The world of trading is changing fast. Technology now plays a huge role in how people invest. We moved from loud trading floors to fast digital exchanges. Now, a new player named etraderai is grabbing everyone’s attention. This platform mixes smart AI with a design that is easy to use. It makes complex trading tricks available to everyone. You do not need to be a pro to use it. It aims to help people who are new to the markets. The goal of etraderai is to make things simple for you. It uses automation to give you a fair shot.

Introduction to the EtraderAI Ecosystem

The financial markets are like a giant puzzle. There are too many moving parts for one person to track. This is where artificial intelligence steps in to help. It can process data way faster than any human. This platform helps you find trades and manage risks. It follows rules that you or the system set up. You can think of it as a smart assistant that never sleeps.

The Evolution of Trading

- Traditional Trading: In the past, trading was done by people shouting on a physical floor.

- Digital Shift: Later, computers made things much quicker and entirely digital.

- The AI Age: Now, machines can learn from the market and make complex choices.

- The Next Step: This shift is what makes etraderai interesting today as it represents the next step in trading history.

Core Objective of etraderai

- Simplify Complexity: The main goal is to make trading less scary for the average person.

- Data Transformation: It takes complex data and turns it into simple, actionable steps.

- No Degree Required: You get powerful tools without needing a math or finance degree.

- Accessibility: It levels the playing field by offering high-tech analytics and fast execution to everyone.

The AI Engine Behind EtraderAI: How it Works

The smart “brain” is the heart of this system. It is not just a bunch of simple code. It uses machine learning to get better over time. The system looks at price charts and trading volumes. It also reads economic news to find good patterns. This is what sets etraderai apart from old trading bots.

Understanding the GPT Technology Integration

- Advanced Logic: New versions like eTraderAI 3.1 GPT use logic similar to OpenAI models.

- Human-like Understanding: The bot can “understand” market data more like a person does.

- Early Trend Spotting: This tech helps the bot identify trends very early in their cycle.

- Software Evolution: It represents a massive jump in how modern trading software functions.

The Machine Learning Advantage

- Historical Analysis: The AI looks at years of old market data to find winning patterns.

- Hidden Connections: It finds links that a human would miss, such as a link between oil and a specific stock.

- Accurate Predictions: These deep data relationships help the system make more accurate forecasts.

24/7 Market Surveillance

- Global Monitoring: The system stays awake all day and night to watch global markets.

- No Fatigue: Unlike humans who need sleep, the AI scans markets constantly.

- Instant Action: It can execute a trade in the middle of the night so you never miss a move.

Core Features That Define the Experience

This platform is packed with tools for every type of trader. These features help you build and test your own plans. You get more than just a simple buy button. Everything is designed to work together in one smooth package.

Customizable Trading Bots

- Asset Choice: You can choose to trade Bitcoin, Ethereum, altcoins, forex, or commodities.

- Trigger Rules: You set the specific rules for when the bot should enter or exit a trade.

- Strategy Match: You can configure the bot to match a conservative or aggressive style.

Advanced Market Analytics

- Real-time Insights: The platform provides live data on market trends.

- Technical Indicators: You get detailed charts with tools like RSI and Moving Averages.

- Sentiment Analysis: It looks at how people feel about the market to gauge future moves.

Backtesting and Strategy Simulation

- Historical Testing: Test your plans on old data to see how they would have performed.

- Identify Weak Spots: Find and fix problems with your strategy before risking real cash.

- Confidence Building: This feature helps you feel sure of your plan before going live.

The Demo Account for Beginners

- Safe Practice: Trade with fake money to learn how the platform works.

- Zero Risk: See the AI in action without any chance of losing your own funds.

- Educational Bridge: Pro traders suggest using this to practice skills before real trading.

The Advantages of an AI-Powered System

Using AI gives you a huge leg up in the market. It handles the boring and hard stuff for you. This lets you focus on the big picture. There are three main reasons why people choose this path.

Emotion-Free Trading

- Logic Over Feeling: The bot operates on data and rules, not fear or greed.

- Consistent Execution: It does not hesitate or panic during market volatility.

- Psychological Safety: Using AI helps you avoid common mistakes like selling too early.

