Introduction to the New Jersey Exit Tax

If you are planning to sell property in the Garden State and move out, you will quickly hear about the dreaded NJ exit tax. This term often causes immediate confusion and worry for homeowners. Many sellers assume this is an additional, punitive levy simply for leaving the state. That assumption is thankfully incorrect.

The NJ exit tax is, in reality, a significant misnomer. It is not a separate, unique state tax or penalty. Rather, the “tax” is actually a mandatory prepayment (or withholding) of the estimated New Jersey capital gains tax you will ultimately owe on the property sale. The state enacted this measure to ensure it collects its due before the seller leaves its jurisdiction. The required amount is held in escrow by the settlement agent until you file your final New Jersey income tax return.

Purpose and Origin

The legislation establishing this requirement was enacted in 2004. Prior to this, many individuals who sold property and moved out of state simply failed to file a final New Jersey tax return. This lack of final filing resulted in significant tax evasion by non-resident property owners or individuals who relocated immediately after a sale.

The law was designed to prevent this issue by creating a mechanism to secure the estimated tax liability upfront. This system forces the seller to address their potential New Jersey income tax liability before the county clerk can record the deed. While the process can be inconvenient and intimidating, its objective is simple: secure the state’s share of the profit made on the sale of property located within its borders.

Who is Subject to the Prepayment

The requirement to make this estimated tax prepayment applies to a specific group of sellers. Generally, any seller of New Jersey real property is subject to the withholding requirement unless they can successfully claim an exemption.

- Non-residents of New Jersey: If you are legally considered a non-resident at the time of the sale, you must comply.

- Intending Movers: If you plan to move out of state immediately after the closing, you are subject to the rule.

- Part-Year Residents: New Jersey treats part-year residents as non-residents for the purpose of this withholding requirement.

- Property Type: The rule applies regardless of the property type. It includes a primary residence, a second home, an investment property, or a rental property.

Determining Residency Status for Tax Liability

Residency status is the most critical factor in determining if you must pay the NJ exit tax prepayment. Exemptions and closing requirements differ substantially based on whether the seller is a resident or a non-resident. Establishing your status clearly is the first step in managing this tax obligation.

Definition of a New Jersey Resident

For the purpose of selling property, a New Jersey resident is defined as an individual who sells a home in the state and maintains residency within the state after the sale. If you are selling one home and moving to another home within New Jersey, you qualify as a resident and can claim an exemption from the withholding.

Definition of a New Jersey Nonresident

A New Jersey non-resident is an individual who sells property in the state and subsequently establishes residency out of state. As noted, the state also legally considers part-year residents as non-residents for this specific withholding purpose. The key concept here is intent: where do you intend to make your permanent home immediately following the sale?

Establishing Non-Resident Status for Tax Purposes

If you are moving out of New Jersey, you have the burden of proving to the state that you have legally established a new domicile. This process is crucial because if you fail to establish non-resident status convincingly, New Jersey may continue to hold you liable for state income taxes. To legally solidify non-resident status and avoid future NJ income tax liability, you must clearly sever ties with the state.

Key factors the New Jersey Division of Taxation may examine to determine if you have abandoned your old domicile include:

- Principal Home: Where is your new main home located, and is it used as your “home”?.

- Time Spent: Where do you spend the majority of your time? This is often the most important factor.

- Vital Interests: Where are your most important personal and financial activities centered?.

To successfully establish non-residency, you should take several specific actions:

- Change your driver’s license and vehicle registration to the new state immediately.

- Register to vote in the new state and cancel your New Jersey registration.

- Change the address on all banking, investment, and financial accounts.

- Establish new relationships with doctors, dentists, and other professionals in the new state.

- Move the bulk of your personal possessions to the new residence.

Taking these steps helps demonstrate a clear and convincing intent to abandon your New Jersey domicile permanently.

Calculating the Estimated Tax Prepayment (Withholding)

The actual calculation of the NJ exit tax prepayment is based on whichever of two specific figures is greater. It is essential to understand this formula, as the 2% minimum can often result in a required withholding even when the actual capital gain tax is low or non-existent.

