The Ashcroft Capital Lawsuit has deeply shaken the investment world. It brings serious attention to how real estate funds manage investor relationships and transparency. This major legal fight raises fundamental questions about how investors are protected. For everyday investors who have put money into these large real estate funds, the result of this case is extremely important. This is more than a typical lawsuit. It is a key example that highlights the risks of syndication-based property investments, focusing heavily on financial responsibility and management practices. The legal battle has caused intense review of the promises and performance updates given by the fund sponsors.

Background and Profile of Ashcroft Capital

Ashcroft Capital is a well-known company in the U.S. property market. It has built its name by focusing on large apartment complexes. The company uses a model called apartment syndication. This setup allows limited partners (LPs) to combine their funds to buy huge properties. The firm’s strategy is to buy and improve underperforming apartment communities. This is called a “value-add” strategy. Their goal is to increase the property’s value, which should lead to high returns for investors.

Key Facts About Ashcroft Capital

- Founders & History: The firm was co-founded by Joe Fairless and Frank Roessler. They started the company in 2015.

- Focus & Scale: Ashcroft specializes in multifamily real estate in the Sun Belt region. It is one of the biggest syndication firms in the U.S. The company manages over $2.7 Billion in assets (AUM).

- Investment Strategy: The main goal is to buy properties and renovate them. This value-add approach is meant to achieve higher profits.

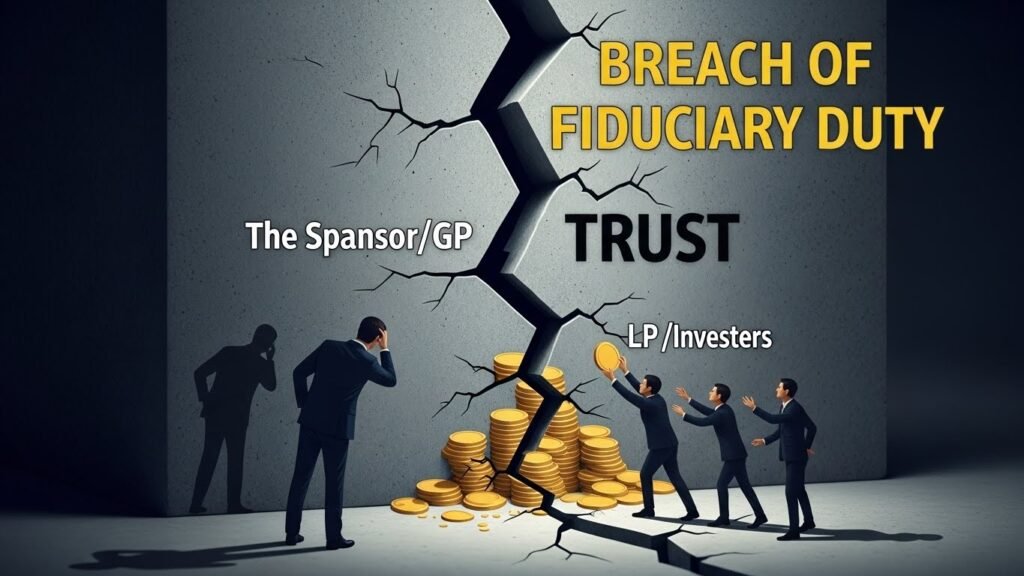

The Role of the Syndicator (Sponsor) and Fiduciary Duty

Understanding the lawsuit requires knowing the syndication model. Ashcroft Capital acts as the Sponsor, meaning they are the General Partner (GP). They find the deals, manage the assets, oversee construction, and handle the final sale. The investors, called limited partners (LPs), provide the money. The law says the GP has a fiduciary duty to the LPs. This duty means the GP must always put the investors’ interests first. A claim of breaking this fiduciary duty is one of the main points in the Ashcroft Capital Lawsuit.

Comparative Analysis with Other Real Estate Syndication Firms

Ashcroft Capital’s active value-add approach is different from simpler, passive investment methods. Active strategies involve constant management and hands-on operational challenges. This gives the sponsor more control over decisions. Because of this, investor success relies heavily on the sponsor’s honesty and management skills. When legal problems happen, they show the risks of trusting the sponsor so completely. The Ashcroft Capital Lawsuit has sharply focused on this reliance.