Significant Time Savings

- Automated Scanning: The bot handles the heavy lifting of watching charts all day.

- Passive Participation: You only need to check in once in a while, giving you your time back.

- Freedom: You can trade while working your day job or even while you sleep.

Access to Sophisticated Strategies

- Institutional Tech: Use the same high-tech tricks that big banks have used for years.

- Complex Management: The system handles multiple indicators and cross-asset correlations.

- Leveled Playing Field: It brings elite strategy tools to the average retail investor.

Getting Started: A Step-by-Step User Guide

Setting up your account is meant to be very easy. The team wanted to keep things simple for users. You can get your bot running in just a few steps. Just follow this path to begin your journey.

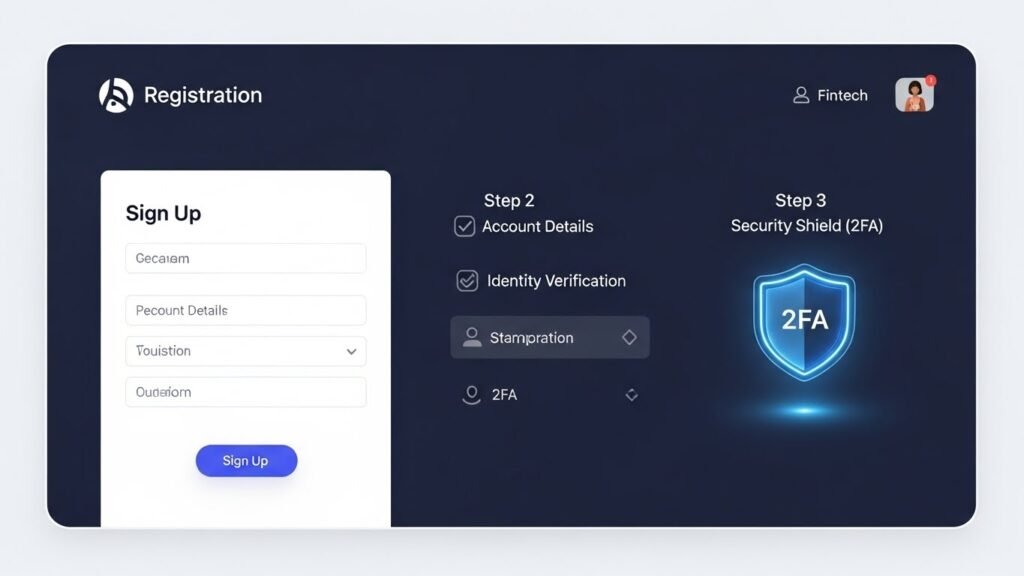

Account Creation and Security Setup

- Registration: Sign up on the official website with a strong password.

- Two-Factor Authentication: Enable 2FA immediately to add a vital layer of safety.

- Identity Protection: Strong security makes it much harder for hackers to get in.

Connecting to Your Brokerage Account

- Fund Control: The platform does not hold your cash; it stays in your brokerage account.

- API Bridge: Use a secure API key to connect the platform to your personal broker.

- Signal Only: The bot only sends “buy” or “sell” signals without touching your actual money.

Configuring Your First Trading Bot

- Select Assets: Choose the specific coins or stocks the bot will watch.

- Set Triggers: Pick the indicators that will tell the bot when to act.

- Capital Allocation: Decide exactly how much money to use for each individual trade.

Core Operational and Technical Framework of EtraderAI

The AI Engine and GPT Integration

The “brain” of the system is built on sophisticated machine learning models rather than simple, static code.

- Machine Learning Evolution: The system utilizes machine learning to improve its performance over time by analyzing price charts and trading volumes.

- Advanced GPT Logic: Newer versions, such as eTraderAI 3.1 GPT, incorporate advanced logic similar to large-scale language models. This allows the bot to “understand” market data with a human-like perspective.

- Trend Identification: This technology is specifically designed to spot emerging market trends very early in their cycles.

- External Data Processing: Beyond simple price action, the AI reads economic news to identify profitable patterns, which distinguishes it from traditional trading bots.

Onboarding and Account Configuration

The transition from a new user to an active trader follows a specific path designed for simplicity.