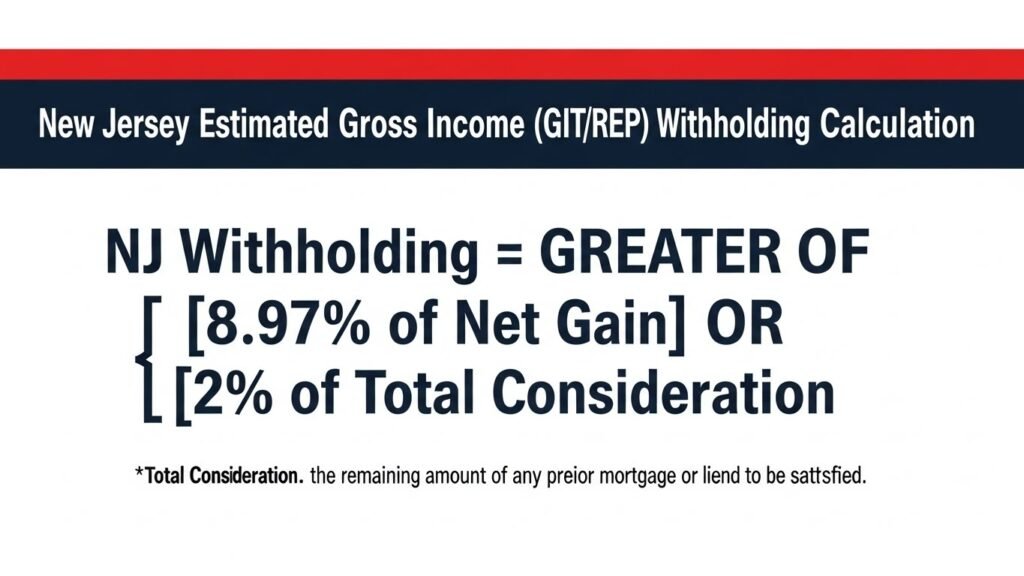

The two statutory options for calculating the withholding are:

- Option 1: 8.97% of the total profit (taxable capital gain) made on the sale.

- Option 2: 2% of the total sales price (total consideration).

The closing agent must withhold the higher of these two calculated amounts. The maximum percentage of 8.97% is derived from New Jersey’s highest income tax bracket.

For example, on a $500,000 sale with a $50,000 profit:

| Calculation | Formula | Amount | Result |

| Option 1 (Gain) | $50,000 profit $\times$ 8.97% | $4,485 | Lower |

| Option 2 (Price) | $500,000 price $\times$ 2% | $10,000 | Higher (Required Prepayment) |

In this scenario, even though the actual tax owed on the gain might be less than $4,485, the seller must remit $10,000 at closing.

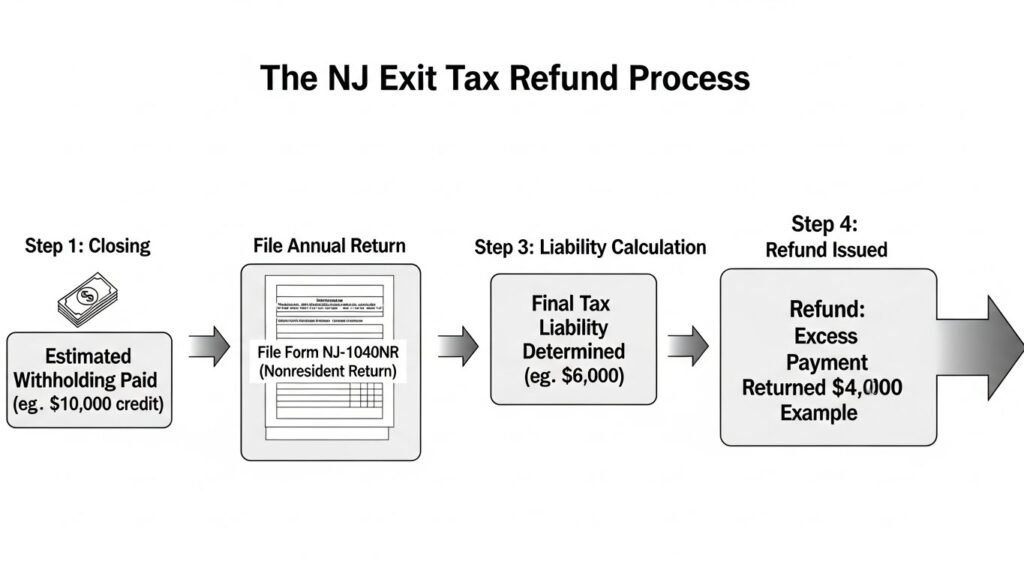

Final Settlement

The estimated prepayment amount is not the final tax bill. It is held in escrow and applied as a credit against your actual New Jersey income tax liability for that year. When you file your New Jersey Non-Resident Income Tax Return (Form NJ-1040NR) for the year of the sale, you report the actual gain or loss. If the estimated payment exceeds your final liability, you will receive a refund for the overpayment.

