You probably see people talking about big wins on social media all the time. Everyone wants to find that next big thing in the robthecoins blockchain world. It can feel like a wild ride if you are new to this. This guide will show you how to navigate this exciting space safely. We will look at how to use smart moves to grow your digital wallet.

Understanding RobTheCoins: The Digital Currency Phenomenon

RobTheCoins is a new way to look at how we handle digital cash. It tries to make the complex world of robthecoins blockchain easy for regular people. Many platforms are too hard to use for beginners today. RobTheCoins wants to change that by making everything simple and clear. It acts as a bridge between old money and the new digital age.

The Core Concept

The main idea here is to simplify how you move and trade coins. Most people get scared when they see a bunch of technical charts and data. This platform focuses on making those transactions feel very natural. It aims to cut out the confusing parts of the robthecoins blockchain. You get a clear view of your assets without the headache.

The High-Concept Pitch

The pitch for this platform is all about giving power back to you. They use a few different stories to explain why they are better. These narratives help people understand the goals of the project. It is not just about trading; it is about a new financial ethos.

- The Robin Hood Narrative: This is all about helping the little guy win against big whales.

- The Disruptive Ethos: They want to break the old rules of big banks and central groups.

Target Audience

The platform is built for everyone who wants to try digital assets. If you are a total newbie, you will find it very easy to start. If you are a pro, you will like the advanced tools available. It serves the whole spectrum of the informed investment community. No matter your skill level, there is something here for you.

Market Positioning

RobTheCoins sits right in the middle of technology and easy access. It aims to solve the problem of technical barriers in the crypto space. Many folks want to invest but do not know how to read a whitepaper. This platform positions itself as the friendly face of the robthecoins blockchain. It makes the “Wild West” of crypto feel much more like home.

How the RobTheCoins Ecosystem Functions

To use the robthecoins blockchain, you need to know how the system works. It is built to be a smooth machine that handles your trades fast. The ecosystem relies on smart tech to keep things running every single day. Let’s look at how you actually get started and stay safe.

User Onboarding

Getting started is as easy as signing up for a regular website. You just create an account and verify who you are to start. The interface is designed to lead you through every single step. You will not feel lost while you are setting things up. It is a very intuitive process for any new user.

Asset Management

Managing your coins is very flexible on this platform. You can deposit your digital goods and start trading right away. It supports many different types of coins and tokens for you. You can see all your assets in one simple dashboard. This makes it easy to track how much money you are making.

Algorithmic Integration

The system uses smart math to find the best prices for you. These algorithms look at market patterns in real-time across the globe. This ensures you are always getting a fair deal when you trade. The tech does the heavy lifting so you do not have to. It provides a competitive edge for every single user.

Safety Infrastructure

Keeping your money safe is the most important part of the robthecoins blockchain. They use top-tier encryption to hide your data from bad actors. You also get two-factor authentication to keep your login very secure. The platform uses secure treasury protocols to lock up the funds. You can rest easy knowing your digital assets are well protected.

Core Features and Offerings

The platform comes with a lot of cool tools for its users. These features are what make the robthecoins blockchain stand out today. They focus on both making money and learning how to be better.

- Streamlined User Interface (UI): Everything is designed to be clean and very easy to read.

- Modern Trading Tools: You get real-time data and charts that are actually helpful.

- Asset Diversity: You can trade Bitcoin, Ethereum, and many other popular altcoins.

Educational Ecosystem

They believe that an educated trader is a successful trader. That is why they offer so much learning material for free. You can find tutorials that explain everything from A to Z. They also provide market updates so you know what is happening. This helps you stay ahead in the fast crypto ecosystem.

Round-the-Clock Support

If you ever run into a problem, help is always there. They have a customer support team that works 24/7 for you. You can reach them with just a simple push of a button. This is great for a market that never sleeps like crypto. You are never alone when you are using this platform.

A Deep Dive into Cryptocurrency Trading Strategies

Trading is not just about luck; it is about having a plan. On the robthecoins blockchain, you can use many different styles. You should pick the one that fits your lifestyle the best. Here are the most common ways people trade their coins.

