Managing money bizfusionworks is all about getting your cash game on point. Most folks think handling money is just about boring math and spreadsheets. But it is actually about freedom and long-term security for your future. If you want to stop stressing and start winning, you need a solid plan. This guide shows you how to master your cash like a pro.

Introduction to the Bizfusionworks Financial Philosophy

The bizfusionworks way brings personal wealth and business success together in one place. Many old-school money plans fail because they are too slow for today’s world. Managing money bizfusionworks simplifies the hard stuff for bosses and regular people alike. It gives you a clear map to move from just surviving to thriving. You will learn how to make your dollars work harder for you every day.

Why Comprehensive Financial Management Matters More Than Ever

Battling Rising Costs and Inflation

- Inflation eats savings because prices for everything keep going up while your cash sits still.

- Income must grow to keep pace with the high cost of living around the globe.

- Smart planning protects your buying power so you do not fall behind.

- Wealth building requires you to outpace the rate of inflation every single year.

Reducing Financial Stress through Organization

- Messy money leads to a ton of mental health struggles and constant worry.

- Structured systems give you total clarity on where your cash is going.

- Peace of mind comes when you know exactly how to handle every bill.

- Financial health improves when you stop guessing and start tracking your numbers.

Identifying and Seizing Growth Opportunities

- Spotting deals is easier when you are not just trying to survive payday.

- Digital side hustles can bring in extra capital to boost your main bank account.

- Market shifts create openings for those who have the cash ready to move.

- Investment strategies help you turn small amounts of money into big piles of wealth.

The Core Principles of the Bizfusionworks Method

Budgeting with Purpose and Flexibility

- Freedom-based models replace old budgets that feel like a financial prison.

- Tracking every dollar puts you in the driver’s seat of your life.

- Dynamic lifestyle shifts require a budget that can change as fast as you do.

- Smart spending ensures you have enough for what really matters to you.

Saving Smartly for the Future

- Emergency funds act as a safety net when life throws you a curveball.

- Retirement planning secures your lifestyle for when you decide to stop working.

- Goal-based savings help you buy the big things you actually want.

- Automatic savings make sure you pay yourself first before spending a dime.

Investing Wisely through Data

- Diversification lowers your risk by spreading your cash across different assets.

- Data-driven insights help you make moves based on facts, not just feelings.

- Maximizing returns is the goal of every smart investor in the market.

- Minimizing losses keeps your portfolio safe during a rough economic cycle.

Strategic Debt Control

- High-interest debt is a trap that keeps you broke and stressed out.

- Good debt can be used to grow a business or buy assets.

- Repayment techniques help you kill off your balances faster than ever.

- Business loans should only be taken when they help you scale your profits.

Continuous Adaptation and Learning

- Static plans become useless when the economy or your life changes.

- Shifting markets require you to stay on your toes and keep learning.

- Financial education is the best investment you can ever make for yourself.

- Professional development keeps your skills sharp and your income high.

Core Features and Tools of the Framework

Comprehensive Finance Content and Analysis

- Home-loan rates must be watched closely to save money on your mortgage.

- Market trends show you where the smart money is moving right now.

- Bookkeeping is a strategic tool that tells the story of your business.

- Risk assessment helps you avoid big mistakes that could cost you everything.

Technology and Digital Integration

- Budgeting apps like Mint or YNAB make tracking your cash super easy.

- Investment platforms allow you to trade stocks and build wealth from home.

- Financial templates simplify the hard work of planning and forecasting your money.

- Digital tools provide real-time data so you can make informed decisions.

Mentoring-Style Guidance

- Step-by-step help is perfect for beginners who are just starting out.

- Entrepreneurial coaching helps bosses avoid common pitfalls in their growth journey.

- Balanced choices happen when you rely on logic instead of your emotions.

- Informed decisions lead to better outcomes for your wallet and your business.

Choosing the right software is a critical part of the Bizfusionworks framework, as digital tools provide the real-time data necessary for informed decision-making. Below is a comparison of the top budgeting tools recommended for mastering your cash flow.

Comparison of Top Budgeting Tools

| Tool | Best For | Key Feature | Pricing Model |

| YNAB (You Need A Budget) | Zero-Based Budgeting | Forces every dollar to have a specific “job” | Subscription-based |

| Mint (Classic) | Total Overview | Great for tracking all accounts, assets, and debts in one place | Free |

| PocketGuard | Overspending Prevention | Shows “In My Pocket” cash after bills and goals are met | Free & Paid versions |

| EveryDollar | Simplicity | Clean interface designed for manual or automated tracking | Free & Paid versions |

| Quicken | Business & Personal | Integrated strategy for those managing personal and business finances | Subscription-based |

How to Select the Right Tool

- Identify your primary need, whether it is simple expense tracking or complex business bookkeeping.

- Check for automation features that allow for a “set-and-forget” system to reduce the willpower needed to save.

- Ensure mobile accessibility so you can update your budget while maintaining a dynamic lifestyle.