Determining Profit and Adjusted Cost Basis

Accurately calculating the profit, or capital gain, is crucial because it determines the amount used in Option 1 of the withholding calculation. The state’s definition of profit follows general federal tax rules.

- Profit (Capital Gain): Calculated as Net Proceeds minus Adjusted Basis.

- Net Proceeds: This is the final sale price minus the costs associated with the sale. These costs include:

- Real estate agent commissions.

- Attorney fees.

- Title insurance.

- Realty Transfer Fees (RTF).

- Other expenses directly associated with closing the sale.

- Adjusted Basis: This is often the most complex number to determine, but it is critical for legally reducing your taxable gain. It represents the total amount you have invested in the property over your ownership period.

- Original Cost: The purchase price paid for the property.

- Acquisition Costs: Certain initial settlement costs, such as title insurance, recording fees, and legal fees paid at the time of purchase.

- Capital Improvements: The cost of any major additions or improvements made over time.

Distinguishing Capital Improvements from Repairs

The distinction between a capital improvement and a routine repair is vital for maximizing your adjusted basis. Only capital improvements can be added to the basis to reduce taxable gain.

- Capital Improvements are costs that materially add to the value of the property, prolong its useful life, or adapt it to new uses. Examples include: adding a deck, installing a new roof, replacing a heating system, installing central air conditioning, or remodeling a kitchen or bathroom.

- Routine Repairs are expenses necessary to maintain the property in its current condition but do not increase its value or life. Examples include fixing a leaky faucet, painting a room, or replacing broken window glass.

Sellers must keep detailed, verifiable records (receipts, canceled checks, invoices) for all capital improvements to substantiate the increased cost basis.

The Mechanics of the Real Estate Prepayment Process

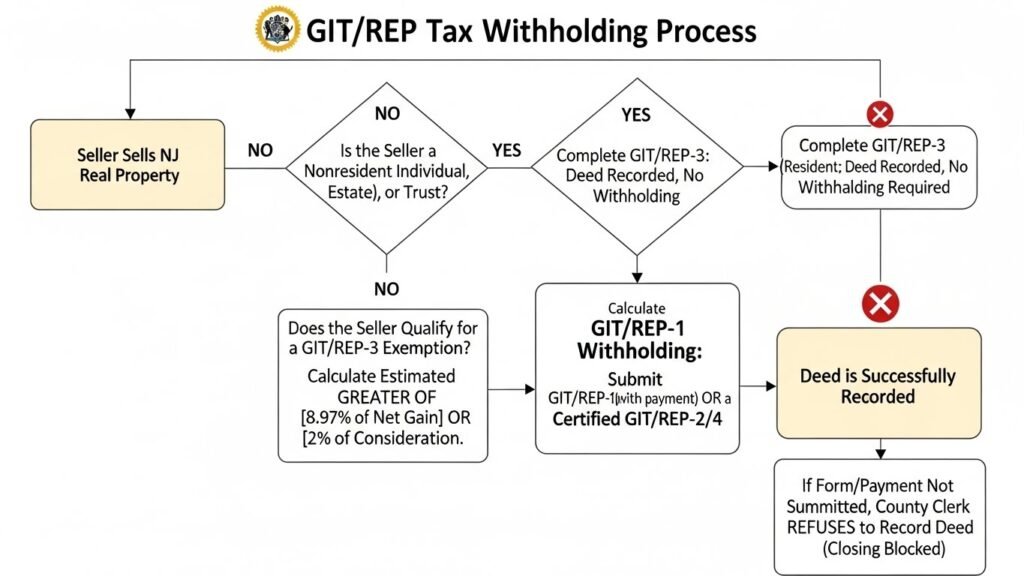

The mechanism for collecting the NJ exit tax prepayment involves specific forms and mandatory closing procedures. The system is designed to intercept the funds before they reach the seller’s pocket.

