In an increasingly digital world, the need for secure, reliable, and easy-to-use online payment systems has never been more critical. Pasonet, an emerging online payment gateway, is revolutionizing how individuals and businesses make transactions. By providing a platform that integrates multiple payment methods and ensures safety, Pasonet is quickly becoming a preferred choice for managing digital finances. This article will explore what Pasonet is, its key features, advantages, and how it stacks up against other popular online payment solutions. Whether you’re a business owner or an individual, this guide will highlight why Pasonet could be the game-changer you need for your online transactions.

What is Pasonet?

Overview of Pasonet

Pasonet is an innovative online payment gateway designed to simplify digital transactions. It serves as a bridge between different payment methods, including credit cards, mobile wallets, and bank accounts, providing a unified platform for processing payments. Whether you’re buying goods online, sending money to family abroad, or paying your utility bills, Pasonet ensures a seamless, fast, and secure payment experience. What sets Pasonet apart is its focus on accessibility, ease of use, and robust security measures that protect both individuals and businesses.

Pasonet’s goal is to eliminate the barriers that often make online transactions complicated. By offering multi-platform support, Pasonet ensures that users can make payments on smartphones, desktops, and tablets, making it a versatile choice for people on the go.

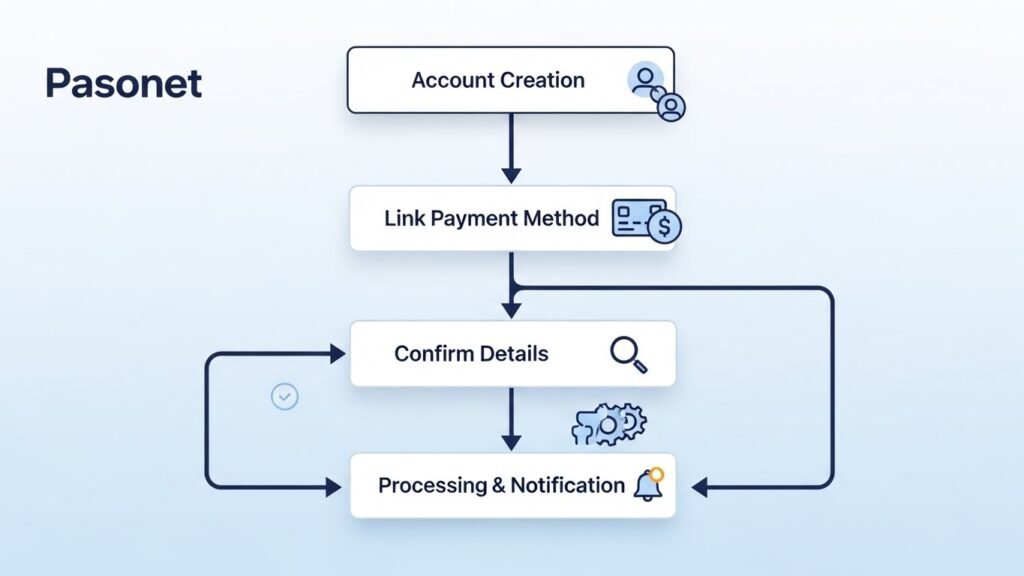

How Pasonet Works

Pasonet simplifies the payment process by allowing users to register and link various payment methods to their account. Once registered, users can initiate transactions with just a few clicks. The process is straightforward:

- Account Creation: You start by creating an account on Pasonet using your email address or phone number.

- Link Payment Methods: Next, link your preferred payment method — whether that’s a bank account, credit card, or mobile wallet.

- Transaction Initiation: Choose the type of transaction you wish to make, such as purchasing goods, transferring funds, or paying bills.

- Confirmation and Processing: After confirming the transaction details, Pasonet quickly processes the transaction and notifies you of the completion.

The entire process is designed to minimize hassle and maximize efficiency, ensuring that users can complete their payments quickly and securely.