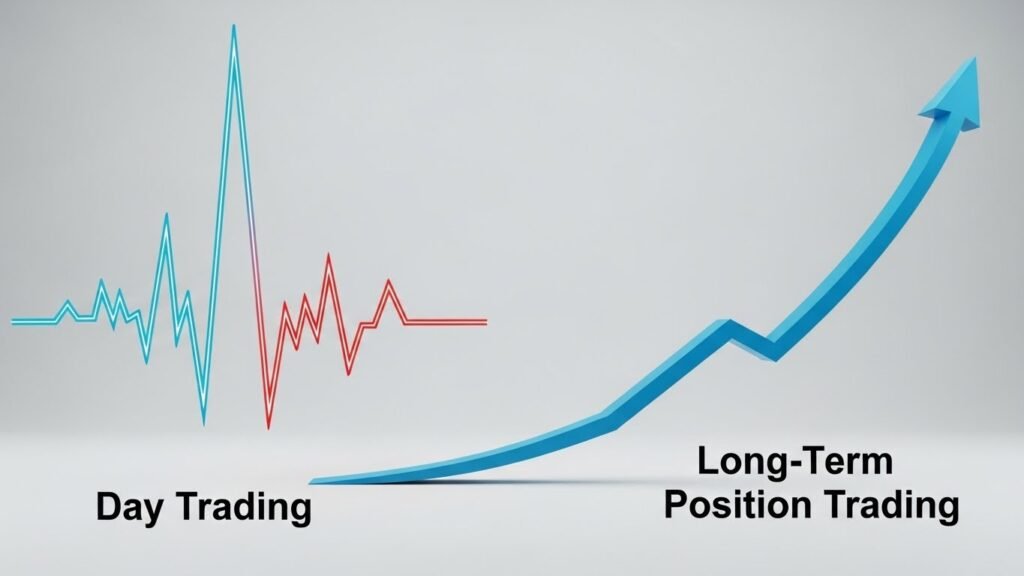

- Day Trading: This is where you buy and sell coins on the same day.

- Swing Trading: You hold your coins for a few days or weeks to profit.

- Scalping: This is very fast trading to make tiny profits many times a day.

- Position Trading: You buy a coin and hold it for months or even years.

The Auto-Yield Approach

This is a “set-and-forget” style for people who are very busy. The system automatically finds the best ways to earn interest on your coins. It harvests yields from different places in the DeFi world for you. This is a great way to earn passive income without much work. It makes the robthecoins blockchain work for you while you sleep.

Redistribution Mechanics

Some tokens have a special rule where sellers pay a small tax. That tax is then given to everyone who is still holding the coin. This “taxation as a feature” rewards you for being a loyal investor. It is like getting a small bonus just for keeping your coins. This creates a strong community of long-term believers in the project.

Technical Analysis vs. Fundamental Analysis

There are two main ways to look at the market before you buy. Most successful traders on the robthecoins blockchain use a bit of both. Understanding these will help you make much better choices with your cash.

The Quantitative Lens (Technical Analysis)

This method is all about looking at charts and past price data. You look for patterns that tell you where the price might go next. Traders use things like support and resistance levels to guide them. It is very math-heavy and looks at how people are acting now. Many people love this for quick trades and fast profits.

The Qualitative Lens (Fundamental Analysis)

This way looks at the “why” behind a project or a coin. You check out the team and the technology to see if it is real. You look at the market demand and if anyone actually needs this coin. It helps you see if a project will be around in five years. This is the best way to find long-term winners in the crypto space.

The Hybrid Method

The best traders combine technical data with fundamental research. This gives you a full picture of what is happening in the market. You can see the short-term trends and the long-term value at once. Using this hybrid method lowers your risk of making a bad move. It is the smartest way to handle your robthecoins blockchain investments.

The Critical Question: Is RobTheCoins Legit or a Hazard?

With so many scams out there, you have to be very careful. You should always check if a platform is a real opportunity or a trap. Looking at the robthecoins blockchain requires a very skeptical eye at first.