Required Forms

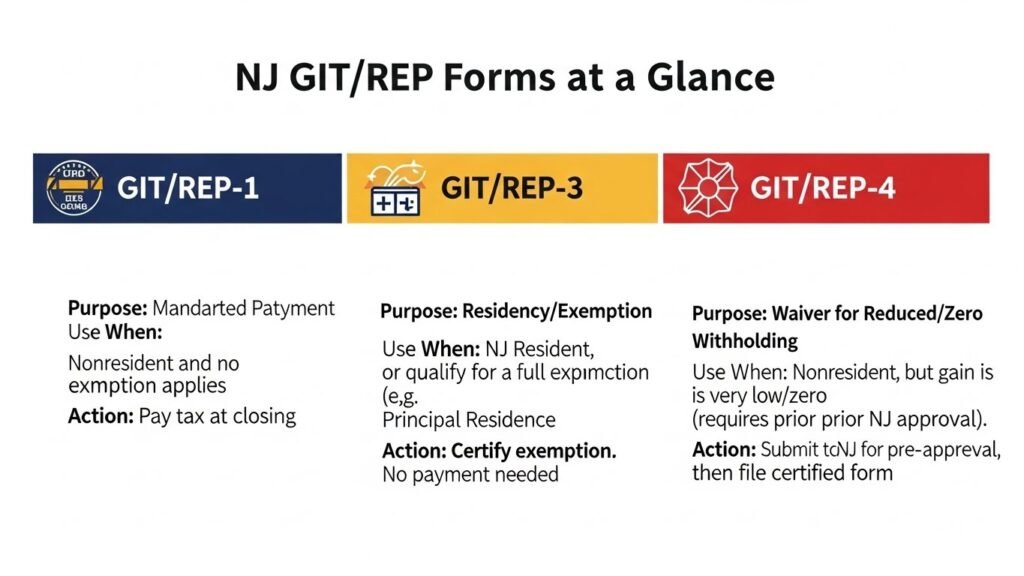

The entire process hinges on the New Jersey Division of Taxation’s GIT/REP forms. These forms must be filed with the county clerk’s office at the time the deed is presented for recording.

- GIT/REP-3 (Seller’s Residency Certification/Exemption): This is the key form used by sellers who are claiming a full exemption from the withholding. If you successfully complete this form, no prepayment is due at closing.

- GIT/REP-1 (Nonresident Seller’s Tax Declaration): This form is used when the withholding is actually due. It declares the estimated tax due based on the calculation method.

- GIT/REP-4 (Waiver of Seller’s Filing of Estimated Gross Income Tax): This form is used to request a reduced withholding amount when the calculated gain is low, but the 2% minimum is excessive (See Reduced Withholding section below).

Closing Procedure and Deed Recording

The closing is where the prepayment requirement is enforced.

- Agent Responsibility: The settlement agency, title company, or buyer’s attorney is legally responsible for ensuring the correct GIT/REP form is filed.

- Escrow: If the seller does not qualify for an exemption, the required prepayment amount is removed from the seller’s proceeds and held in escrow.

- Deed Block: New Jersey law explicitly states that no county officer can record the property deed unless it is accompanied by the appropriate GIT/REP form and the estimated tax payment (or proof of exemption). This effectively blocks the sale until the withholding is satisfied.

Handling Sales at a Loss or No Profit

One of the most frustrating aspects of the NJ exit tax prepayment is that the 2% minimum rule applies even if you sell the property at a loss or break even.

- Required Withholding: Even with no profit, the seller is still required to make a prepayment equivalent to 2% of the gross sale consideration at closing.

- Full Refund: Since no capital gains tax is owed when there is a loss, the seller will receive the entire 2% back when they file their New Jersey Non-Resident Income Tax Return (NJ-1040NR).

- Inconvenience: The payment is treated strictly as an estimated tax. The key problem is the temporary inconvenience and loss of liquidity, as the seller must wait until the next tax filing season to reclaim their funds.

New Jersey Capital Gains Tax: The Underlying Tax Liability

The NJ exit tax prepayment is merely a placeholder for the actual capital gains tax. Understanding the state’s rules for taxing profit from a home sale is essential for planning, regardless of the withholding requirement.

NJ Capital Gains Tax Rate

In New Jersey, a capital gain from the sale of property is treated as ordinary income. This differs from federal tax rules, which often offer preferential long-term capital gains rates.

- Rate Structure: The gain is subject to the state’s progressive income tax brackets, which can reach the highest marginal rate of 10.75%. The exact rate a seller pays depends on their total taxable New Jersey income for the year, including the property gain.

- Long-Term vs. Short-Term: New Jersey does not distinguish between long-term and short-term capital gains for tax purposes. All gains are taxed the same as ordinary income.

Key Differences from Federal Tax Rules

The interplay between federal and state tax codes is where the largest opportunity—and risk—lies for home sellers.

- Lack of State Exclusion: New Jersey has no state-level capital gains exclusion similar to the federal rule. Gains are taxed in the same manner as other types of income.

- Role of Federal Exclusion (IRC Section 121): This critical federal rule allows for a substantial exclusion of gain on the sale of a primary residence. This is the most important exemption for avoiding the NJ exit tax prepayment.

The Internal Revenue Code (IRC) Section 121 allows a taxpayer to exclude:

- Up to $250,000 of gain for single filers.

- Up to $500,000 of gain for married couples filing jointly.