- Registration and Verification: Users begin by signing up on the official website with a strong password. Following registration, creators verify the information and send a confirmation email to activate the account.

- Capital Requirements: A minimum initial deposit of $250 is required to begin live trading. This can be deposited via bank transfer, debit/credit cards, or other available methods.

- Configuring Strategy: Before the AI begins scanning the market, users must set specific “trigger rules” for entering or exiting trades and choose which assets (such as Bitcoin, Forex, or Commodities) the bot should watch.

Security Architecture and Fund Safety

To protect user interests, the platform integrates several layers of technical and procedural security.

- Access Protection: Users are urged to enable Two-Factor Authentication (2FA) immediately to provide a vital layer of safety against unauthorized access.

- API Bridge Connection: The platform does not hold user cash directly; funds remain in the user’s personal brokerage account. The bot connects via a secure API key to send “buy” or “sell” signals without having direct access to withdraw funds.

- Strict Security Protocols: The system employs encryption and other strict protocols to safeguard data and trading activities.

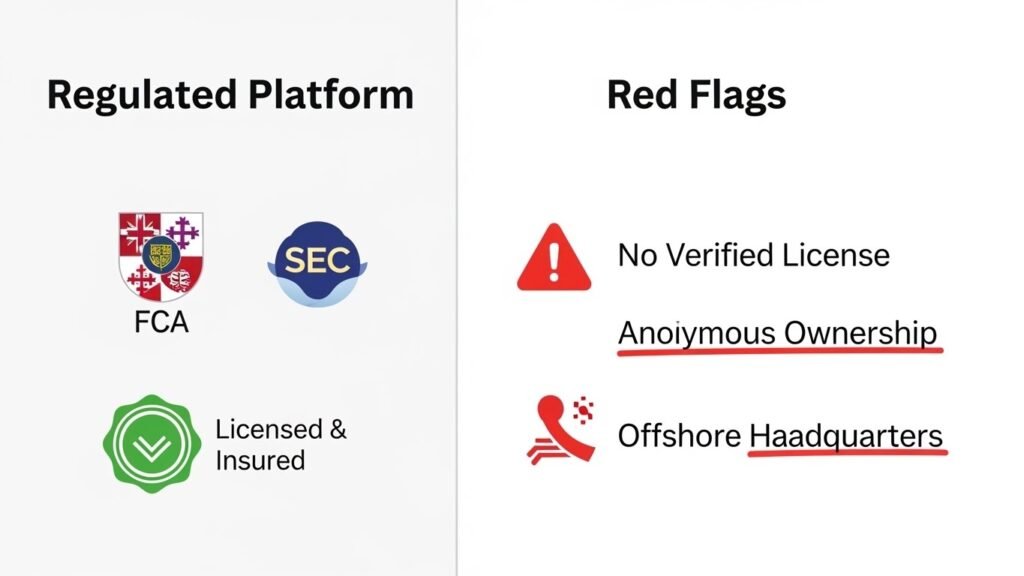

Critical Risk Warnings and Platform Red Flags

Despite the technological advantages, several significant “red flags” and risks are documented that require user vigilance.

- Lack of Regulatory Oversight: The platform is not registered with major global financial regulators such as the FCA, SEC, ASIC, or CySEC. This means there is no official government body providing oversight or protection for the user.

- Limited Transparency: There is a notable lack of information regarding the company’s executive team and its verified physical office location.

- Unverifiable Performance: Users should be wary of marketing claims that promise “guaranteed” wins or zero risk, as reputable financial services always include realistic warnings about potential losses.

- Reported Operational Issues: Independent watchdogs have labeled the platform as “high-risk,” and there have been reported cases of users experiencing difficulties when attempting to withdraw their funds.

Risk Management and Protective Measures

Automation requires strict limits to protect your capital from market volatility.

