead, and the potential for global collaboration. By continuing to innovate, educate, and collaborate, we can build a financial world that is more connected, more inclusive, and more transparent.

FAQs

What is OpenFuture World?

OpenFuture World is the transformation of the global financial system, driven by Open Banking and Open Finance, which allow for better collaboration, transparency, and customer control over financial data.

How does Open Banking benefit consumers?

Open Banking benefits consumers by giving them more control over their financial data, enabling them to access more personalized and affordable financial services.

What are the challenges of Open Banking?

The main challenges of Open Banking include ensuring data security, overcoming privacy concerns, and getting both traditional banks and consumers to adopt new systems.

How does blockchain enhance Open Banking?

Blockchain provides a secure way to share data, ensuring transparency and trust in transactions. It also supports smarter contracts and strengthens data security.

Why is consumer education important in Open Banking?

Educating consumers helps them understand the benefits and risks of Open Banking, which can lead to greater adoption and better financial decision-making.