Defining Vehicle Acquisition Methods

Getting a new set of wheels can feel like a huge puzzle. You have to decide if you want to buy or rent the car. This choice is the difference between financing and leasing. Understanding these two methods is the first step toward making a smart financial move. You need to pick the option that fits your budget and lifestyle.

Let’s break down the fundamentals of financing and leasing a car. The choice you make impacts your monthly payments and your long-term ownership goals. You will see how each path affects your money differently.

What is Car Financing?

When you choose financing, you are essentially taking out a loan. You use this money to complete the vehicle purchase. Think of it as borrowing cash from a bank or another lender. You agree to pay back this loan over a set period, which is called the term.

The car becomes yours once the full loan amount is paid off. This means you gain full ownership. The monthly payments you make cover the principal amount borrowed. They also cover the interest rates charged by the lender, plus any related fees. By financing, you are building equity in the vehicle over time. This is a big win for your financial future.

What is Car Leasing?

Leasing a car is like a long-term rental. You do not own the vehicle. Instead, you are paying the dealership or manufacturer for the right to drive the car for a specific time. This term is usually short, maybe two or three years.

Your monthly payments primarily cover the estimated drop in the vehicle’s value during the lease period. This drop is known as depreciation. The monthly payments also include a finance charge, called the money factor, and various fees. Because you are renting, you never build equity. When the lease ends, you simply return the car to the dealership. This arrangement works well for people who always want a new ride.

How Car Financing Works: The Step-by-Step Process

Financing a car can seem intimidating, but it follows a clear process. The goal is to secure the best loan terms possible. Preparation is the key to minimizing your costs and maximizing your savings. This entire process helps determine how much you will borrow and what your payment will be.

Preparation and Application

Before you set foot in a dealership, you need to do some homework. Knowledge is power, especially when dealing with interest rates. You should know where you stand financially.

Check Your Credit Score and Credit Report

The very first step is checking your credit score. Your score is the single most important factor for lenders. A high score shows financial responsibility. This allows you to qualify for the lowest rates on your auto loan. Conversely, a low score means higher interest rates and thus, higher total cost. Always review your credit report for errors before submitting an application. Knowing your score gives you leverage in the negotiation.

Get Prequalified

The next smart move is to get prequalified for a loan. This means a bank or online lender gives you an estimate of how much they would loan you. They also provide an estimated interest rate. This prequalification gives you a clear spending ceiling. You can start shopping for your desired vehicle purchase within a set budget. Remember, prequalification is not a final offer. It is just an informed estimate to help you prepare. This initial step saves a ton of time at the dealership.