- Look for data-driven insights that help you make moves based on facts rather than emotions.

Getting Started: A Step-by-Step Implementation Guide

Step 1: Comprehensive Situational Assessment

- Cataloging income lets you see exactly how much cash is coming in.

- Tracking expenses shows you where you are wasting money every single month.

- Listing debts helps you create a plan to get to zero balances.

- Valuing assets gives you a clear picture of your total net worth.

Step 2: Setting Targeted Financial Goals

- Buying a house is a huge milestone that requires a specific savings plan.

- Early retirement is possible if you start investing a big chunk now.

- Scaling a business needs a roadmap for spending and hiring more people.

- Specific targets keep you focused when you feel like spending impulsively.

Step 3: Designing a Custom Budget

- Basic necessities like food and rent should always come first in line.

- Savings and investments are your ticket to long-term wealth and freedom.

- Lifestyle spending is for the fun stuff that makes life worth living.

- Budget allocation ensures every dollar has a job to do for you.

Step 4: System Automation

- Set-and-forget systems take the willpower out of saving money every month.

- Automated bill pay keeps you from getting hit with nasty late fees.

- Automatic investing builds your portfolio while you are busy living life.

- Money tracking becomes effortless when you use tech to do the work.

Step 5: Regular Monitoring and Optimization

- Monthly reviews let you catch small problems before they become big ones.

- Quarterly updates help you adjust your plan for larger life changes.

- Evolving plans stay relevant even when the world around you gets crazy.

- Informed decisions come from looking at your data on a regular basis.

Specialized Strategies for Individuals

Personal Financial Freedom for Different Life Stages

- Students should focus on avoiding debt and building good money habits early.

- Young professionals need to maximize their income and invest in the market.

- Families must balance today’s bills with future college and retirement needs.

- Wealth creation happens when you stay consistent over a long period of time.

Specialized Strategies for Business Growth

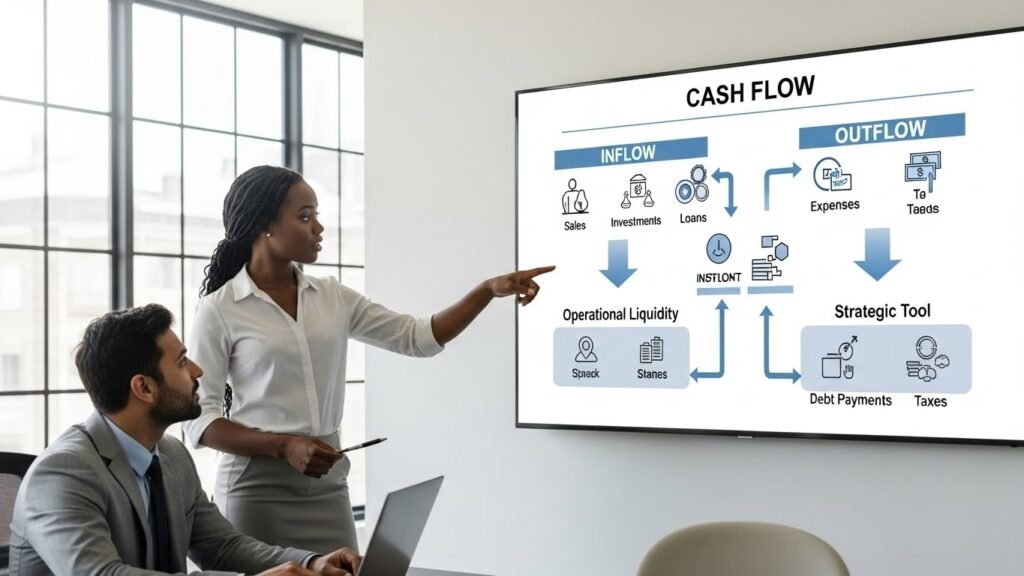

Mastering Cash Flow and Operations

- Inflow and outflow must be balanced to keep your business doors open.

- Operational liquidity ensures you have the cash to pay your team daily.

- Optimizing expenses helps you keep more of the money your business makes.

- Identifying leaks prevents small losses from sinking your entire company ship.

Strategic Profit Reinvestment

- Business expansion happens when you put profits back into the company.

- Innovation funding keeps you ahead of your competitors in the marketplace.

- Capital growth is the result of smart reinvestment over many years.

- Scalability is only possible if you have a plan for your profits.

Risk Mitigation and Resilience

- Business insurance protects you from lawsuits and unexpected disasters or accidents.

- Cash reserves help you stay afloat during slow months or recessions.

- Diversified revenue means one lost client won’t kill your entire business.

- Strategic planning prepares you for the worst while you hope for best.

Small Business Scaling

- Side hustles can grow into full-time jobs with the right money moves.

- Corporate structure becomes necessary as your team and profits get bigger.

- Growth capital might be needed to reach the next level of success.

- Hiring experts helps you focus on what you do best as a boss.

Bridging the Gap: Integrating Personal and Business Finance

- Unified views help entrepreneurs see their total wealth in one place.