The Origin and Details of the Legal Dispute

The Ashcroft Capital Lawsuit did not start suddenly. It grew from a series of business decisions and concerns voiced by investors. The main issue is that the firm allegedly failed to keep the promises made during investment pitches. This created unhappy former partners. Eventually, these concerns turned into formal legal action. The case is now a key topic of conversation across the entire investment industry.

Key Players Involved in the Lawsuit

- The Case Title: Cautero v. Ashcroft Legacy Funds. It was officially filed in early 2025.

- The Plaintiffs: The people making the complaint are a group of 12 accredited investors, led by Anthony Cautero. They are seeking significant financial compensation for their losses.

- The Defendants: Ashcroft Capital, the real estate investment firm.

- Legal Teams: Lawyers for both sides are very active. They must handle complicated securities laws and corporate paperwork.

Simple Breakdown of Key Allegations

The plaintiffs have made several serious collective claims, seeking over $18 million in damages. The main point of their argument is that they were intentionally misled.

- Misrepresentation of Returns: The investors claim that the profit forecasts were too optimistic and unrealistic. The actual financial results did not match these projections.

- Lack of Transparency and Communication: Investors claim they had poor communication and late updates. They also state the company failed to provide proper financial reports on time.

- Inadequate Risk Disclosure: The plaintiffs argue they were not properly warned about major financial risks. They were not prepared for the resulting financial problems.

- Inappropriate Use of Funds: The complaint suggests investor money was misused. They claim their capital was used for things like property upgrades or operational costs without their approval.

- Breach of Fiduciary Duty: This is a serious claim that the firm acted wrongly with money. The company allegedly put its own financial interests first, possibly through early sales or high-fee refinancing.

Ashcroft Capital’s Official Response and Defense Strategy

In response to these claims, Ashcroft Capital has fought back. The firm has strongly denied all the investor allegations. They are actively trying to stop false rumors and protect their business reputation. The company is trying to highlight its history of investor success.

Why Ashcroft Capital Still Stands Strong (Track Record and Compliance)

Ashcroft’s defense relies on its history and following the rules. The company claims it is innocent in the Ashcroft Capital Lawsuit.

- Official Denial: Soon after the case became public, CEO Joe Fairless issued an official statement. He firmly denied all claims and promised commitment to the firm’s long-term values.

- Compliance Defense: The firm states that all required due diligence documents were provided. This includes Private Placement Memos (PPMs), which accurately mentioned potential risks. They confirm their SEC filings are up-to-date and publicly available.

- Proven Performance: The firm points to its reliable history. They claim to have successfully managed over 50 apartment assets.

Proactive Communication and Countering Rumors

Ashcroft Capital has tried to communicate actively. They believe that being clear is the best way to fight against false information.

- Transparency Tools: The firm releases detailed reports on property performance. They hold online meetings (webinars) where leaders explain financial decisions. Their Investor Portal offers educational materials.

- Distinguishing Fact from Speculation: The company addresses that online searches can make rumors seem bigger. They argue that much of the online talk comes from investors misunderstanding things or poor communication. They suggest competitors may use tactics to get attention (clickbait).

Current Legal Status and Analysis of Potential Outcomes

The Ashcroft Capital Lawsuit is not finished. The court process is currently very active. The final outcome will set an important standard for the entire property syndication industry.

The Litigation Process: Discovery Phase and Pending Verdict

The case is currently in the discovery stage, which is a key phase.

- Discovery Phase: Both sides are busy collecting necessary court documents and evidence. This involves getting testimonies from former employees and reviewing emails.

- Firm’s Motion: Ashcroft Capital’s legal team is trying to get a part of the case dismissed. They strongly deny all claims in court.

- Plaintiff’s Demands: The investors’ lawyer is demanding access to past financial records. This is to get clarity and support their claims of hidden risk.

Legal Paths and Payout Considerations

Legal experts are closely watching the possible results. The dispute could end in a few different ways.

- Settlement Before Trial: This is a common way to end a case. The parties agree on a compensation amount. This is usually finalized with a secret settlement agreement.

- Plaintiff Victory: If the court finds financial wrongdoing, the limited partners (LPs) could win a large payment. This might include compensation and extra penalties (punitive damages). The firm could also face restrictions on raising new money.

- Defendant Victory: If the firm proves the poor performance was only due to market changes and not misconduct, the case will be dismissed. The plaintiffs would lose their invested money with no recovery.

- Class Action Formation: If more limited partners (LPs) join the case, it could become a formal Class Action. This might result in a single, consolidated payment and force the firm to change how it operates.