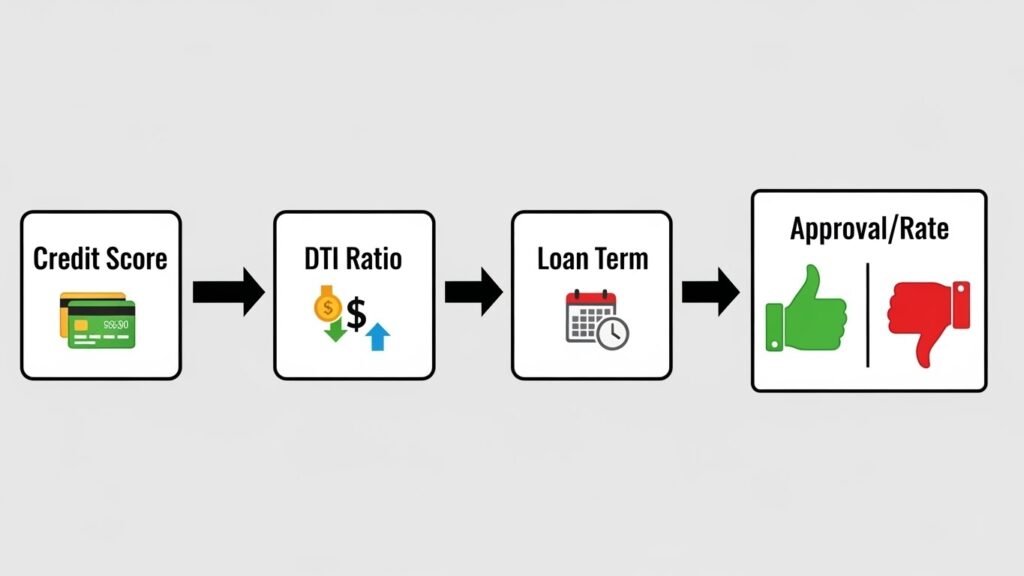

Lender Review and Approval Factors

Once you submit your official application, lenders start their review. They need to ensure you can pay back the money you want to borrow. They look at several factors to determine your risk profile. These factors determine the final loan terms they offer you.

- Credit Score: Your history of managing credit cards, mortgage, student loan, and other debts.

- Loan Amount: The total amount of money you want to borrow for the vehicle.

- Term Length: How long you have to pay back the loan (e.g., 36, 60, or 72 months).

- Debt-to-Income Ratio (DTI): The percentage of your gross monthly payments that goes toward servicing all your debts.

- Age of the Vehicle: Newer cars often receive better loan rates than older ones.

Using a Cosigner

If your credit score is low, or if you are a student or self-employed with limited credit history, you may need a cosigner. A cosigner is a person who legally agrees to pay the loan if you default. Adding a financially strong cosigner can drastically improve your chances of approval. They also help you secure a much lower interest rate. This can lead to big savings over the life of the loan.

Choosing and Finalizing the Loan

After getting approved, you might have a few loan offers on the table. This is where your shopping pays off. You need to compare offers carefully to maximize your savings. Do not simply take the first offer you see.

Source Options

You have three main sources when looking to finance a vehicle:

- Dealership Financing: The dealership works with a network of lenders. They act as an intermediary, often offering competitive rates.

- Bank or Credit Union: Applying directly through your personal banking institution. This is often the best choice if you have a great credit score.

- Personal Loan: Getting a loan that is not specifically tied to the auto purchase. This option gives you cash upfront, but the rates might be higher.

Negotiation and Finalization

You must focus on negotiating the final vehicle purchase price first. Do not discuss your loan application or trade-in until you have settled on the car price. Once the price is final, you can negotiate the interest rates. Use the lowest prequalification rate you received as leverage against the dealership’s financial service provider.

Finally, you need to review the loan terms meticulously. Understand the total amount you will pay, including all fees and interest. After you are satisfied, you sign the documents and finalize the finance agreement. This puts you in the driver’s seat of your new auto. Now, let’s explore the leasing option.

How Car Leasing Works: The Process and Providers

Since financing leads to full ownership, leasing offers a completely different path. With leasing, you are essentially paying for the depreciation of the car. This means you only cover the portion of the vehicle’s value that you use. Because of this structure, monthly payments are often lower than a traditional loan. However, you must adhere to strict lease rules.

The process of leasing is often handled entirely through the dealership. They work with specific financial service providers or the manufacturer’s own finance arm. Understanding who you are renting from is vital to understanding the loan terms.

Ways to Lease Your Car

You have a few ways to secure a lease agreement. Each source has unique loan terms and potential savings.

- Dealership Leasing: This is the most common path. You negotiate the details with the salesperson and the dealership’s finance manager. The dealer organizes the entire lease from start to finish.

- Manufacturer Leasing: This is done through the manufacturer’s dedicated banking or finance subsidiary. This often yields special programs and better rates. They may offer seasonal deals or loyalty programs.

- Third-Party Leasing: Certain lenders or third-party companies offer lease arrangements. These options might be useful if you do not qualify for prime rates directly through the dealer.

Comprehensive Comparative Analysis: Financing vs. Leasing

Choosing between financing and leasing requires a detailed comparison. You need to weigh the benefits of ownership against the flexibility of renting. Every detail, from the down payment to the mileage restrictions, matters for your budget.