Assessing Authenticity

You need to compare what they say with what they actually do. A legitimate platform will have clear proof of its market standing. Always look for peer reviews and expert opinions from the community. If something sounds too good to be true, it probably is a scam. Authentic projects are always open about how they make their money.

The Transparency Paradox

Transparency is a big deal in the world of digital finance. Some projects are very open, while others like to stay hidden. You have to decide if you trust the people behind the curtain.

- Anonymous Teams: Many founders stay hidden to protect their own privacy.

- Verifiable Code: Check if the code is open-source on sites like GitHub.

Third-Party Validation

A great way to check a project is to look for an audit. Reputable firms like CertiK or Hacken look for bugs in the code. If a project has a clean audit, it is a very good sign. It shows they care about your safety and the robthecoins blockchain. Never put money into a project that refuses to show an audit.

The Duality of Reviews

You will always see a mix of good and bad reviews online. Some people love how fast and easy the platform feels to use. Others might complain about a withdrawal taking too much time. You have to look at the big picture and see which stories are more common. A few bad reviews are normal, but a lot of them are a huge red flag.

Risk Management: Benefits and Hazards

Every investment comes with some level of risk and reward. You need to weigh these before you jump into the robthecoins blockchain. Understanding the balance will help you stay safe and profitable over time.

The Potential Benefits

The upside of crypto can be life-changing if you play it right. You get to be part of a revolutionary protocol that is changing finance. It is much easier to start here than with old-school stock markets. You also get to join a community of people who think like you do. The financial freedom you can find here is a huge draw for many.

The Inherent Hazards

You also have to face the scary parts of the crypto world. Prices can go up and down very fast, which we call market volatility. There is always a risk of a technical bug or a hack happening. Some projects are just “pump and dump” schemes built to steal your cash. You must be prepared to lose any money you put into these assets.

Common Mistakes and How to Avoid Them

Even smart people make silly mistakes when they trade crypto. Avoiding these traps will put you ahead of most other retail investors. Here is what you should watch out for on the robthecoins blockchain.

- Emotional Trading: Do not let fear or greed tell you what to do.

- Research Failure: Do not just follow what a TikTok influencer tells you.

- Security Neglect: Always use 2FA and never share your private passwords.

- Lack of Diversification: Do not put every single penny into just one coin.

- Missing Stop-Losses: Always set a point where you will sell to stop a loss.

Advanced Strategies and On-Chain Realities

To gain a competitive edge, successful traders look beyond basic charts and dive into the actual data recorded on the blockchain.

Intrinsic Value vs. Market Price

Fundamental analysis in the RobTheCoins ecosystem involves calculating “intrinsic value”—what a project is actually worth based on its technology and adoption—versus its current market price. If the fundamental value is high but the market price is low, it represents an undervalued buying opportunity. Conversely, a high price driven purely by social media hype is a clear signal to stay away.

Whale Watching and Market Impact

“Whales” are individuals or organizations that hold such massive amounts of a coin that their single buy or sell orders can move the entire market.

- Tracking Inflows: Traders often watch “exchange inflows.” If the average amount of a specified cryptocurrency being deposited into exchanges rises significantly, it often indicates that whales are preparing to “dump” their holdings, leading to a price drop.

- Liquidity Hoarding: Whales can also affect liquidity by hoarding coins, creating a “scarcity” that isn’t based on actual demand but on artificial holding.

Token Burn and Scarcity Mechanics

Many projects use a “token burn” mechanism to manage their economy.

- Intentional Removal: Tokens are sent to an inaccessible “burn address” (a wallet with no private key), permanently removing them from circulation.

- Price Impact: By reducing the total supply while demand stays the same or grows, the remaining units theoretically become more valuable. This is the blockchain version of a company repurchasing its own shares to boost value for current shareholders.

Critical Security and Technical Safeguards

Protecting your digital wallet requires more than just a strong password; it requires understanding the fundamental rules of blockchain resilience.

Seed Phrase and Key Management

Your 12 or 24-word “Secret Recovery Phrase” is the ultimate backup for your private keys.

- The “No Recovery” Rule: Unlike a bank account, if you lose your seed phrase and your device is reset, your assets are gone forever. No support team can retrieve it for you.