Investor and Industry Reactions

The news of the Ashcroft Capital Lawsuit has created a stir. Investor feelings have been seriously affected across the entire real estate fundraising community. The legal showdown has caused public online discussion forums to become very active.

Concern Over Distributions and Continuous Capital Calls

A big source of anger for investors is the timing of money coming in and going out.

- Paused Distribution: Limited partners (LPs) were shocked when the firm suddenly stopped giving out cash flow distributions.

- Capital Calls: Adding to the shock, the firm kept asking for more money through capital calls, even though the projects were performing poorly.

- Asset Management Fees: Forums are full of claims that the firm continued to charge asset management fees even while investors received nothing. This suggests the firm prioritized its own interests.

Real Estate Community Dialogue and Forum Activity

The trustworthiness and business ethics of Ashcroft Capital are being discussed everywhere.

- Forum Discussion: On sites like Reddit, BiggerPockets, and Facebook groups, people are asking tough questions. These include why the firm didn’t disclose the risk sooner and why financial reports were missing.

- Investor Anxiety: The high level of worry is clear in the market response. Many investors are concerned about how the lawsuit might affect their investment stakes.

The Broader Impact on Real Estate Syndication

The Ashcroft Capital Lawsuit serves as a clear warning for everyone in the real estate sector. It has created a need for much closer review (Enhanced Scrutiny) across the board.

Legal and Due Diligence Implications for Investors

The lawsuit proves that investors cannot just rely on a friendly sales pitch. Doing thorough research (due diligence) is vital.

- Enhanced Scrutiny: Investors must look beyond general claims. They need to demand comprehensive rules for real estate syndications.

- Vetting Sponsors: The case stresses how important it is to thoroughly check fund managers. Investors must review their history and management methods.

- Market Context: It is crucial to remember that all investment carries risk. The market has recently seen high volatility and interest rate changes. Investors must be prepared for these market cycles, which can cause poor performance.

Potential Industry-Wide Shifts and Regulatory Changes

The result of the lawsuit could permanently change the property investment industry.

- Stricter Disclosures: The lawsuit might lead to stricter rules for what companies must disclose. Firms may be forced to provide financial updates more often.

- Push for Transparency: Stakeholders are now demanding clearer communication. They want firms to hold regular meetings and provide accurate reports.

- Change Syndication Procedure: Many companies are beginning to adjust their syndication process. They are putting in place key compliance checks to be more accurate about their internal rate of investment (IRR) and potential loss risks.

Financial Performance and Investor Capital Risk

The heart of the legal and financial distress is the huge difference between the high profit estimates given to investors and the actual results when market conditions changed.

Specific Metrics of Underperformance

While the exact Internal Rate of Return (IRR) figures that led to the lawsuit are usually private, the financial messages about the capital calls show a significant loss of capital value.

- Risk of Total Loss: Communications warned that if one of the affected funds (specifically Ashcroft Value-Add Fund 1 or AVAF1) had to sell assets into a weak market, investors with certain share classes, likely Class B, faced a projected total loss of their invested money.

- Partial Recovery for Senior Investors: For Class A shares, which usually have priority for repayment, a forced sale was predicted to return only about 71% of the original investment. This shows a huge loss of the main investment.

- Initial Projections vs. Reality: The firm’s original plan relied on achieving high profits through fast renovations in Sunbelt areas. However, rapidly rising interest rates, unexpectedly high costs for new interest rate caps, and soaring construction/labor costs meant actual spending was higher than planned. This severely squeezed the net operating income (NOI) and the potential for returns.

Funds and Properties Cited in Financial Distress

The most public signs of financial trouble have focused on one of Ashcroft Capital’s first major funds:

- Ashcroft Value-Add Fund 1 (AVAF1): This fund appears to be the main source of distress, needing restructuring and a capital call. Its properties were financed with floating-rate debt.

- The Halston Portfolio: Specific properties, including those in the Halston 5 portfolio, were mentioned in investor updates as facing multiple capital calls.

- Affected Assets: The properties are generally older apartment communities (e.g., built in the 1970s) located in Sunbelt states like Texas, Florida, and Georgia. The success of the value-add strategy for these assets depended heavily on successful and timely renovations.

Legal and Regulatory Context

Status of the Investor Lawsuit

The main legal case is called Cautero v. Ashcroft Legacy Funds, a class action complaint filed by limited partners (LPs).