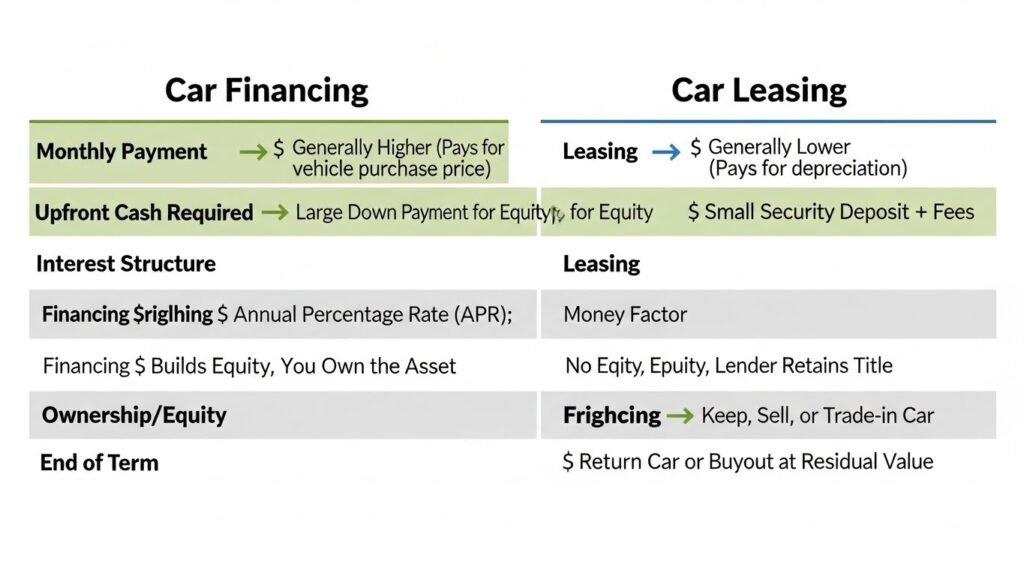

Financial Structure and Upfront Costs

The initial costs and the makeup of your monthly payments differ greatly between the two methods. These structural differences are the first factor influencing your long-term savings.

- Monthly Payments: Financing payments are generally higher because you are paying off the entire vehicle purchase. Leasing payments are lower because they only cover the depreciation amount.

- Down Payment: Financing usually requires a significant down payment, sometimes 20% of the car’s value. Leasing requires a smaller refundable security deposit. Sometimes, it might require a small amount of cash up front, but not a large deposit toward the full price.

- Acquisition/Disposition Fees (Leasing): Lease contracts include these special fees. Acquisition fees are charged at the beginning to set up the lease. Disposition fees are charged at the end when you return the car.

- Interest/Money Factor: Financing uses a standard interest rate (APR). Leasing uses a “Money Factor” to calculate the finance charge. Both represent the cost of borrowing money.