Key Features of Pasonet

1. Security and Privacy

In today’s digital world, security is paramount. Pasonet uses advanced encryption protocols to safeguard all transactions and sensitive user data. By implementing industry-standard security measures, including SSL certificates and two-factor authentication (2FA), Pasonet ensures that your financial details are kept private and protected from unauthorized access. These security features make Pasonet a trustworthy choice for anyone concerned about online fraud or data breaches.

Key Benefits:

- End-to-End Encryption: All data transferred via Pasonet is encrypted to ensure maximum protection.

- Fraud Prevention: Pasonet continuously monitors transactions for suspicious activity, offering an added layer of security.

- Data Privacy: Pasonet follows strict privacy policies, ensuring that your personal and financial information remains confidential.

2. Ease of Use

Pasonet has been designed with simplicity in mind. Its user-friendly interface allows individuals with little to no technical expertise to complete transactions effortlessly. Whether you’re sending money, making a purchase, or managing payments, Pasonet ensures a seamless experience. Its intuitive dashboard lets users quickly navigate through the platform, making it a great choice for users of all ages and technical backgrounds.

Features that Enhance Usability:

- Simple Registration: The sign-up process is fast and straightforward.

- Clear Navigation: Pasonet’s platform is designed to be intuitive, reducing the learning curve.

- Multi-Language Support: The platform offers multiple languages, making it accessible to a global audience.

3. Multi-Platform Access

Whether you’re at home or on the go, Pasonet ensures you can complete your transactions from any device. The platform is optimized for smartphones, tablets, and desktops, so users have the flexibility to handle their payments wherever they are. This versatility makes it a perfect fit for today’s fast-paced, mobile-driven society.

Supported Devices:

- Smartphones (Android and iOS)

- Tablets (Android and iOS)

- Desktop Browsers (Chrome, Safari, Edge)

With Pasonet, there’s no need to worry about whether your device will support the platform. You can initiate payments at any time, from virtually any device, ensuring a seamless experience across all platforms.

4. Rapid Transaction Processing

Pasonet prides itself on its quick processing times. Most transactions are completed within minutes, allowing businesses and individuals to send and receive payments without long delays. This feature is particularly beneficial for businesses that rely on quick payments to maintain operations. Whether you’re purchasing products online or transferring funds to a loved one, Pasonet ensures that the process is completed in record time.

Key Benefits:

- Instant Payment Confirmation: Once a transaction is completed, users receive an immediate notification.

- Fast Transfers: Funds are typically transferred instantly or within minutes, minimizing waiting times.

- Streamlined Operations for Businesses: Businesses can process payments quickly, ensuring smooth cash flow.

5. Low Transaction Fees

One of the major advantages of using Pasonet is its low transaction fees. Unlike many traditional banks and payment gateways that charge high fees for processing payments, Pasonet offers competitive rates that make it a cost-effective solution. Whether you’re sending money to family, paying for services, or handling business transactions, Pasonet helps you save on transaction costs.

How Pasonet Saves You Money:

- Lower Fees than Banks: Pasonet’s transaction fees are much lower than traditional bank transfers.

- No Hidden Charges: Pasonet is transparent with its pricing, so you know exactly what you’re paying for.

- Affordable International Payments: Send money abroad with minimal fees, making it an excellent choice for global transactions.

Advantages of Using Pasonet

1. Convenience at Your Fingertips

Pasonet simplifies the process of managing your finances by consolidating multiple payment methods into one platform. Users no longer have to manage separate bank accounts, credit cards, and mobile wallets; Pasonet allows you to access all your payment methods in one place. Whether you’re paying a bill or making an online purchase, Pasonet provides a convenient solution for your digital payment needs.

Key Convenience Features:

- Multiple Payment Methods in One Platform

- Easy Access from Any Device

- Simple Payment Tracking and History

2. Cost-Effectiveness for Businesses and Individuals

With its low transaction fees and competitive pricing model, Pasonet is an affordable solution for both personal and business use. For individuals, this means saving on everyday transactions. For businesses, Pasonet’s cost-efficient fees allow companies to reduce overhead costs associated with payment processing, improving profitability.