- Physical Storage: Never store this phrase in a digital format (like a screenshot or email). It should be written down and kept in a secure, physical location.

Double-Spend and Network Resilience

The robthecoins blockchain is designed as a “trustworthy ledger” that prevents common financial fraud.

- Preventing Double-Spending: The network uses decentralized consensus protocols (like Proof of Work or Proof of Stake) to ensure that a single digital coin cannot be spent twice. Thousands of computers verify the validity and order of every transaction.

- Resilience Against Shutdown: Because a decentralized blockchain runs on computers all over the world, there is no single “off switch.” Even if a government bans crypto or shuts down local exchanges, the information on the ledger remains accessible and the network continues to run.

User Experience Reality Checks

Expert insights suggest that while a platform may claim 24/7 rapid support, user reviews often tell a different story. Common issues found in emerging platforms include:

- Slow Support Response: Reported delays during times of high market volatility.

- Withdrawal Friction: Technical or “security check” delays that prevent users from moving their funds quickly.

- Community Quality: If a project’s Telegram group dismisses all technical questions as “FUD” (Fear, Uncertainty, Doubt), it is likely a community built on greed rather than technology.

Expert Insights and the Future of the Industry

The future of the robthecoins blockchain looks very bright to many experts. We are seeing big companies finally start to use this technology. This brings more stability and trust to the whole crypto industry.

- Institutional Integration: Big banks are starting to offer crypto services to clients.

- Regulatory Landscape: Governments are making new rules to protect small investors.

- AI and Machine Learning: Smart bots are going to make trading much faster and easier.

- Democratization of Finance: DeFi is giving banking to people who never had it before.

Final Verdict: Navigating the Hype Toward Informed Participation

In the end, the robthecoins blockchain is a powerful tool if you use it right. You have to look past the hype and see the real value underneath. It can be a high-risk gamble or a smart prospect depending on your moves. Always put your own education first before you spend any of your capital.

| Strategy Type | Risk Level | Time Commitment |

| Day Trading | Very High | High (Full Day) |

| Swing Trading | Medium | Moderate |

| Auto-Yield | Low to Medium | Very Low |

| Position Trading | Medium | Low |

FAQs

What are the main differences between a crypto broker and a crypto exchange?

A crypto exchange is a marketplace where you trade directly with other users, often resulting in lower fees. A broker acts as a middleman that finds the best prices for you across multiple markets, which can be more convenient for beginners. Platforms like the robthecoins blockchain often combine these features to offer a seamless experience for all users.

How do market orders differ from limit orders?

A market order buys or sells a coin instantly at the current best available price, which is fast but risky during high volatility. A limit order allows you to set a specific price at which you are willing to buy or sell, giving you more control over your entry and exit points. Using limit orders is a smart way to manage your robthecoins blockchain assets more precisely.

Can I lose more money than I invest in crypto?

In standard spot trading, you can only lose the amount you initially put in if the coin’s value goes to zero. However, if you use leverage or margin trading, it is possible to lose more than your initial deposit and end up owing the platform money. It is highly recommended to avoid leveraged positions until you have a deep understanding of the robthecoins blockchain ecosystem.

What exactly is a “gas fee” on a blockchain?

Gas fees are small payments made to the network’s miners or validators to process and verify your transactions. These fees go directly to the people maintaining the network, not necessarily to the platform you are using. On the robthecoins blockchain, these fees can fluctuate based on how many people are trying to use the network at the same time.

Why is crypto often described as “pseudonymous” rather than “anonymous”?

Most blockchains are public ledgers, meaning every transaction and wallet balance is visible to anyone in the world. While your real name is not attached to the wallet address, your identity can often be traced through the exchanges you use or your online activity. True privacy on the robthecoins blockchain requires advanced tools and careful management of your digital footprint.

Is cryptocurrency legal tender in the United States?

No, cryptocurrency is currently not recognized as legal tender by the U.S. government, meaning businesses are not required to accept it for payments. However, it is legal to own and trade as a digital asset or commodity in most states. Always check your local state regulations to see how they view the robthecoins blockchain and related services.

How do I report my crypto earnings on my taxes?