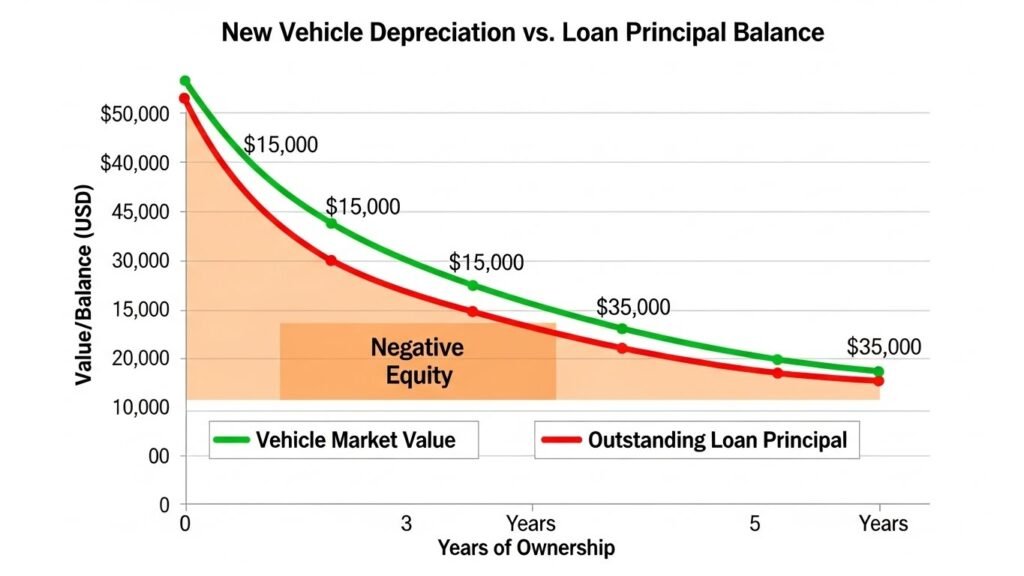

Ownership, Equity, and Depreciation

The true difference lies in who holds the title and the value of the vehicle over time. This impacts your financial growth.

- Ownership and Equity Build-up: With financing, you build equity as you pay down the loan principal amount. The car is your asset. With leasing, you build zero equity because the lender or manufacturer retains ownership. You are simply paying to rent the auto.

- Depreciation Risk: When financing, you assume the risk of depreciation. If the car loses value fast, your equity suffers. With leasing, the lessor assumes this risk. They set the predicted residual value at the start of the term.

- End-of-Term Flexibility: When your loan is paid off, you can sell, trade-in, or keep the vehicle (Financing). When a lease ends, you must either return the car or buy it at the pre-set residual value.

Long-Term Costs and Restrictions

Beyond the monthly payments, various rules and repair costs come into play. These are essential details to factor into your total budget.

- Maintenance and Repair Costs: When financing, you are responsible for all maintenance and repair costs once the warranty expires. When leasing, major repair costs are usually covered by the factory warranty during the short lease term. You only pay for routine upkeep.

- Mileage Restrictions and Penalties: Financing gives you unlimited driving freedom. Leasing imposes strict mileage limits (often 10,000 to 15,000 miles per year). If you exceed the mileage limit, you pay a steep penalty fee for every extra mile.

- Early Termination Costs: If you need to sell a financed car early, you just pay off the remaining loan balance. Breaking a lease early is much harder and far more expensive. It often involves paying the remaining monthly payments and huge fees.

- Required Insurance Coverage: Both require comprehensive insurance. However, lenders and lessors often mandate higher liability limits. This increases your insurance premiums, especially on a lease.

Impact on Credit Score

Both financing and leasing involve managing debt. Therefore, both affect your credit score and overall financial profile.

- Financing vs. Leasing on Debt-to-Income (DTI) Ratio: Financing involves a large, long-term debt, which can raise your DTI ratio. Leasing involves a lower monthly obligation. This can keep your DTI lower, which might help if you plan to apply for a mortgage soon.

- Building Long-Term Credit History: Both require responsible payment history. Timely monthly payments build strong credit for future needs like student loans or other banking products. Failing to pay on time hurts your credit score and credit report in both cases. Now that you know the comparison points, let’s talk strategy.

Negotiation Strategies for Both Paths

You now have the knowledge to compare financing and leasing. The next step is knowing how to negotiate. Whether you choose to buy or rent, strong negotiation skills are essential for achieving maximum savings. You want the lowest possible interest rates and monthly payments.

Negotiating a Car Loan

When you are ready to apply for an auto loan, remember to separate the negotiations. Never let the dealership combine the car price and the loan terms. That is how they hide extra fees.

Focus on Vehicle Price FIRST

Always settle on the final vehicle purchase price before discussing finance. This ensures you are not overpaying for the car. Once you agree on the price, you can move on to the loan application. If you have a trade-in, keep that negotiation separate too. You want a fair value for your old auto.

Anchor with External APR

Use your lowest prequalification rate as leverage. Show the dealership the rates you already received from your bank or credit union. The dealership may try to match or beat that interest rate. If their finance officer cannot beat your external rate, just take the personal loan from your banking institution. This simple trick can save thousands in interest.

Analyze the Total Cost

Be wary of the dealership focusing only on the lowest monthly payments. A lower payment often means a longer loan term (e.g., 72 or 84 months). Longer loan terms result in paying much more total interest. Always focus on the total amount you will pay over the full term. Use online calculators and tools to check the total finance cost. You should aim to buy the shortest term you can comfortably afford in your budget.

Negotiating a Car Lease

Leasing negotiations are trickier because there are multiple variables. You need to focus on three key figures, not just the monthly payment. These figures are the Capitalized Cost, the Residual Value, and the Money Factor.

Negotiating the Capitalized Cost

The Capitalized Cost (or Cap Cost) is the price of the vehicle used to calculate your lease. You must negotiate this figure down, just like a standard purchase price. The lower the Cap Cost, the less depreciation you pay for, and the lower your monthly payments will be.

Understanding the Residual Value

The Residual Value is the car’s predicted value at the end of the lease term. This value is set by the manufacturer or financial service provider and is usually non-negotiable. A higher residual value is good for you. It means the car is expected to depreciate less, resulting in lower monthly payments.

Lowering the Money Factor

The Money Factor is the cost of borrowing for the lease; it is similar to the interest rate. You can ask the dealership to lower this factor. If they resist, you can offer a larger security deposit. A larger deposit can sometimes reduce the Money Factor, leading to further savings on your monthly payments.

End-of-Lease Specifics and Options

After enjoying the car for the full lease term, you reach a crucial point. You must decide what to do next. The lease agreement outlines specific procedures for returning or buying the vehicle. Understanding these rules will help you avoid surprise fees.

Lease-End Inspection

About 60 to 90 days before your lease ends, the financial service provider or a third-party inspector will review the vehicle. They look for wear and tear that exceeds the normal limit defined in your contract.

Wear and Tear Definitions

Normal wear and tear includes minor scuffs, small door dings, and tire tread that is above the minimum standard. Excessive wear and tear leads to penalty fees. This includes large dents, broken glass, or mismatched tires. It also covers significant damage to the interior or electronic components. It is smart to fix any major damage before the inspection to reduce your repair costs.

Turning in the Vehicle

If you decide not to buy the car, you simply return it to the dealership. You must have scheduled this turn-in date ahead of time.

Disposition Fees

Most lease agreements include a disposition fee. This fee covers the dealership’s cost to clean and prepare the car for resale. This fee is usually non-negotiable. You must ensure you remove all personal items and provide all original equipment, like spare keys and the owner’s manual. Failing to return accessories can result in extra charges.

Lease Buyout Process

You always have the option to buy the car at the end of the lease. This is called a lease buyout. The price is the residual value set when you signed the lease.

Refinancing the Buyout Amount

If you choose the buyout, you often need to refinance the purchase. You apply for a new auto loan from a bank or credit union to cover the buyout price. This is essentially a new finance agreement. This new loan gives you full ownership and allows you to build equity. Sometimes, lenders offer specialized refinance options for this specific scenario.

Refinancing an Auto Loan

Refinance is a powerful tool for managing your financial life. If you have an existing loan, you can often get better loan terms by refinancing. This involves paying off your old loan with a new loan that has a lower interest rate.

When to Refinance

It makes sense to refinance your auto loan in a few key situations.

- Lower Interest Rates: If your credit score has improved since you first applied, you likely qualify for lower rates.

- Lower Monthly Payments: Refinancing can reduce your monthly payments by lowering the interest rate or extending the loan term.

- Removing a Cosigner: If the borrower’s credit score is now strong enough, they can refinance to release the cosigner from the obligation.

The Refinance Process

The process is similar to applying for the original loan. You submit an application to a new lender.

- Application and Appraisal: The new lender reviews your credit report and the current value of your vehicle.

- Payoff: If approved, the new lender sends the funds to pay off your old loan. Your new monthly payments begin with the new lender.

Pros and Cons of Refinancing

Refinancing is not always the best move. You must weigh the savings against the cost.

- Pros: You gain immediate savings from lower interest rates. You may also reduce your monthly payments.

- Cons: If you are near the end of your original loan term, the savings might be small. Also, extending the term lowers the payment but increases the total interest paid. You need to use online calculators to ensure it is worth the effort.

The Role of the Trade-In and Down Payment in Detail

Your trade-in and down payment are critical components of the vehicle purchase. They directly impact the final loan amount you need to borrow.