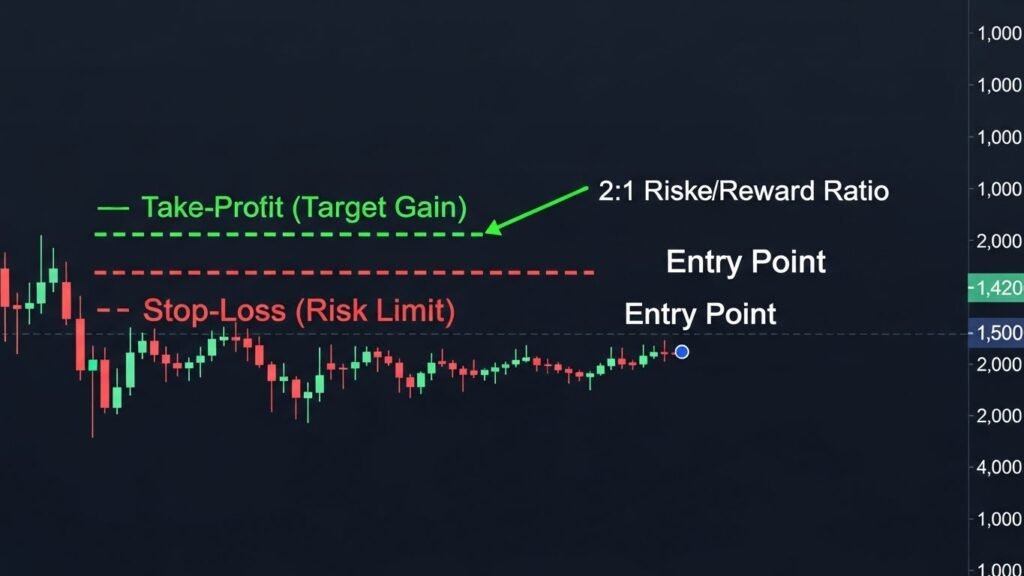

- Automated Exit Orders: Utilizing Stop-Loss orders is critical to automatically sell an asset if the price drops too low, while Take-Profit orders lock in gains once a target is reached.

- Position Sizing: Traders should limit the amount of money risked on any single trade to a small percentage of their total balance.

- Asset Diversification: Spreading wealth across different assets (like combining Crypto and Forex) ensures that a single bad market move does not ruin the entire account.

Risk Management within the Ecosystem

Trading always comes with some level of risk. You must use tools to protect your capital. Automation is powerful but it needs strict limits. These features are the most important part of trading.

The Critical Role of Stop-Loss and Take-Profit

- Stop-Loss: Automatically sells an asset if the price drops too low to prevent big losses.

- Take-Profit: Closes a trade once it hits a winning target to lock in your gains.

- Consistency: Using both orders is key to long-term survival in the market.

Position Sizing and Diversification

- Risk Per Trade: Limit how much you risk on any single move to a small percentage.

- Spread the Wealth: Trade different assets so that one bad move doesn’t ruin your account.

- Stability: Balance across assets helps keep your total account value stable.

Addressing Regulatory Concerns and Red Flags

You must be careful with any online platform. There are many scams out there in the world. Some people have raised concerns about etraderai. It is important to look at the facts clearly.

Lack of Verified Licensing

- No Official Registry: It is not registered with major groups like the FCA or SEC.

- Missing Clearances: It has not been cleared by ASIC or CySEC either.

- No Oversight: Without a license, there is no official group watching them for you.

The Problem of Limited Transparency

- Anonymous Ownership: The platform does not clearly list who actually owns the company.

- Hidden HQ: There is no verified physical office location listed for the business.

- Leadership: Information about the executive team is missing from public view.

Unverifiable Performance Claims

- Guaranteed Profits: Be very wary of ads that promise “guaranteed” wins or zero risk.

- Marketing Red Flags: Reputable services will always warn you about the chance of loss.

- Fabricated Results: Some platforms use fake results or endorsements to trick users.

| Feature | Standard Legit Platform | etraderai Red Flags |

| Regulation | FCA, SEC, ASIC licensed | No verified licenses found |

| Transparency | Clear HQ and leadership | Anonymous ownership |

| Profit Claims | Realistic risk warnings | Promises of “guaranteed” wins |

| Fund Safety | Custodial safeguards | Unregulated and offshore |

Investigating the “Swindle or Real Deal” Debate

People have different opinions on this software. Some say it works great for their needs. Others say they have lost a lot of money. This has sparked a big debate online lately.

Red Flags of Fraudulent Websites

- New Domains: Be careful with websites that were just recently created.