- Freelancer budgets should separate work money from personal spending money daily.

- Credit management is vital for getting low rates on personal and business loans.

- Integrated strategies ensure your business supports the lifestyle you truly want.

Common Pitfalls and How to Avoid Them

- Ignoring budgets is the fastest way to lose control of your cash.

- Overspending during growth phases can kill a business before it starts.

- Skipping emergencies leaves you vulnerable when things go wrong in life.

- Get-rich-quick schemes usually end up leaving you with less than nothing.

- Stagnant plans lead to failure because they do not adapt to change.

Expert Tips for Sustainable Success

- Start small and focus on being consistent with your money every week.

- Savings as bills means you pay your future self first no matter what.

- Localize advice to make sure you follow your own regional tax rules.

- Stop comparing your wealth to others and focus on your own goals.

Limitations and Practical Considerations

- Educational only means this guide is not a replacement for professional advice.

- Certified advisors should be consulted for complex tax or legal money issues.

- Market conditions can change how well some of these strategies work.

- Adapt strategies to fit your specific city, state, or country rules.

Conclusion: Achieving a Lifestyle of Security and Opportunity

Managing money bizfusionworks is the key to a better life and business. By mixing discipline with a little flexibility, you can win the money game. Proactive moves today lead to a huge payoff for your future self later. Start taking control right now and watch your wealth grow every year.

FAQs About Managing Money Bizfusionworks

What is the primary goal of the Bizfusionworks framework?

The primary goal is to provide a structured yet flexible roadmap that balances personal financial freedom with sustainable business growth. It aims to move users from a state of financial survival to long-term stability and wealth creation.

Who is the ideal user for these strategies?

The framework is designed for a wide audience, including college students building habits, freelancers managing fluctuating income, and small business owners looking to scale operations.

Is the system too complex for beginners without a finance background?

No, managing money bizfusionworks is built specifically to simplify complex financial concepts into actionable, easy-to-follow steps. It emphasizes a “mentoring-style” approach that makes it accessible for those with zero prior finance experience.

How does this method specifically assist small businesses?

It provides a blueprint for cash flow management, profit reinvestment, and expense optimization. This ensures that the business remains liquid and has the capital necessary to innovate and expand.

How does the framework help in minimizing overall financial risk?

It utilizes defensive tools such as emergency funds, diversified investment portfolios, and strategic risk assessments to protect against market volatility.

What is the 50/30/20 rule in the context of Bizfusionworks?

While the framework suggests custom categories, many users find success by allocating 50% of income to needs, 30% to wants, and 20% to savings and debt repayment to maintain fiscal discipline.

How can I improve my credit score using these principles?

By implementing automated bill payments to ensure on-time history and using debt control strategies to lower your credit utilization ratio.

What are the best ways to hedge against inflation?

Bizfusionworks suggests investing in appreciating assets like stocks or real estate and ensuring your income growth rate exceeds the annual inflation rate.

Should I pay off debt or save for an emergency first?

The framework generally recommends building a starter emergency fund first to avoid taking on more debt when unexpected expenses arise.

How do I determine my personal net worth?

You calculate this by listing all your assets (cash, investments, property) and subtracting all your liabilities (loans, credit card debt, mortgages).

What is the role of tax planning in this framework?

Strategic tax planning helps you keep more of your earnings by utilizing legal deductions and tax-advantaged accounts like 401(k)s or IRAs.

How often should I update my financial roadmap?

You should conduct a brief monthly review to track spending and a more detailed quarterly or annual update to adjust for major life changes.

What is the difference between an asset and a liability?

An asset is something that puts money into your pocket (like a rental property or stock), while a liability is something that takes money out (like a car loan or credit card balance).

Can I use these strategies if I have a very low income?

Yes, the principle of “starting small but staying consistent” is a core tenet of the philosophy, focusing on habit-building regardless of the starting amount.

How does outsourcing bookkeeping help business growth?

It allows business owners to stop wasting time on tedious administrative tasks and focus their energy on high-level strategic planning and revenue-generating activities.

What are the signs of “lifestyle inflation”?

Lifestyle inflation occurs when your spending increases at the same rate as your raises, preventing you from ever actually building wealth.

How do interest rate trends affect my mortgage?

Rising interest rates make borrowing more expensive, so tracking these trends can help you decide when to refinance or lock in a fixed rate.

What is a “diversified” investment portfolio?

It is a portfolio that spreads capital across various sectors (tech, real estate, energy) to ensure that a downturn in one area doesn’t ruin your entire net worth.

How do I start a digital side hustle to boost my capital?

The framework suggests identifying a scalable skill, like consulting or e-commerce, and reinvesting the initial profits to grow it into a significant income stream.

Why is emotional decision-making dangerous in finance?

Emotional moves, like panic-selling during a market dip, often lead to permanent losses, whereas logic-based decisions follow long-term data for better ROI.

What is the “pay yourself first” method?

This involves automatically routing a portion of your paycheck into savings or investments before you have a chance to spend it on daily expenses.