Positive vs. Negative Equity

When trading in your old auto, its current market value is compared to the remaining loan balance.

- Positive Equity: Your car is worth more than the remaining loan balance. This surplus acts like an additional down payment on your new vehicle. This increases your savings.

- Negative Equity (Upside-Down): Your car is worth less than the remaining loan balance. This shortfall must be paid off. Lenders often allow you to roll this negative equity into your new loan or lease.

Capitalizing Negative Equity

Rolling negative equity into a new loan is generally a bad financial practice. It immediately increases the new loan amount. This means you are paying interest on an old debt and a new one. This practice eliminates any potential equity you might gain from the new car for a long time. It raises your monthly payments unnecessarily.

Strategic Use of Cash Down

The purpose of a down payment differs between financing and leasing.

- Financing: A large deposit reduces the principal amount borrowed. This cuts down on the total interest you pay, leading to major savings.

- Leasing: A large cash deposit (called a Capitalized Cost Reduction) is risky. If the vehicle is totaled early, the insurance company pays the lessor. Your cash deposit is typically not refunded. It is safer to use that money to pay the first monthly payments.

Specifics for Different Buyer Types

The path to securing a favorable loan or lease changes depending on your financial history and income situation. Lenders and financial service providers have different requirements for various borrowers.

First-Time Buyers

If you have little to no credit history, getting a loan can be tough.

- Challenge: Lenders have no way to predict your payment behavior.

- Solution: Apply for small auto loans through a credit union or utilize a cosigner. Some manufacturers offer specific programs for student finance. This helps you establish your first credit report.

Self-Employed and Gig Workers

Verifying income is the main challenge for self-employed individuals.

- Challenge: Income fluctuates, and traditional pay stubs are not available.

- Solution: Lenders require two years of tax returns or extensive banking records to prove stable income. You may need to provide profit and loss statements.

Bad Credit and Subprime Financing

If your credit score is low, you fall into the subprime category.

- Challenge: Lenders view you as high-risk. You will face significantly higher interest rates.

- Solution: Save up a large down payment. The larger the deposit, the less the lender risks. Focus on fixing errors on your credit report and rebuilding your score first. Higher rates mean higher monthly payments and much less savings.

Vehicle Shopping and Selection (Pre-Finance/Lease)

The finance conversation only begins after you choose the vehicle. Making smart vehicle purchase decisions saves you money long-term.

Choosing the Right Vehicle Type

Your choice of auto affects your borrowing power and maintenance costs.

- New vs. Used: New cars usually get lower interest rates from manufacturers. Used cars are cheaper upfront but may have higher interest rates and greater repair costs.

- Price and Value: Researching the car’s market value is essential. Do not rely on the sticker price.

Pricing Tools and Resources

Use online tools and resources before visiting the dealership.

- Market Value: Use services like Kelley Blue Book or Edmunds to determine the fair trade-in value of your old auto and the market price of the new vehicle. This prepares you for negotiation.

- Calculators: Use loan and lease calculators to estimate monthly payments based on different rates and terms. This helps you stick to your budget.

Legal and Documentation Requirements

The final step in financing or leasing involves a mountain of paperwork. You must understand what you are signing.

Key Loan and Lease Documents

You must identify the key agreements the dealership presents.

- Retail Installment Contract (Financing): This is the official loan agreement. It details the principal amount, the interest rate, the total finance charge, and the complete payment schedule.

- Lease Agreement (Leasing): This contract details the lease term, the mileage limit, the residual value, and all associated fees (acquisition, disposition, early termination fee).

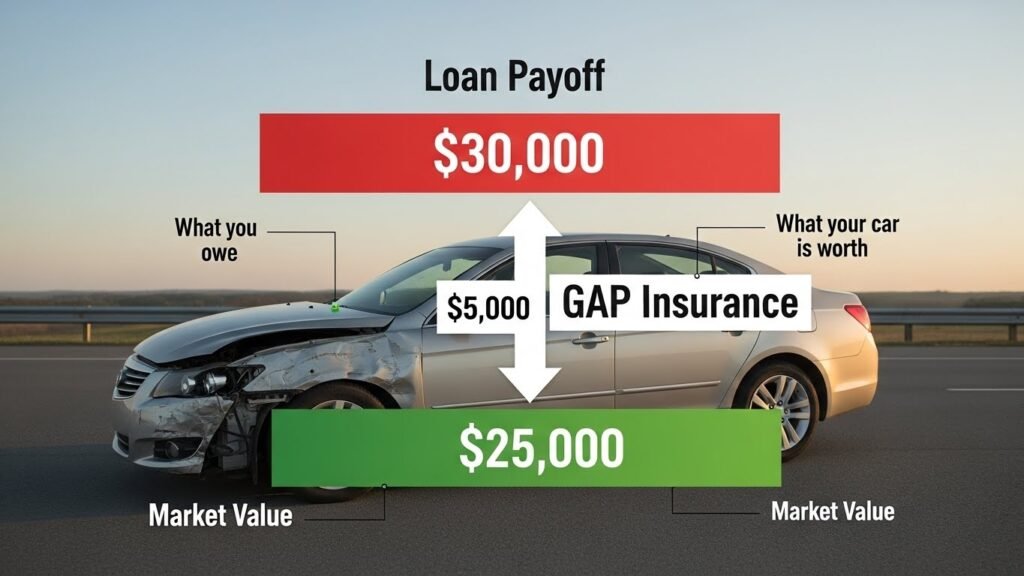

The Role of Gap Insurance

Gap insurance is vital for nearly all finance and lease agreements.

- The Gap: When a new car is totaled, the insurance company only pays the vehicle’s current market value, which is usually less than the loan or lease payoff amount. This difference is the “gap.”

- Protection: Gap insurance covers this financial gap. It prevents the borrower or lessee from having to pay thousands out of pocket for a car they can no longer drive. Most lenders require it, especially if you have a low down payment.

By following these comprehensive steps, you move beyond simple comparison. You can approach any dealership or lender fully prepared. This level of education guarantees a smarter, more cost-effective vehicle purchase decision.

Making the Right Choice: Summary and Key Takeaways

You now understand the mechanics and the costs associated with both financing and leasing. The final step is aligning this education with your personal financial goals and needs. There is no universally “best” option. The ideal choice depends on your budget and lifestyle.

When is Financing Best?

Financing is the best choice for the consumer who prioritizes long-term asset value. It is the traditional route to achieving full ownership.

- Long-Term Goal: You prioritize full ownership, building equity, and owning the asset for many years. You see the car as a long-term investment, not just a transportation expense.

- Usage: This is ideal if you are a high-mileage driver. It is also perfect if you plan any major customizations or modifications to the auto. There are no mileage restrictions to worry about.

- Financial Tolerance: You are comfortable with higher initial monthly payments. You accept the responsibility for all future maintenance and repair costs after the factory warranty expires. You are willing to take on the risk of depreciation.

When is Leasing Best?

Leasing is perfect for those who prioritize flexibility and low short-term costs. It is essentially renting the experience of a new vehicle.

- Preference: You prefer driving a brand new car every two to three years. You always want the latest technology and safety features. You enjoy avoiding the long-term commitment of a loan.

- Usage: This suits you if you are a low-mileage driver. Your driving habits must fall comfortably within the mileage limit (e.g., 12,000 miles per year).

- Financial Focus: You need the lowest possible monthly payments to fit your current budget. You want the certainty that most major repair costs will be covered by the warranty. This avoids surprise fees and large expenses.

Final Decision Point

The optimal choice relies entirely on aligning the acquisition method with your individual needs, financial capacity, and lifestyle. Always consult a financial advisor or use calculators and tools to project your total costs. Whether you buy or rent, being prepared is the best way to secure maximum savings and avoid unnecessary fees. Use this comprehensive guide to navigate the dealership with confidence. This education will ensure your vehicle purchase decision is smart and stress-free.

Frequently Asked Questions (FAQs)

What is the difference between APR and the Money Factor?

APR, or Annual Percentage Rate, is the standard interest rate used when financing a car loan. It is expressed as a simple percentage. The Money Factor (sometimes called the Lease Factor) is used in leasing. It represents the finance charge on the lease. To roughly convert the Money Factor to an APR, you multiply the Money Factor by 2,400.

Is a used car eligible for leasing?

Yes, some financial service providers and dealerships offer used car leasing, often referred to as certified pre-owned (CPO) leasing. However, the terms are usually shorter, and the monthly payments may not be significantly lower than financing due to higher depreciation rates on older vehicles.

Does taking out an auto loan affect my mortgage application?

Yes, taking out a new loan, whether for financing or leasing, increases your total debt-to-income (DTI) ratio. Mortgage lenders carefully review DTI. A high ratio, especially from a large auto loan, can potentially reduce the size of the mortgage you qualify for or increase the interest rates you are offered.

What is the “principal amount” in a car loan?

The principal amount is the actual amount of money you borrowed to purchase the vehicle, excluding any interest or fees. When you make a monthly payment, a portion goes toward interest, and the remainder reduces the principal amount. Reducing the principal is how you build equity.

Can I sell a financed car if I still owe money on the loan?

Yes, you can sell a financed car, but you must pay off the outstanding loan balance immediately. The dealership or private buyer will typically send the payoff amount directly to your lender. If the sale price is less than the loan amount (negative equity), you must pay the difference out of pocket.

How soon after buying a car can I refinance?

Lenders often recommend waiting 6 to 12 months after the initial auto loan purchase. This allows time for your credit report to update your payment history and for your credit score to improve. It also lets the loan properly season.

What fees are included in the capitalized cost of a lease?

The capitalized cost (Cap Cost) is the total amount financed in a lease. It includes the agreed-upon price of the vehicle, taxes, licensing fees, documentation fees, and the acquisition fee. It can also include the cost of any added warranty or insurance products.

What happens if I make extra payments on my car loan?

If your loan agreement does not include a prepayment penalty, making extra payments is a great way to save money. Ensure your extra payment is applied directly to the principal amount. This reduces the base on which interest is calculated, shortening the term and lowering the total interest paid.

Can I modify a leased vehicle?

Generally, no. Leased vehicles must be returned in near-original condition. Most lease agreements prohibit significant modifications, such as adding aftermarket parts, tinting windows heavily, or changing the exhaust system. If you do modify the car, you must restore it to stock condition before the turn-in date or face significant fees.

What is a security deposit in leasing? Is it always refundable?

The security deposit is a sum of money collected at the beginning of the lease to cover potential damages, excess wear and tear, or a failure to make the final payment. It is usually refundable at the end of the lease, provided you meet all the lease terms and return the vehicle in acceptable condition.

How does the length of the loan term affect my interest rate?

Generally, a shorter loan term (e.g., 36 or 48 months) results in a lower interest rate because the lender has less risk. Conversely, a longer loan term (e.g., 72 or 84 months) usually carries a higher interest rate because the risk of depreciation and non-payment increases over time.

Can I get an auto loan if I am self-employed?

Yes, but the application process is more demanding. Lenders require proof of stable income, typically by reviewing two years of personal and business tax returns, and possibly recent bank statements. They want to see consistent income to approve the loan.

What is the role of a credit union versus a traditional bank in lending?

Credit unions are not-for-profit cooperative financial service providers, often offering slightly lower interest rates (APR) and fees than traditional for-profit banks. However, you must be a member of the credit union to apply for an auto loan.

What is a “balloon payment” loan?

A balloon payment loan is a type of finance where your monthly payments are significantly lower than a standard loan because they don’t cover the entire principal amount. A large lump sum payment—the “balloon”—is due at the end of the loan term. This option carries the risk of needing to refinance or sell the car quickly when the final payment is due.

Should I get a vehicle inspection before buying a used car?

Absolutely. Before finalizing a used vehicle purchase, you should always get a pre-purchase inspection (PPI) by an independent, trusted mechanic. This inspection ensures you understand the true condition of the car and helps uncover hidden repair costs or maintenance needs before you commit to the finance agreement.