- Generic Language: Watch for marketing that sounds too basic or sounds like a template.

- Fake Reviews: Look out for reviews that are only positive and lack detail.

The Verdict of Independent Watchdogs

- High-Risk Label: Groups like InvestorWarnings.com list this platform as high-risk.

- No Audits: Experts point to the lack of independent auditing as a major proof of risk.

- Withdrawal Issues: There are reported cases of users having trouble getting their money out.

What to do if You Have Already Invested

If you have money in etraderai, do not panic. You need to take quick and smart action. Protecting your remaining funds is the top priority. Follow these steps to help secure yourself.

Immediate Withdrawal and Documentation

- Fast Action: Try to withdraw your entire balance as soon as possible.

- Screenshots: Take pictures of all your chat logs and transaction history.

- Record Keeping: Save every email to use as evidence if you need to file a claim.

Tracing Lost Funds and Reporting

- Expert Help: If you cannot withdraw, look for official services to help trace your funds.

- Authorities: Report the situation to your local cybercrime police and regulators.

- Recovery Scams: Be careful of “experts” who promise to get your money back for a fee.

The Future of Trading and the Role of EtraderAI

AI is not going away anytime soon. It will only get smarter and more common. The way we trade will keep evolving daily. You need to adapt to stay ahead.

The Shift to Algorithmic Dominance

- Machine-Led Markets: Most trades today are already handled by high-speed computers.

- Data Over Gut: Cold data is rapidly replacing gut feelings in the investment world.

- Platform Role: Systems like etraderai are a part of this growing global trend.

The Human as a Strategist

- Managing the System: You won’t be replaced; you will become the manager of the AI.

- Man and Machine: Success comes from combining human strategy with machine execution.

- Efficiency: This partnership allows you to be a much faster and better trader.

Strategy for Success: The 30-Day Demo Trading Plan

Building a demo plan is the most critical step before committing real capital to any automated system. A structured “paper trading” phase allows you to refine your settings and build confidence in the AI’s logic without the stress of financial loss. Below is a detailed 30-day roadmap designed to help you transition from a beginner to a confident system manager.

Phase 1: The Setup (Days 1–3)

The goal here is to mirror your future live account as closely as possible to ensure your results are realistic.

- Balance Selection: Set your demo balance to exactly what you intend to deposit in a live account, such as $250 or $1,000. Practicing with a $50,000 demo balance when you only have $250 in real life creates a false sense of security.

- Platform Familiarization: Spend these days clicking through every menu. Learn where the “Emergency Stop” button is and how to manually close a trade if the AI ever hits an error.

- API Connection Test: Ensure your demo platform is successfully receiving price data from the markets. Confirm that when you click “Buy” in the demo, the order executes instantly.

Phase 2: Conservative Calibration (Days 4–10)

Start by setting the AI to its most cautious levels. You want to see how the bot handles small movements before seeking big wins.

- Asset Selection: Choose 1 or 2 highly liquid assets like Bitcoin or major Forex pairs like EUR/USD. Avoid volatile “penny coins” during this week.

- Tight Risk Controls:

- Set a Stop-Loss of no more than 1–2% per trade.

- Set a Take-Profit at a 2:1 ratio; if you risk $5, you aim to gain $10.

- The “Hands-Off” Rule: Let the bot run without interfering. Observe how it enters trades based on the indicators you selected.

Phase 3: Strategy Stress Testing (Days 11–20)

Now that you understand the basics, it is time to see how the bot handles different market conditions.

- Trend vs. Sideways: Observe how your bot performs when the market is moving up versus when it is just “bouncing” in a flat range.

- Indicator Tuning: If the bot is entering too many losing trades, try adjusting your technical indicators. For example, if using the RSI, change the “Oversold” trigger from 30 to 20 to make the bot more selective.

- Logging Results: Keep a simple journal. Note down every time the AI made a choice you didn’t expect. Did it sell too early or hold through a crash?

Phase 4: Performance Review & Live Prep (Days 21–30)

This final week is for deciding if your strategy is ready for real money.

- Analyze Win Rate vs. Profitability: A bot can win 70% of the time but still lose money if its few losses are huge. Ensure your total gains are higher than your total losses.