In many regions, including the U.S., digital currency is treated like property or a commodity for tax purposes. You must report capital gains or losses every time you sell, trade, or spend your coins. Keeping detailed records of your robthecoins blockchain transactions is essential for staying compliant with the law.

What happens if I lose the “seed phrase” to my digital wallet?

Your seed phrase is the master key to your digital assets; if you lose it, you lose access to your money forever. There is no “forgot password” button for a private wallet because there is no central company in charge of your keys. Always keep a physical backup of your robthecoins blockchain recovery phrase in a safe, fireproof location.

Are crypto investments insured by the FDIC?

Unlike traditional bank accounts, cryptocurrency held on exchanges or in private wallets is generally not insured by the FDIC. If a platform goes bankrupt or is hacked, there is no government guarantee that you will get your money back. This is why using a secure and reputable robthecoins blockchain platform is so critical for long-term safety.

What is the difference between a “hot wallet” and a “cold wallet”?

A hot wallet is connected to the internet, making it convenient for frequent trading but more vulnerable to online hacks. A cold wallet is a physical device kept offline, providing the highest level of security for long-term storage. Most pros keep only a small amount on the robthecoins blockchain for daily use and move the rest to cold storage.

How does “staking” earn me rewards?

Staking involves locking up your coins to help support the security and operations of a blockchain network. In return for this service, the network gives you newly minted coins or a share of transaction fees as a reward. It is a popular way to earn passive income while holding assets on the robthecoins blockchain.

What are “stablecoins” and why are they used?

Stablecoins are digital tokens pegged to the value of a stable asset like the U.S. Dollar or Gold. They allow traders to keep their value in the digital space without worrying about the massive price swings of Bitcoin or Ethereum. They are often used as a “safe harbor” during volatile times on the robthecoins blockchain.

Can my crypto account be hacked even if I use a strong password?

Yes, hackers can use phishing emails, malware, or SIM-swapping to bypass even the strongest passwords. This is why enabling two-factor authentication (2FA) through an app like Google Authenticator is absolutely necessary. It adds a physical layer of security that makes it much harder to steal your robthecoins blockchain funds.

What is a “smart contract” in the crypto world?

A smart contract is a self-executing piece of code that automatically carries out the terms of an agreement when certain conditions are met. They eliminate the need for a middleman or lawyer to verify a transaction. These contracts are the foundation of decentralized apps and many features within the robthecoins blockchain.

Why do some coins have a “burn” mechanism?

Burning tokens involves sending them to an inaccessible wallet, effectively removing them from the total supply forever. This is often done to create scarcity, which can help increase the value of the remaining tokens over time. Many projects on the robthecoins blockchain use burns to manage their economy and reward holders.

How can I verify if a coin’s whitepaper is real?

A real whitepaper should clearly explain the problem the project solves and the technical details of how the technology works. Be wary of papers that are full of marketing hype, vague promises, or “copy-pasted” text from other famous projects. Checking the whitepaper is a key step in performing due diligence on the robthecoins blockchain.

What are “whales” and how do they affect the market?

Whales are individuals or organizations that hold a massive amount of a specific cryptocurrency. Because they own so much, their large buy or sell orders can cause the price to move significantly in a short time. Small traders on the robthecoins blockchain often watch whale movements to predict where the price might go next.

Is “mining” still a profitable way to get crypto?

Mining can be profitable, but it now requires very expensive hardware and cheap electricity to make a return. For most regular people, it is much easier and cheaper to simply buy coins on a platform. However, mining remains the backbone of security for many networks like the robthecoins blockchain.

What is a “Double-Spend” attack?

A double-spend occurs when a bad actor tries to send the same digital coin to two different people at the same time. The blockchain is designed to prevent this by having thousands of computers verify every single transaction. This security feature is what makes the robthecoins blockchain a trustworthy ledger for finance.

Can a government “shut down” a decentralized blockchain?

While a government can ban the use of crypto or shut down local exchanges, they cannot easily stop a truly decentralized network. Because the network runs on thousands of computers globally, there is no single “off switch” to pull. This resilience is one of the most powerful features of the robthecoins blockchain technology.