To qualify for this exclusion, the seller must have owned and used the home as their principal residence for periods totaling at least two years during the five-year period ending on the date of the sale.

Crucially, New Jersey recognizes this federal exclusion for the purpose of the withholding. If the seller’s entire gain is excludable under IRC Section 121, they can claim an exemption from the prepayment by filing the GIT/REP-3 form. If, however, any taxable gain remains after the application of the federal exclusion, the exemption does not apply, and the withholding (the greater of 10.75% of the remaining gain or 2% of the price) must be paid.

Impact of Capital Improvements on Taxable Gain

Since the tax rate can be high, minimizing the calculated profit is paramount. The primary legal method for doing this is by maximizing the adjusted cost basis.

- Documentation is Critical: Sellers must keep comprehensive records of all expenses that qualify as capital improvements. These records are necessary to substantiate the cost basis if the state were to perform an audit.

- Substantiating Costs: For a $40,000 kitchen remodel, a seller must have receipts, contracts, and proof of payment. The IRS guidelines that New Jersey follows are strict on what can be included.

- Reducing Liability: Every dollar successfully added to the adjusted basis directly reduces the final taxable capital gain by one dollar. For a high-income earner, this could save 10.75 cents for every dollar of basis claimed.

Exemptions and Strategic Actions to Avoid the Prepayment

The requirement to withhold the NJ exit tax is not absolute. Sellers can avoid the prepayment entirely by qualifying for one of the “Seller’s Assurances” or by taking strategic actions to minimize the gain.

Qualification for Full Exemption (Form GIT/REP-3 Criteria)

The following conditions allow a seller to file Form GIT/REP-3, the Seller’s Residency Certification/Exemption, thereby completely eliminating the withholding requirement at closing.

- For NJ Residents (Staying): If the seller maintains their New Jersey residency after the closing, they are exempt. They simply certify this on the GIT/REP-3 form. Any final tax owed on the gain is then paid with their regular state resident income tax return (NJ-1040).

- Federal Exclusion: The most common exemption for those leaving the state is when the property was a primary residence and the entire gain is excludable under the Federal IRC Section 121. If your profit is less than the $250,000 or $500,000 limit, no prepayment is required.

- Minimal Consideration: The total sale consideration (price) for the property is $1,000 or less. This generally applies only to niche transactions or non-arms-length transfers.

- Old Deed or Corrective Deed: The deed is dated prior to August 1, 2004, and has not been previously recorded, or the deed is a corrective deed that does not change the consideration amount.

- Distressed Sale or Agency Transfer: The property is a short sale initiated by the mortgagee, and the seller receives no proceeds. Other exemptions exist for transfers to or by government agencies or mortgage companies.

Strategic Actions to Qualify and Reduce Tax Liability

For non-residents, avoiding the withholding often requires proactive planning before the sale even occurs. These strategies directly aim to fit the sale into one of the available exemptions.

- Maximize the Federal Capital Gains Exclusion: This is the most powerful strategy. Ensure rigorous documentation proves the home met the “two out of five years” use requirement. If you are a single filer with a $200,000 gain, ensuring you meet the IRC Section 121 rules means you owe no withholding, thus avoiding the prepayment entirely.

- Increase the Cost Basis: Before listing the property, organize and calculate every dollar spent on capital improvements. If this calculation can reduce the total gross gain to an amount that is fully covered by the IRC Section 121 exclusion, you will achieve the full exemption. Working with a CPA or tax attorney to compile a detailed cost basis spreadsheet is highly advisable.

- Maintain Residency Status: If possible, execute the sale while still legally maintaining your New Jersey residency. This avoids the status of “non-resident seller” that triggers the entire withholding regime. Sellers need to be careful with the timing of their physical move and the transfer of their “vital interests” to ensure their legal status is resident on closing day.

Reduced Withholding (Form GIT/REP-4)

What if you have a profit that is too large for the federal exclusion, but the 2% minimum withholding is still grossly inflated compared to your actual tax liability?

- The Problem: For a $1 million sale with only a $50,000 taxable gain, the 2% withholding is $20,000. However, 8.97% of the $50,000 gain is only $4,485. The required $20,000 prepayment is more than four times the actual tax bill.

- The Solution: Sellers can file GIT/REP-4 to request a lower withholding amount. This form allows the seller to use the 8.97% of the calculated gain, even if it is lower than the 2% of the price.

- Benefit: Filing the GIT/REP-4 allows you to only pay the $4,485 withholding at closing, rather than the full $20,000, thereby drastically improving your cash flow.

- Caution: This still requires filing the NJ-1040NR to finalize the amount, but it prevents the unnecessary tie-up of tens of thousands of dollars for several months.