- Slippage Simulation: Remember that demo accounts execute perfectly, but live markets have “slippage” where the price changes slightly before your order fills. Subtract a small percentage from your demo profits to account for this real-world friction.

- Final Decision: If your demo account is consistently profitable over these 30 days, you are ready to move to Phase 1 of live trading with the minimum $250 deposit.

Success Checklist for Your Demo Phase

- Treat it as Real: If you wouldn’t make a $100 trade in real life, do not do it in the demo.

- No “Re-fills”: If you blow your demo balance, do not just click “reset.” Analyze why you lost and start the 30-day plan over.

- Focus on Process: The goal isn’t to make a fortune in fake money; it is to prove that your bot follows your rules 100% of the time.

Conclusion: Balancing Innovation with Vigilance

The etraderai platform is a very powerful tool. It offers a new way to enter the markets. But it also has some serious red flags. You must balance the “hype” with cold facts. Success comes from being smart and very careful.

Always use risk management like stop-losses. Do your own research before sending any money. Use the demo account to practice your skills. Remember that no one can guarantee you profits. Stay disciplined and you can navigate this era.

FAQs

What is the primary goal of the EtraderAI platform?

The main objective of the platform is to simplify the complexity of financial markets for average individuals, turning intricate data into actionable steps without requiring a finance degree.

How does the AI engine differ from traditional trading bots?

Unlike old bots that follow simple, static code, this system uses machine learning and reads economic news to identify profitable patterns and trends.

What is the minimum deposit required to start live trading?

To begin live trading on the platform, a minimum initial deposit of $250 is required.

Does EtraderAI hold my trading capital directly?

No, the platform does not hold your cash; your funds remain in your personal brokerage account.

How does the bot execute trades if it doesn’t hold my money?

The bot connects to your broker via a secure API key, allowing it to send “buy” or “sell” signals without having the authority to withdraw funds.

What is the benefit of the GPT technology integration?

Newer versions like eTraderAI 3.1 GPT use advanced logic to “understand” market data with a human-like perspective, helping to spot trends very early in their cycle.

Is EtraderAI regulated by any financial authorities?

The platform is not registered with major global regulators such as the FCA, SEC, ASIC, or CySEC, meaning there is no official government oversight.

Can I practice trading without risking real money?

Yes, the platform offers a demo account that allows users to trade with fake money to learn the system with zero risk to their actual funds.

What assets can I trade using the customizable bots?

Users can choose to trade a variety of assets, including Bitcoin, Ethereum, altcoins, Forex, or commodities.

How does the system handle market monitoring?

The AI provides 24/7 market surveillance, scanning global markets constantly without the fatigue that affects human traders.

What are “Stop-Loss” and “Take-Profit” orders?

A Stop-Loss automatically sells an asset if the price drops too low to prevent large losses, while a Take-Profit closes a trade once a winning target is reached to lock in gains.

How does the platform protect my account from unauthorized access?

The system utilizes encryption and urges users to enable Two-Factor Authentication (2FA) immediately to add a vital layer of safety.

Why is transparency considered a concern for this platform?

There is a notable lack of information regarding the company’s executive team, its ownership, and its verified physical office location.

What should I do if I experience difficulty withdrawing funds?

If you cannot withdraw your balance, you should document all transactions with screenshots and report the situation to local cybercrime police and regulators.

Does the platform guarantee profits?

No, users should be wary of any claims promising “guaranteed” wins; reputable services always include warnings about the potential for loss.

What is the purpose of backtesting a strategy?

Backtesting allows you to test your trading plans against historical data to see how they would have performed, helping you fix weak spots before risking real cash.

How does the AI find connections between different assets?

The machine learning algorithms analyze years of data to find hidden links, such as the relationship between oil prices and specific stocks.

Can the AI bot trade while I am at work or asleep?

Yes, the automation allows for passive participation, executing trades in the middle of the night or while you are busy with other tasks.

What is position sizing?

Position sizing is a risk management technique where a trader limits the amount of money risked on any single trade to a small percentage of their total account balance.

What does “high-risk” label from independent watchdogs mean?

Groups like InvestorWarnings.com have labeled the platform high-risk due to lack of regulation, withdrawal issues, and missing independent audits.