- Key Allegations: The lawsuit is centered on claims of misrepresentation and not properly informing investors of key risks. Specifically, the claims argue that the firm failed to prepare for and disclose the severe financial shock from rising interest rate cap costs and the risks of using high levels of floating-rate debt.

- Basis of Claim: Investors claim that the promised high returns were based on overly optimistic market assumptions and that the firm did not take enough protective steps, which directly led to the current situation where investor money is at risk.

- Jurisdiction: While the official court details for disputes involving private investment firms are often kept private, major financial lawsuits like this are typically filed in U.S. federal district courts, such as the Southern District of New York or similar areas where the investor base and financial activities are concentrated.

Regulatory Oversight and Filings

Ashcroft Capital funds are usually set up as private offerings under Regulation D (Reg D) of the Securities Act. This means they are free from many of the public filing rules of the U.S. Securities and Exchange Commission (SEC).

- SEC Scrutiny: The use of Reg D filings, which are typically sold only to accredited investors, has been under more careful review following widespread problems in the real estate syndication sector. While there is no formal, public SEC enforcement action or investigation against Ashcroft Capital confirmed, the claims fall under the SEC’s authority regarding securities fraud and false statements in private offerings.

- Enhanced Disclosures: The whole situation emphasizes a new effort to push for greater transparency and more frequent, detailed financial reports from private equity real estate firms to their limited partners.

Financial Stabilization Measures and Timeline

The financial problems became public and urgent when the firm switched from regular payments to capital calls, showing an immediate need for cash to save the assets.

Timeline of Capital Calls and Distribution Pauses

- Pausing of Distributions: Like many sponsors facing debt costs higher than income (negative leverage) and rising operating expenses in the high-interest-rate environment, the first action was to stop the monthly or quarterly cash distributions to investors. This was done to save cash for debt payments and running costs.

- Capital Call Initiation (2023/2024): The firm started multiple capital calls, specifically for AVAF1 and the Halston 5 portfolio, beginning in 2023 and continuing into 2024. These calls required LPs to put in more money, often a set percentage of their original investment (e.g., 15-20%), into the fund.

- Purpose of Capital Calls: The money raised was urgently needed to:

- Cover the extremely high cost of buying new interest rate caps, a necessary protection against floating-rate debt.

- Pay for necessary major repairs (CapEx) and renovations to finish the value-add plan and increase the property’s income.

- Repay an $11 million interest-free short-term loan that the principals had personally given to the fund to meet loan terms.

Ashcroft Capital’s Official Response and Support Actions

The co-founders, Joe Fairless and Frank Roessler, sent messages to investors explaining why the capital calls were needed. They stressed the severe issues in the floating-rate debt market and the need to protect the assets.

- Commitment to Investors: In letters to investors, the principals stated they were committed to helping investors through the tough time, confirming they had already personally invested a lot of their own capital into the fund.

- Principal Investment: They revealed they had provided an $11 million interest-free short-term loan to the fund to cover unexpected costs. They said this move was to keep the fund liquid and comply with lender requirements until the capital call could be completed.

- Mitigation Strategy: The capital call was presented as a smart move to avoid a forced “fire sale” of properties, which would guarantee huge losses. The plan was to use the new money to switch three of the largest loans to more stable, fixed-rate debt. This would lower the portfolio risk and buy time for the market to improve and for property renovations to boost revenue.

The Immediate Fallout and Future Trajectory

The firm was forced to pause payments and ask for more money as a desperate measure to avoid a fire sale and protect the properties. Although the principals injected their own funds to stabilize the situation, the damage is double: financial and reputational.

- Financial Outcome: The near future depends on successful refinancings and the direction of the market. A successful recovery is possible, but the original high-profit goals are now severely reduced, if not entirely gone.

- Reputational Damage: The company’s standing has been badly hurt. This will certainly make it harder to raise money and form new partnerships in the future, no matter what the legal outcome is.

Key Lessons Learned for All Investors

The Ashcroft Capital situation offers an important and expensive lesson for both sponsors and Limited Partners:

- Risk Disclosure is Paramount: High profit forecasts must be balanced with clear and strong warnings about the worst-case scenarios, especially concerning exposure to floating-rate debt and the cost of rate caps.

- Due Diligence on Structure: Investors must carefully check the deal structure, focusing on the financial safety net for unexpected costs, the terms of the debt, and the penalties for failing to pay a capital call.