How Pasonet Helps You Save Money:

- Affordable Transaction Fees

- Reduced Overhead for Businesses

- No Setup or Hidden Fees

3. Global Reach and Accessibility

Pasonet is available in multiple countries, enabling global payments and transactions. This feature makes it particularly valuable for businesses with international clients or individuals who need to send money across borders. Whether you’re a freelancer receiving payments from clients around the world or a business handling cross-border sales, Pasonet makes international transactions straightforward and affordable.

Supported Countries:

- United States

- United Kingdom

- India

- Brazil

- Canada

- Australia

Pasonet makes it easy to send and receive funds from anywhere, at any time, helping users navigate the complexities of international payments with ease.

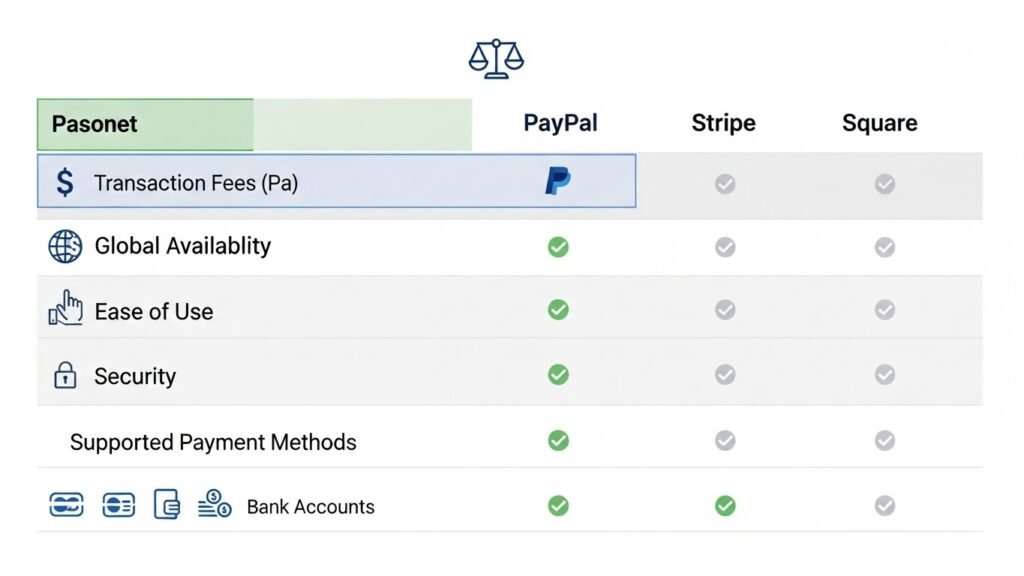

Pasonet vs. Other Payment Solutions

In this section, we’ll compare Pasonet with other popular online payment platforms, including PayPal, Stripe, and Square, to see how it measures up.

| Feature/Platform | Pasonet | PayPal | Stripe | Square |

| Transaction Fees | Low | High | Moderate | Moderate |

| Global Availability | Yes | Yes | Yes | Yes |

| Ease of Use | Easy | Easy | Moderate | Easy |

| Security | High | High | High | High |

| Supported Methods | Bank, Mobile, Card | Bank, Card, PayPal | Bank, Card | Bank, Card |

Why Pasonet Stands Out

Pasonet’s combination of low fees, speed, and user-friendly interface makes it an appealing option for both personal and business transactions. While other platforms may have higher fees or more complex processes, Pasonet ensures a seamless experience at a fraction of the cost.

Here is the additional information, following your instructions:

Pasonet: A Look into the Technology Behind the Platform

1. Advanced Payment Processing Technology

Pasonet uses cutting-edge technology to ensure that every payment is processed quickly and securely. The platform integrates machine learning algorithms and artificial intelligence (AI) to enhance transaction verification, detect fraudulent activity in real time, and provide predictive analytics for businesses. This integration of AI and machine learning makes Pasonet a reliable choice for users seeking not only speed but also security.

2. Blockchain Integration for Enhanced Security

One of the unique aspects of Pasonet’s technology is its potential integration with blockchain technology. By leveraging blockchain’s decentralized nature, Pasonet ensures that all transaction data is immutable and tamper-proof. This adds an extra layer of transparency, allowing users to trace the history of their transactions securely. Although Pasonet currently uses traditional encryption methods, future plans include utilizing blockchain for even greater data security and faster payments.