Final Considerations for Sellers and Planning

Successfully navigating the NJ exit tax prepayment requires forethought and detailed documentation. The inconvenience of the withholding is not just an administrative hurdle; it has a real impact on a seller’s financial health, particularly for those relying on the home sale proceeds for their next move.

Other Taxes and Fees Associated with the Sale

The estimated tax prepayment is only one component of the total cost of selling property in New Jersey. Sellers must also account for several other mandatory fees and taxes.

- Federal Capital Gains Tax: If the profit exceeds the federal exclusion amount (IRC Section 121), the remaining gain is subject to federal capital gains rates, which are separate from the New Jersey tax.

- Realty Transfer Fee (RTF): This is a separate state fee paid by the seller upon recording the deed. The RTF is calculated based on the sales price and is mandatory unless a specific exemption applies (e.g., transfers between family members).

- Mansion Tax/Graduated Percent Fee (GPF): For transactions over $1,000,000, a supplemental fee, often historically called the “mansion tax,” is imposed on the seller. This fee has a graduated percentage structure, with higher rates for prices over $2,000,000, $2,500,000, etc.. As of July 10, 2025, new legislation modifies these graduated fees and confirms the seller is responsible for all fees.

- Local Municipal Fees: These are local costs, which can vary by municipality.

- Closing Costs: Sellers must also pay closing costs, including title insurance and attorney costs.

Considerations for Seniors

Many senior citizens plan to sell their primary residence to fund their retirement or their move to a warmer, more tax-friendly state. They often assume they receive an automatic exemption from the NJ exit tax prepayment due to their age.

- No Automatic Exemption: There is no special or automatic exemption from the prepayment solely based on a seller’s age.

- IRC Section 121 Eligibility: Eligibility for relief is solely based on meeting the criteria for the primary residence exclusion (IRC Section 121). If a senior meets the “two out of five years” use requirement, their large $500,000 joint exclusion is usually enough to cover the entire gain, thereby qualifying them for the GIT/REP-3 exemption and avoiding the withholding. The planning focus must be on IRC Section 121 qualification, not age.

Financial Planning and Cash Flow

The most significant financial inconvenience of the NJ exit tax prepayment is the impact on a seller’s cash flow.

- Impact on Liquidity: For sellers who need the full proceeds of their sale for a down payment on their next home or to fund immediate retirement expenses, having 2% of the sale price locked away for months can create a financial crisis.

- Contingency Planning: Sellers relying on sale proceeds must plan for this temporary reduction in liquidity. They may need to utilize short-term bridge financing or negotiate a delayed closing on their purchase property until the refund can be secured.

- Timely Filing: To minimize the period of lost liquidity, sellers must ensure their New Jersey non-resident return (NJ-1040NR) is filed as soon as possible after the close of the tax year. Delays in filing or errors on the form will delay the refund.

Pre-Move Documentation Checklist

Before officially moving out of state and closing the sale, sellers should work with their CPA or tax advisor to complete a thorough documentation checklist. This diligence is the best way to ensure compliance and avoid unnecessary withholding or future audits.

- Review Capital Gains Exposure: Calculate the estimated gross gain and the adjusted basis to determine if the gain will exceed the IRC Section 121 exclusion amount.

- Document Primary Residence Status: Gather evidence (utility bills, voter registration, insurance) to prove the “two out of five years” rule was met, justifying the GIT/REP-3 exemption.

- Verify GIT/REP Forms: Ensure the title company or attorney has the correct forms (GIT/REP-3 for exemption or GIT/REP-4 for reduced withholding) ready for signing and filing at closing.

- Understand Tax Liability: Know the difference between the prepayment (the estimated tax) and the final tax liability (the actual tax owed on the gain).

- Keep Records: Retain copies of all closing documents, the GIT/REP form, and all capital improvement receipts for future tax filings or audit protection.

By approaching the sale with this level of preparation, homeowners can demystify the NJ exit tax and ensure a smoother, more financially sound transition out of the state.

Frequently Asked Questions (FAQs) on the NJ Exit Tax

GIT/REP Forms, Compliance, and Penalties

What are the different GIT/REP forms, and which one should a nonresident seller use?

The GIT/REP forms certify the seller’s status and payment method. The most common forms are:

- GIT/REP-1 (Nonresident Seller’s Tax Declaration): Used by nonresident sellers to pay the estimated tax at the closing of the sale. It includes the voucher (NJ-1040-ES).

- GIT/REP-2 (Nonresident Seller’s Tax Prepayment Receipt): Used if the nonresident seller pays the estimated tax prior to closing by submitting the payment directly to the Division of Taxation to obtain a certified receipt.

- GIT/REP-3 (Seller’s Residency Certification/Exemption): Used if the seller is a New Jersey resident or if they qualify for one of the statutory exemptions (e.g., IRC Section 121 principal residence exclusion, or a sale with no gain).

- GIT/REP-4 (Waiver of Seller’s Filing Requirement): Used when the seller has calculated a low or zero gain, but does not meet a GIT/REP-3 exemption. It requires prior approval from the Division of Taxation to pay less than the standard withholding amount.

- GIT/REP-4A (Nonresident Seller’s Tax Declaration and Prepayment/Waiver Receipt – For Re-recording): Used only when a deed must be re-recorded due to a typographical, clerical error or omission, and there is no additional consideration.

What happens if the nonresident seller refuses to sign a required GIT/REP form or pay the estimated tax?

The buyer (grantee) and the settlement agent (title company or attorney) have a responsibility to ensure a properly completed and signed GIT/REP form (GIT/REP-1, -2, or -3) is filed with the deed. If the seller refuses to comply, the county clerk will not record the deed, preventing the closing from proceeding until the form is submitted.

What is the maximum statutory withholding rate for the estimated tax payment?

The statutory rate for the estimated tax payment is calculated as the greater of:

- $8.97\%$ of the seller’s recognized gain for federal income tax purposes.

- $2\%$ of the total consideration (gross sales price) stated on the deed.

The $8.97\%$ rate is the highest income tax rate that was in effect when the law was enacted, though New Jersey’s current highest tax bracket is $10.75\%$.

What does “consideration” mean for the $2\%$ calculation?

“Consideration” is defined broadly by New Jersey law. It means the actual amount of money and the monetary value of any other thing of value constituting the entire compensation paid or to be paid for the transfer of title. Crucially, this definition includes the remaining amount of any prior mortgage obligation to which the property is subject or which the buyer agrees to assume.

If I use a GIT/REP-3 exemption, can I still be audited?

Yes. Checking an exemption box on the GIT/REP-3 certifies under penalty of perjury that you meet the listed condition, which allows the deed to be recorded without upfront payment. However, checking this box does not relieve you of your final tax liability. If the Division of Taxation later determines that you did not qualify for the exemption (e.g., you failed the IRC Section 121 tests), you will be liable for the tax due plus penalties and interest.

Calculations, Refunds, and Liability

How do I get a refund if the estimated tax I paid (the “Exit Tax”) is more than my final tax liability?

You must file a New Jersey Nonresident Income Tax Return (Form NJ-1040NR) for the tax year of the sale. The estimated tax paid at closing will be claimed on this return as a credit. If the final tax calculated is less than the amount withheld, the State will issue a refund of the excess.

Is there a specific form to request an expedited refund of the prepayment?

Yes. If you have filed your federal tax return and know you are due a refund from the sale, you may file Form A-3128, Claim for Refund of Estimated Gross Income Tax Payment. This form is specifically for requesting the return of the prepayment amount when the final tax return (NJ-1040NR) has not yet been processed or cannot be filed quickly.

What penalties apply if I fail to file a return or underpay my final tax liability?

Failure to file a return or pay the tax due can result in a penalty of $100 per day (for failure to file the GIT/REP form), plus interest and potential civil/criminal charges for tax evasion or making false certifications on the GIT/REP forms.

Special Situations and Exemptions

How does the “Exit Tax” apply to property that was acquired through inheritance?

If the property was inherited, the seller’s basis is generally the Fair Market Value (FMV) on the decedent’s date of death (stepped-up basis). If the sale price is equal to or less than this stepped-up basis, there is no gain.

- You must still file a GIT/REP form.

- If an estate or trust is the seller and recognizes no gain, they would use the appropriate exemption box on the GIT/REP-3 form, certifying no recognized gain for tax purposes.

Am I exempt from the prepayment if I am completing a Section 1031 like-kind exchange?

No, a full exemption does not automatically apply if cash (“boot”) or non-like-kind property is received as part of the exchange.

- If the transfer is a pure 1031 exchange with no boot, you may use an assurance box on the GIT/REP-3.

- If you receive cash or other non-like-kind property, you must pay the estimated tax (using a GIT/REP-1) on the greater of the non-like-kind consideration received or the fair market value of the non-like-kind property.

How does the “Exit Tax” apply to a limited liability company (LLC) or trust?

If the seller is an LLC, partnership, or trust, the rules depend on its classification:

- Nonresident Individual-Owned LLCs/Trusts: If the entity is treated as a disregarded entity (single-member LLC) or a grantor trust, the withholding applies as if the individual were the seller (using GIT/REP-1, -2, or -3 based on individual residency).