- Transparency First: The most vital lesson for sponsors is that being transparent—communicating openly and quickly about poor performance—is the only way to keep long-term trust, even when market problems hit.

The final legal and financial decision in the Cautero v. Ashcroft Legacy Funds dispute will likely not just decide the fate of Ashcroft Capital, but will also establish a new, stricter standard for responsibility and openness across the entire multi-billion-dollar multifamily real estate syndication industry.

Conclusion

The Critical Juncture for Ashcroft Capital and the Syndication Model

The current distress surrounding the Ashcroft Capital funds, culminating in the Cautero v. Ashcroft Legacy Funds lawsuit and the urgent capital calls, represents a critical turning point for the real estate syndication industry. It highlights the profound risks embedded in highly leveraged investment structures when faced with sudden and adverse economic shifts, particularly the sharp rise in interest rates and associated hedging costs.

The lawsuit and the necessary financial restructuring of funds like AVAF1—which forced investors to choose between injecting fresh capital and facing a near-total loss—have shattered the perception of multifamily real estate as a consistently safe and high-yielding asset class in all market conditions.

Frequently Asked Questions

What is the specific legal structure of the Ashcroft Legacy Funds?

The funds, including those referenced in the lawsuit, are typically structured as Limited Partnerships (LPs) or Limited Liability Companies (LLCs). This structure separates the roles of the General Partner (GP)—the fund manager, Ashcroft Capital—who handles management and liability, from the Limited Partners (LPs)—the investors—whose liability is generally limited to the amount of capital they commit.

What is the primary difference between a General Partner (GP) and a Limited Partner (LP) in this context?

The General Partner (GP), which is Ashcroft Capital, holds the management responsibility and makes all investment decisions, including securing loans and authorizing capital calls. The Limited Partners (LPs), the investors, are passive. Their primary function is to contribute capital, and in return, they are protected from the fund’s operational liability.

What is the role of an “accredited investor” in these private offerings?

Ashcroft Capital’s funds are primarily offered under SEC Regulation D, which allows a company to raise capital without public registration, provided it sells only to “accredited investors.” An accredited investor must meet specific income or net worth thresholds (e.g., $200,000 annual income or $1 million net worth excluding a primary residence), with the assumption that they are sophisticated enough to understand and bear the risks of investments that lack the protections of a public offering.

What is a preferred return, and how is its payment impacted by the distribution pause?

A preferred return is a hurdle rate that Limited Partners must receive before the General Partner can take any share of the profits. If a preferred return is, for example, 8%, the LPs are due all of the first 8% of annual profits. When distributions are paused, the preferred return often accrues. This means the amount due to the LPs is tracked, and the fund must pay all accrued and current preferred returns before the GP can receive any profit split later.

How does a floating-rate loan differ from a fixed-rate loan, and why was it used?

A floating-rate loan has an interest rate that changes periodically based on a benchmark index (like SOFR or the Prime Rate). These loans were popular in recent years because they offered a lower initial interest rate and greater prepayment flexibility, which suited the “value-add” strategy’s anticipated short hold period. A fixed-rate loan has an interest rate that remains constant for the loan’s term, providing certainty but typically having a higher initial rate and prepayment penalties.

What exactly is an interest rate cap, and why did the cost of replacement spike so high?

An interest rate cap is a financial derivative—essentially an insurance policy—that a borrower (Ashcroft Capital) purchases to protect itself from excessive rate increases on a floating-rate loan. It sets a ceiling (the cap) on the loan’s interest rate. The cost of replacement caps spiked dramatically because, as the Federal Reserve rapidly raised rates, the probability of the cap being breached increased, making the insurance much more expensive for underwriters to offer.

What were the typical initial target Internal Rate of Return (IRR) figures advertised for these funds?

While specific figures vary by fund, many real estate syndications targeting accredited investors during the market’s peak were advertising aggressive target Internal Rates of Return (IRR) often in the 15% to 20% range, sometimes higher, along with a 2x to 3x equity multiple over a 5-7 year hold period. These projections were based on robust rental growth and favorable exit cap rates that did not materialize in the current economic environment.

What are the legal penalties for investors who refuse to participate in a capital call?

The penalties for a Limited Partner (LP) who defaults on a capital call are severe and explicitly defined in the fund’s legal agreements (the Limited Partnership Agreement or LPA). Penalties can include: forfeiture of a portion or all of their prior capital contributions, a reduction in their equity stake and future profit distribution, or their interest being purchased at a substantial discount by other LPs or the GP.

What defense is Ashcroft Capital likely to present in court against the fraud claims?

The firm’s legal defense will likely center on the argument that the financial distress resulted from unforeseen, systemic macroeconomic factors (e.g., unprecedented inflation, rapid interest rate hikes) that constitute an “Act of God” or a change in circumstances outside of their control. They would also likely assert that all necessary risk disclosures were provided in the voluminous legal offering documents, even if verbally communicated projections were more optimistic.

What is the function of Birchstone Residential, the firm’s in-house management company?

Birchstone Residential is Ashcroft Capital’s vertically integrated property management and construction management company. The purpose of this in-house structure is to gain efficiency, reduce third-party costs, and maintain greater control over the value-add renovation process, allowing the firm to theoretically execute its business plan faster and more profitably.

What is the concept of a “waterfall structure” in these funds, and how is it affected?

The waterfall structure defines the order in which cash flows (profits from operations or sale) are distributed to the investors and the sponsor. A typical waterfall has tiers: first, return of capital to LPs; second, preferred return to LPs; and third, a split of remaining profits between the LPs and the GP (often an 80/20 split). The financial distress halts cash flow at the lower tiers, significantly delaying or potentially eliminating payments in the higher tiers, particularly the profit-split to the GP.

Is Joe Fairless still actively involved in the day-to-day operations and management of the firm?

Yes, publicly available information continues to list Joe Fairless as a co-founder and principal of Ashcroft Capital, actively involved in high-level strategy and investor communications, particularly surrounding the fund restructuring and capital calls.

What is the typical projected hold period for these value-add multifamily investments?

The standard projected hold period for a value-add multifamily syndication, like those undertaken by Ashcroft Capital, is typically 5 to 7 years. This timeline allows enough time to execute renovations, realize rent growth, stabilize the asset, and then exit (sell or refinance) the property at a projected higher valuation.

What type of fraud or claim is typically alleged in these types of class action lawsuits?

The claims usually fall under securities fraud statutes. The core of the allegation is that the firm either: 1) made material misrepresentations of fact (e.g., claiming a deal was conservative when it was highly speculative), or 2) failed to disclose material facts (e.g., minimizing the existential risk posed by floating-rate debt) to induce investors to purchase securities (the fund shares).

What is a “key person event,” and is it a factor in this situation?

A key person event is a legal trigger in a fund’s operating agreement that occurs if a named principal, such as Joe Fairless or Frank Roessler, becomes permanently unable to perform their duties or leaves the firm. Such an event often gives the Limited Partners the right to vote to replace the General Partner or even terminate the fund. There is no public indication that such an event has been declared in this case.

What is the significance of the fact that the principals extended an $11 million short-term loan to the fund?

This action, disclosed in investor communications, serves as a dual message. From the firm’s perspective, it demonstrates skin in the game and a genuine attempt to keep the fund solvent. From a critical perspective, it underscores the severity of the financial crisis, indicating a liquidity gap so large that the General Partner had to step in with private capital just to meet immediate obligations like debt service and loan covenants.

What regulatory filing is required when raising capital under SEC Regulation D?

The specific regulatory filing is Form D. This form is a simple notice that the issuer (Ashcroft Capital) must file with the SEC after it has started selling securities in reliance on a Regulation D exemption. It provides basic information about the offering, the issuer, and the amount sold, but it does not require full financial disclosure like a public company filing.

How does this situation affect the firm’s ability to sell or refinance the properties?

The financial difficulties significantly complicate both selling and refinancing. A distressed property or portfolio is typically difficult to sell at an optimal price. Furthermore, lenders are now far more cautious, potentially refusing to refinance or demanding much lower loan-to-value ratios, higher collateral, and more expensive rate caps for any new debt.

What is the expected timeline for the resolution of the Cautero class action lawsuit?

Class action lawsuits, especially those involving complex financial structures and multiple parties, are typically protracted. A resolution, either through a court decision or a settlement, could take anywhere from two to five years or more, depending on the volume of discovery, the court’s calendar, and the parties’ willingness to negotiate.

What is the current outlook for the Sunbelt multifamily market that was key to the firm’s strategy?

The Sunbelt market remains fundamentally strong in the long term due to population and job migration trends. However, in the short to medium term, it faces challenges: increased supply from new construction, higher property insurance costs, and compressed valuations due to the increased cost of debt (higher cap rates), all of which have undermined the rapid appreciation models of the past few years.