Pasonet’s Impact on Small and Medium-Sized Enterprises (SMEs)

1. Empowering SMEs with Affordable Payment Solutions

For small and medium-sized enterprises (SMEs), managing payments and transactions can be a significant challenge due to high fees and complicated processes. Pasonet addresses this issue by offering low transaction fees and an easy-to-use platform that simplifies payments, allowing SMEs to streamline their financial operations. The cost-effective nature of Pasonet helps businesses save money, which can be reinvested into growth and expansion.

2. Simplified Cross-Border Transactions for SMEs

Cross-border transactions can be costly and time-consuming for SMEs. Pasonet solves this problem by providing businesses with an efficient way to handle international payments at a fraction of the cost compared to traditional methods. With its global reach, Pasonet allows SMEs to conduct business seamlessly across borders, enhancing international trade opportunities and expanding market reach.

The Future of Pasonet: What’s Next?

1. Expanding Payment Method Integration

In the coming years, Pasonet plans to expand its supported payment methods. While the platform currently supports credit cards, bank accounts, and mobile wallets, there are plans to integrate emerging payment methods like cryptocurrencies. This will give users more flexibility in managing their finances and provide businesses with new ways to receive payments from customers worldwide.

2. AI-Powered Fraud Detection and Prevention

Pasonet is working on developing more advanced AI-powered fraud detection systems. The future of online payments is heavily reliant on AI to identify and prevent fraudulent activity in real time. By using AI to monitor payment behaviors and detect patterns associated with fraud, Pasonet aims to provide an even safer payment environment for users. This will not only protect users but also enhance trust in the platform.

3. Expanding Global Reach

Pasonet’s long-term goal is to increase its footprint globally. The platform is focusing on increasing its availability in underdeveloped markets where access to reliable online payment methods is limited. By expanding to more countries, Pasonet aims to create a more inclusive financial ecosystem, enabling millions of users in emerging economies to access secure and fast payment solutions.

User Experience: How Pasonet Stands Out

1. Seamless User Interface for Enhanced Experience

One of Pasonet’s standout features is its user interface (UI). The platform prioritizes simplicity, ensuring that users can navigate it without confusion. The intuitive design makes transactions easy to perform, even for those who may be less familiar with digital payment systems. The clean layout and step-by-step guides enhance the overall user experience, reducing the friction often encountered with other payment systems.

2. Customer-Centric Features for Personalization

Pasonet places a strong emphasis on personalization, offering users the ability to customize their payment experiences. For instance, users can set up recurring payments for services they use regularly, customize notifications, and even track spending. The ability to personalize these settings helps users stay organized, save time, and manage their finances more efficiently.

The Role of Pasonet in Promoting Financial Inclusion

1. Bridging the Gap in Digital Payments

Financial inclusion is a critical issue for many people around the world who do not have access to traditional banking services. Pasonet plays an essential role in bridging this gap by providing a platform that allows anyone with a smartphone and an internet connection to send and receive money. By expanding its services to underbanked populations, Pasonet is helping millions of people gain access to secure financial tools that were once out of reach.

2. Empowering Individuals in Developing Economies

Pasonet’s low fees and wide accessibility make it a game-changer for individuals in developing economies. People in these regions often face challenges with accessing reliable and affordable financial services, and Pasonet is breaking down those barriers. Whether it’s sending remittances or making digital payments for essential goods and services, Pasonet empowers users to take control of their finances.

Regulatory Landscape: Pasonet’s Compliance and Global Standards

1. Adhering to Global Payment Regulations

Pasonet ensures that it meets global payment regulations, including the General Data Protection Regulation (GDPR) and Anti-Money Laundering (AML) requirements. By complying with these regulations, Pasonet not only protects its users but also builds trust with governments, regulatory bodies, and financial institutions. This level of compliance positions Pasonet as a trustworthy player in the global payment ecosystem.

2. Transparent Reporting and User Data Protection

Transparency is essential for any online payment system, and Pasonet prioritizes it. The platform ensures that all user data is handled with the utmost care and complies with privacy protection standards. It regularly updates its privacy policy to reflect any changes in regulations and ensures that users have access to information about how their data is used.