- Nonresident Entities: Nonresident estates and trusts must withhold. Partnerships and corporations have separate withholding rules, often using Forms 1080-C and 1080-E.

Are there exemptions for military service members or their spouses?

Yes, New Jersey provides exemptions for active-duty military personnel and their spouses/civil union partners under certain conditions, primarily revolving around the federal Servicemembers Civil Relief Act (SCRA). If the domicile (legal home) remains outside of New Jersey due to military orders, the seller may qualify for a full exemption using the appropriate box on the GIT/REP-3.

Does the “Exit Tax” apply to commercial or rental property sales?

Yes. The requirement for estimated gross income tax payment applies to all nonresident individuals, estates, and trusts selling any type of real property (residential, commercial, or rental) in New Jersey. The only difference is that the IRC Section 121 exclusion for primary residences is not available, meaning gain on these properties is almost always taxable.

What if the property is jointly owned by a NJ resident and a nonresident?

Only the nonresident’s percentage of ownership is subject to the withholding requirement. The resident owner must complete the GIT/REP-3 to certify their residency. The nonresident owner must file the appropriate form (GIT/REP-1 or GIT/REP-4) and pay the estimated tax only on their share of the consideration or gain.

Who is responsible for ensuring the payment is made: the seller, the buyer, or the title company?

The seller is primarily liable for the tax. However, the law places the responsibility for collecting and remitting the funds (the withholding) on the settlement agent (usually the buyer’s attorney or title company). The county clerk is prohibited from recording the deed without the required GIT/REP form and payment/waiver, which gives the buyer leverage to ensure compliance.

What if the seller is a foreign person without a Social Security Number (SSN)?

The seller is required to provide an SSN or Individual Taxpayer Identification Number (ITIN) to ensure the payment is credited to their tax account. If a foreign seller does not have an ITIN, they must apply for one using a Federal Form W-7. For the purposes of closing, a GIT/REP-1 can be filed with a pro forma W-7 attached, which the county clerk forwards to the state. (Note: Foreign sellers are also subject to Federal FIRPTA withholding rules).

What if I move back to New Jersey shortly after the sale?

If you move back to New Jersey after the sale but during the same tax year, you may be considered a part-year resident. You would still report the gain from the sale on your New Jersey income tax return (NJ-1040) but would be taxed as a resident for the portion of the year you were present, potentially qualifying for a full credit on the estimated tax paid.

Can I offset the estimated tax payment against my other New Jersey income tax liability for the year?

Yes. The estimated payment is a credit against your total New Jersey Gross Income Tax liability for the year, not just the capital gains tax from the sale. If you have other sources of income taxable by New Jersey (like rental income or wages), the prepayment will be used to satisfy that tax obligation first, and any remaining balance will be refunded.

What documentation is required to secure a GIT/REP-4 (reduced withholding)?

To apply for a GIT/REP-4 waiver, you must submit a formal application to the Division of Taxation prior to closing. Required documentation typically includes:

- A completed GIT/REP-4 form.

- A detailed calculation of the recognized gain, including evidence of the adjusted basis (purchase price, capital improvements).

- A copy of the contract of sale.

- A copy of the HUD-1/Closing Disclosure statement.

What is the GIT/REP-4A form and when is it used?

The GIT/REP-4A is a specific form used to correct a typographical error on a previously recorded deed. It is used when the original grantor (seller) cannot be located to sign a new GIT/REP-3/Waiver. It is the only GIT/REP form that can sometimes be completed and signed by the grantee (buyer), but only when there is no consideration/money involved in the re-recording.

What forms are used if a property is transferred as part of a divorce or to correct a deed?

- Divorce: Transfers between spouses incident to a divorce are often exempt from the tax, as there is generally no recognized gain for federal purposes. The seller would likely check the box on the GIT/REP-3 related to a transfer where no gain is recognized.

- Corrective Deeds: Deeds used to correct a prior recorded deed, or deeds transferring title for $1,000 or less (often nominal consideration) may use an exemption box on the GIT/REP-3 as well.

How does the Federal FIRPTA withholding interact with the New Jersey “Exit Tax”?

If the seller is a foreign person, they are subject to both:

- Federal FIRPTA Withholding: A separate federal withholding of $15\%$ (typically) of the gross sales price if the seller is a non-U.S. person.

- New Jersey “Exit Tax”: The New Jersey state withholding (8.97% of gain or 2% of consideration).

Both amounts must be withheld at closing, and both require separate forms and are sent to the respective tax authorities (IRS and NJ Division of Taxation).