Conclusion: Why Choose Pasonet?

Pasonet has proven itself as a reliable, secure, and cost-effective solution for online payments. With its focus on simplicity, security, and customer-centric features, Pasonet is well-positioned to lead the way in the digital payment space. Whether you’re an individual looking for a secure way to manage personal finances or a business seeking to streamline transactions, Pasonet offers the tools and features necessary to succeed. With plans for continued growth and innovation, Pasonet is undoubtedly a platform to watch in the coming years.

Frequently Asked Questions (FAQs)

1. Can I use Pasonet for both personal and business transactions?

Yes, Pasonet is designed for both personal and business use. Individuals can use the platform for day-to-day payments such as purchasing goods or sending money, while businesses can take advantage of its features for processing payments, managing subscriptions, or conducting international transactions.

2. How does Pasonet ensure the privacy of my financial data?

Pasonet takes privacy seriously. It uses industry-standard encryption techniques to protect all financial data shared during transactions. Additionally, it adheres to international privacy regulations, including GDPR, ensuring that your personal and financial information is securely handled and never shared without consent.

3. Does Pasonet offer support for recurring payments or subscriptions?

Yes, Pasonet allows users to set up recurring payments for services such as subscriptions, utilities, and memberships. This feature helps individuals and businesses automate regular payments without the need to manually initiate them each time.

4. Can I cancel or dispute a transaction on Pasonet?

Pasonet offers mechanisms for canceling or disputing transactions under specific circumstances. However, the ability to cancel or dispute a payment depends on the type of transaction and the stage at which it is in the payment process. For issues like unauthorized payments or transaction errors, Pasonet provides support to assist users in resolving the matter.

5. What happens if I lose access to my Pasonet account?

If you lose access to your Pasonet account, whether due to a forgotten password or a compromised account, Pasonet provides a recovery process to help you regain access. You will need to verify your identity through a registered email or mobile number to reset your password and secure your account.

6. Is Pasonet available in my country?

Pasonet is expanding its services globally, and while it is available in many countries, it is important to check the specific availability in your region. You can visit the Pasonet website or app to find out if your country is supported for transactions.

7. How does Pasonet protect against fraudulent activity?

Pasonet employs advanced fraud detection tools that monitor transactions in real-time for suspicious activity. It uses machine learning algorithms to identify patterns and prevent fraudulent transactions before they are processed. Additionally, the platform requires multi-factor authentication (MFA) for extra security during sensitive transactions.

8. Are there any limits on the amount I can send or receive using Pasonet?

Yes, Pasonet has set limits on transaction amounts, which may vary depending on the user’s account type (individual or business) and the payment method used. These limits are in place to prevent fraud and ensure that all transactions comply with regulatory standards. You can review your specific limits in your account settings.

9. Can I link multiple payment accounts to Pasonet?

Yes, Pasonet allows users to link multiple payment accounts, including bank accounts, credit cards, and mobile wallets, to a single profile. This flexibility ensures that you can easily choose your preferred payment method for each transaction.

10. How can I get in touch with Pasonet’s customer support?

Pasonet provides multiple channels for customer support, including live chat, email, and phone support. You can reach out to their customer service team for any issues related to account setup, transactions, or technical difficulties. Support is available 24/7 to ensure that users have assistance whenever needed.

11. How do I create an account on Pasonet?

Creating an account is simple. Visit the Pasonet website, sign up with your email or phone number, and link your preferred payment method.

12. Can I use multiple payment methods with Pasonet?

Yes! Pasonet supports linking various payment methods, including bank accounts, credit cards, and mobile wallets.

13. Is Pasonet safe to use for online payments?

Yes, Pasonet employs top-notch security features, including end-to-end encryption, to protect your transactions.

14. How long does a transaction take on Pasonet?

Most transactions are completed within minutes. International transactions may take slightly longer, but they’re still faster than traditional bank transfers.

Here’s a new FAQs section with fresh questions and answers that provide additional insights about Pasonet without repeating content from the main article: