Introduction to QLCredit and the New Era of Finance

In today’s world, getting access to credit is often difficult, especially for those with limited financial history. Traditional credit systems are slow and sometimes unfair. However, QLCredit is changing the game. It uses new technology to make credit accessible for everyone—quickly and fairly.

Overview of the Financial Landscape

For years, people had to rely on banks to get loans and manage credit. But traditional systems have many problems:

- High interest rates

- Long wait times for approval

- Limited access for people without a credit history

As technology improves, new digital platforms are providing faster, easier ways to manage money and get loans. QLCredit is a part of this new wave, offering a digital way to access credit, using AI and alternative data to assess a person’s financial health.

The Traditional Credit Model’s Shortcomings

Traditional credit systems mainly focus on a person’s credit score, which doesn’t always tell the full story. Some problems with traditional credit systems include:

- Limited data: Credit scores don’t consider many important factors like payment history for bills or mobile phone usage.

- Exclusion: Many people with no formal credit history—like freelancers, gig workers, or people in rural areas—struggle to get loans.

- Slow approval process: Traditional loans can take weeks to approve, which isn’t fast enough for today’s world.

The Digital Revolution in Financial Services

Today, more and more people are turning to digital platforms for their financial needs. These platforms use:

- AI-powered credit scoring – to make better decisions based on more data.

- Real-time processing – to approve loans much faster.

- Alternative data sources – like transaction history, social media behavior, or even bill payments, which give a more accurate picture of a person’s financial health.

QLCredit is part of this digital change, offering easier and faster access to loans without relying on traditional credit scores.

The Need for Innovation in Financial Solutions

As the world moves more online, financial systems need to change. Traditional systems just aren’t fast or fair enough. People want:

- Access to credit without needing a traditional credit history.

- Faster loan approvals without long delays.

- More options for borrowing, with flexibility and transparency.

QLCredit is answering these needs. It provides quick, fair loans that are available to people, regardless of their credit history.

What is QLCredit?

QLCredit is a digital credit platform designed to make loans faster, easier, and more accessible. Unlike traditional credit systems, QLCredit uses AI and alternative data to assess a person’s financial health. This means that even if someone has limited or no credit history, they can still get access to loans.

A Next-Generation Digital Credit Platform

QLCredit isn’t like the traditional banks. It works online and uses technology to approve loans and manage credit. Here’s how it works:

- AI-powered decisions: It uses advanced algorithms to understand your financial health.

- Mobile-first: You can apply for loans from your phone, making it easy and accessible from anywhere.

- Faster approval: No more waiting weeks for approval. Loans are processed quickly.

Core Mission of QLCredit

At QLCredit, the goal is simple: to help people access financial support when they need it. The platform is built around inclusivity and fairness. It doesn’t rely on outdated credit scores but uses alternative data to give a more complete picture of a person’s financial life.

Vision for Financial Inclusion and Empowerment

QLCredit believes in a future where:

- Everyone can access credit—even those without a traditional credit history.

- Small businesses get the support they need to grow.

- People can improve their financial health with better tools and education.

QLCredit is focused on breaking down barriers in the financial world, making it easier for everyone to get the credit they need to succeed.

How QLCredit Fits into the Global Fintech Ecosystem

The world of finance is changing fast. QLCredit is part of the larger fintech movement, which is all about using technology to improve financial services. Here’s how QLCredit fits in:

- Decentralized finance (DeFi): Unlike traditional banks, QLCredit uses decentralized systems that allow for quicker, more efficient loans.

- Blockchain technology: It ensures transparency and security in every transaction.

- Global reach: QLCredit aims to provide access to credit for people around the world, especially those in underserved areas.

Philosophy and Differentiation of QLCredit

QLCredit stands out because it doesn’t just focus on giving loans. It’s about:

- Making credit more accessible for everyone.

- Using technology to make the process faster and more fair.

- Providing financial education to help users make better decisions.

AI-Driven Transparency and Accessibility

One of the key features of QLCredit is its AI-powered credit scoring. Unlike traditional systems, which rely on outdated credit scores, QLCredit uses:

- Alternative data: Information like spending habits, mobile phone usage, and social signals are used to assess a person’s creditworthiness.

- Real-time decisions: QLCredit makes decisions quickly, so users don’t have to wait days or weeks to find out if they’re approved.

This approach makes the process more transparent and accessible to more people.

Ethical Lending Practices

At QLCredit, fairness is a priority. The platform ensures that:

- There are no hidden fees or surprise charges.

- All users understand the terms before they agree to any loan.

- Users are educated about responsible borrowing and financial literacy.

Inclusivity as a Core Value

QLCredit aims to help people from all walks of life:

- Freelancers and gig economy workers often struggle to access traditional loans. QLCredit provides them with an opportunity to build their credit and access financing.

- People in rural areas or underserved communities can now get loans, thanks to alternative data and mobile-first technology.

How QLCredit Promotes Financial Well-Being

At QLCredit, the goal isn’t just to lend money—it’s about helping users improve their financial health. The platform offers:

- Financial education tools to help users understand credit and budgeting.

- Personalized financial advice to help people make informed decisions.

- Tools for credit rehabilitation for those looking to improve their financial standing.

By combining credit with education, QLCredit empowers users to make smarter financial choices.

How QLCredit Works

QLCredit uses cutting-edge technology to simplify the credit process, making it faster, more transparent, and accessible for everyone. Here’s a breakdown of how it works:

AI-Powered Credit Assessment

One of the key features of QLCredit is its use of artificial intelligence (AI) to assess creditworthiness. Unlike traditional methods, which rely mainly on credit scores, QLCredit uses a wider range of data sources to get a complete picture of a person’s financial behavior. This includes:

- Behavioral data: This can include spending habits, mobile usage patterns, and even bill payment behavior.

- Alternative data: Information from social signals, business transactions, and even education history can be used to assess creditworthiness.

- Real-time analysis: QLCredit uses AI to make fast and accurate credit decisions, improving the overall loan approval process.

With AI, QLCredit can offer personalized credit assessments, making loans available to people who might otherwise be denied due to traditional credit score limitations.

Instant Approval and Fast Disbursal

A key advantage of QLCredit is the speed at which it processes loans. Traditional financial institutions often take days or even weeks to approve loans. With QLCredit, the process is much faster:

- Instant approval: Once you submit an application, QLCredit uses its AI to assess your financial data and approve loans in real time.

- Fast disbursal: Once approved, the funds are transferred quickly, often within hours. This speed is especially valuable in emergency situations or when funds are needed immediately.

This streamlined process removes much of the bureaucracy that slows down traditional lending systems.

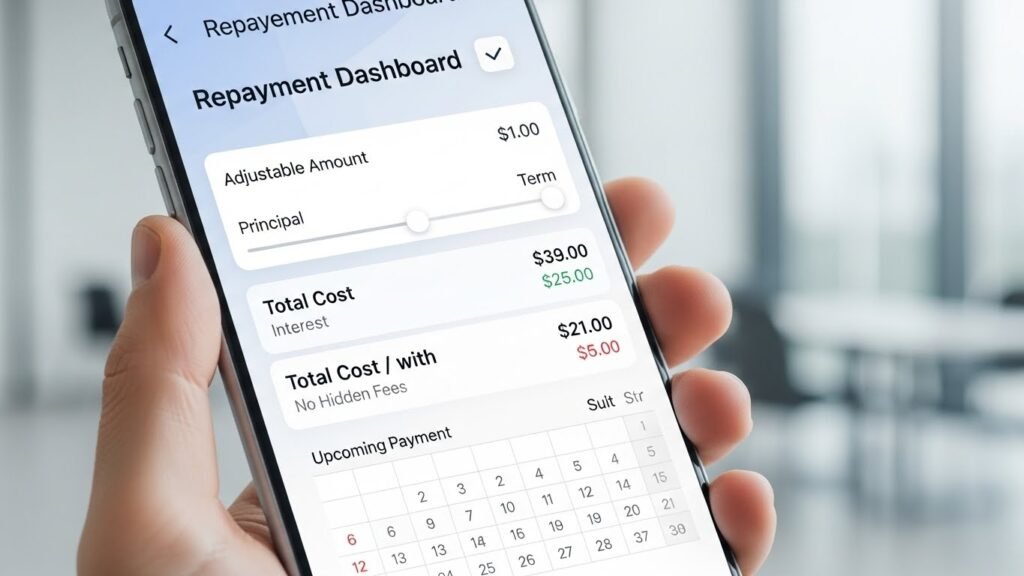

Transparent and Flexible Repayment Options

Another major feature of QLCredit is its commitment to transparency and flexibility when it comes to repayment. Unlike traditional systems that may have hidden fees or unclear terms, QLCredit is upfront about all charges. Some of the key benefits include:

- No hidden fees: All costs are clearly explained before users accept the loan terms.

- Flexible repayment plans: QLCredit offers repayment schedules that work for users, including options for adjusting payments based on income changes.

This flexibility ensures that users can manage their repayments in a way that suits their financial situation.

Key Features of QLCredit

QLCredit stands out not just for its technology, but also for its key features that make credit more accessible and user-friendly. Here’s a look at the most important features:

Accessibility for All

One of QLCredit’s core values is inclusivity. Unlike traditional financial systems that often exclude people with poor or no credit history, QLCredit uses a range of data to ensure everyone has access to credit. This includes:

- Individuals with limited credit history: Using alternative data sources, QLCredit can assess people who might otherwise be turned away by traditional banks.

- Mobile-first design: The platform is optimized for mobile devices, making it easier for people to access credit from anywhere.

- Global reach: QLCredit aims to serve underserved populations around the world, particularly those in rural or remote areas.

By offering these services, QLCredit is ensuring that more people have access to the financial products they need.

Financial Education Tools

QLCredit believes that financial well-being goes beyond just offering loans. The platform is designed to help users improve their financial knowledge, with tools such as:

- Credit education hub: Resources that explain how credit works, how to improve your credit score, and tips for responsible borrowing.

- Guides for financial planning: Step-by-step guides to help users create budgets, save for the future, and manage their debts.

- Interactive tools: Educational content that engages users and helps them understand their financial habits.

These tools empower users to take control of their finances, helping them to make informed decisions about borrowing and saving.

Security and Data Protection

In the digital age, security is paramount. QLCredit uses state-of-the-art measures to protect user data and ensure privacy:

- Data encryption: All personal and financial data is encrypted, ensuring that it remains secure.

- Two-factor authentication (2FA): To enhance account security, QLCredit uses 2FA to ensure only authorized users can access their accounts.

- Blockchain-inspired encryption: QLCredit employs blockchain technology to secure transactions and keep data tamper-proof.

These measures ensure that users’ personal information is safe and that their financial activities are protected from fraud.

Reward and Loyalty Programs

QLCredit understands the importance of building long-term relationships with its users. That’s why the platform offers various reward and loyalty programs, including:

- Cashback offers: Users can earn cashback for making timely repayments or for referring new customers to QLCredit.

- Loyalty bonuses: Long-term customers can earn bonuses as a reward for responsible borrowing.

- Discounts on future loans: Repeat borrowers may receive discounts or lower interest rates on future loans.

These programs encourage responsible financial behavior while also rewarding loyal customers.

Advantages of Using QLCredit

Using QLCredit comes with a range of benefits that make it an attractive alternative to traditional financial systems. Here’s why QLCredit is a top choice for modern borrowers:

Simplified Loan Process

Traditional loan applications can be a hassle, requiring a lot of paperwork and long waiting periods. QLCredit simplifies the entire process:

- No paperwork: All applications are done digitally, removing the need for physical forms and signatures.

- Quick approvals: Thanks to AI, QLCredit can approve loans in real time.

- Easy-to-understand terms: Users can easily understand the terms of their loan, ensuring there are no surprises later on.

This streamlined process saves time and makes borrowing easier for everyone.

Improved Financial Inclusion

QLCredit is dedicated to improving financial inclusion, making sure that people who have been traditionally excluded from the credit system can get access to financial services. Here’s how it helps:

- Serving the unbanked: Many people around the world don’t have access to banking services. QLCredit provides an alternative, giving people access to credit without relying on traditional banks.

- Support for small businesses: Small businesses and entrepreneurs who may not qualify for loans from traditional banks can turn to QLCredit for the capital they need to grow.

This focus on inclusion helps to close the gap in financial services, providing opportunities for everyone.

Transparency and Trust

Trust is essential when it comes to financial services. QLCredit builds trust with its users by offering:

- Clear terms: All loan terms are explained upfront, so users know exactly what they’re agreeing to.

- No hidden fees: Unlike many traditional financial services, QLCredit has a no hidden fees policy, making the entire loan process transparent.

By being open about its fees and terms, QLCredit creates a sense of trust with its users, which is crucial for building long-term relationships.

24/7 Accessibility

Another great feature of QLCredit is that it’s always available. Traditional banks often have limited hours, and loan applications can only be submitted during business hours. With QLCredit, you can:

- Apply anytime: The platform is available 24/7, so you can apply for loans whenever you need.

- Check loan status: You can track the progress of your loan application and repayment anytime.

- Access from anywhere: Since QLCredit is mobile-first, you can manage your finances on the go, wherever you are.

This round-the-clock accessibility makes managing your credit easier and more convenient than ever before.

The Technology Behind QLCredit

The success of QLCredit is built on a foundation of innovative technology that drives efficiency, accuracy, and security in credit lending. Let’s take a closer look at the cutting-edge technologies that power QLCredit.

Artificial Intelligence and Machine Learning

One of the key technological drivers of QLCredit is artificial intelligence (AI). The platform uses AI to assess credit risk, ensuring that loan approvals are based on more than just traditional credit scores. Here’s how AI benefits QLCredit:

- Data-Driven Decisions: AI models analyze various data sources such as transaction histories, social behavior, and other non-traditional financial indicators to assess a person’s ability to repay a loan.

- Predictive Modeling: By predicting the likelihood of repayment, QLCredit can make smarter lending decisions in real-time, allowing more individuals to access credit.

- Improved Accuracy: AI can process and analyze vast amounts of data much faster than humans, improving the accuracy of loan approvals and reducing errors.

Blockchain Integration

QLCredit integrates blockchain technology to enhance transparency, security, and data integrity. Blockchain ensures that every transaction is recorded in a secure, immutable ledger. Here’s how blockchain improves QLCredit:

- Security: Blockchain uses cryptographic techniques to ensure that all financial transactions are secure and resistant to tampering.

- Transparency: All transactions are visible to parties involved, enhancing the trust between users and the platform.

- Decentralization: By decentralizing data storage, QLCredit reduces the reliance on centralized databases, minimizing the risk of data breaches.

Blockchain technology ensures that QLCredit operates securely, providing peace of mind to users who may be concerned about data privacy and security.

Cloud-Based Infrastructure

A cloud-based infrastructure allows QLCredit to scale efficiently and offer seamless services to users worldwide. Here’s how it benefits QLCredit:

- Scalability: The cloud infrastructure allows QLCredit to easily scale as more users join the platform, ensuring that it can handle an increasing number of loan applications without compromising performance.

- Real-Time Processing: Cloud-based technology ensures that data is processed in real-time, enabling quick loan approvals and rapid disbursal of funds.

- Global Accessibility: Since the platform is hosted in the cloud, users from all around the world can access QLCredit from any device, whether they’re using a mobile phone or a computer.

This cloud infrastructure makes QLCredit a fast, reliable, and accessible platform, ensuring that users can always manage their finances with ease.

Real-Life Impact Stories and Case Studies

While QLCredit is built on advanced technology, its real power lies in the impact it has on people’s lives. Let’s look at some real-life examples of how QLCredit has helped individuals and businesses improve their financial situations.

Testimonials from Users

QLCredit has made a significant difference for many users by offering access to credit when they needed it most. Here are a few stories from people who have benefited from QLCredit:

- Freelancers and Gig Workers: Many freelancers struggle to access traditional loans due to the lack of a regular paycheck. With QLCredit, a freelance web developer in New York was able to secure a business loan to expand their services. The AI-powered system assessed their transaction history and social signals, providing them with a personalized loan offer that met their needs.

- Small Business Owners: A small entrepreneur in rural India had been struggling to get a loan from traditional banks. After turning to QLCredit, they were able to get the funds needed to purchase new equipment and hire employees, allowing their business to grow and thrive.

These stories show that QLCredit is not just a financial tool—it’s an empowering force that enables individuals and businesses to reach their goals.

Case Studies of Financial Empowerment

In addition to individual stories, QLCredit has helped entire communities access the financial support they need:

- Microloans for Rural Communities: In remote areas where traditional banks are absent, QLCredit has provided microloans to individuals in need. These loans have helped farmers buy seeds and tools, small shop owners stock their businesses, and local artisans expand their operations.

- Gig Economy Support: In countries with large gig economies, QLCredit has empowered gig workers by providing easy access to loans based on non-traditional data such as payment history for short-term gigs. This has allowed workers to smooth out income fluctuations and plan for the future.

These case studies highlight how QLCredit is helping underserved populations by offering credit in places where traditional financial services may not be available.

Data Privacy and Security: A Top Priority

As the digital finance space grows, so does the need for robust data protection. QLCredit takes data security very seriously, ensuring that all transactions are safe and that users’ personal information is protected at all costs.

Protecting User Data

QLCredit employs state-of-the-art encryption techniques to protect sensitive user data. Some of the key security measures include:

- Data Encryption: All financial data and personal information is encrypted, ensuring that it can’t be accessed by unauthorized parties.

- Biometric Verification: Users can secure their accounts with biometric verification (fingerprint or facial recognition), adding an extra layer of security.

- Secure Communication Channels: All communication between the user and QLCredit is secured through encrypted channels, minimizing the risk of data breaches.

These measures ensure that users can trust QLCredit with their financial information, knowing it is secure and protected.

Commitment to Privacy Regulations

QLCredit is committed to following global privacy standards, including the General Data Protection Regulation (GDPR), which ensures that users’ data is handled with the utmost care and responsibility.

- Data Transparency: Users are always informed about how their data is being used, and they can easily opt-out or delete their data if they choose.

- Compliance with Global Standards: QLCredit regularly audits its security and privacy practices to ensure compliance with global regulations, offering users confidence in the platform’s privacy protection measures.

Ongoing Security Measures

The world of cybersecurity is always changing, and QLCredit continually upgrades its security measures to stay ahead of potential threats. This includes:

- Regular Security Audits: The platform undergoes frequent security audits to identify and fix any vulnerabilities.

- Dark Web Monitoring: QLCredit monitors the dark web for any signs of stolen user data, ensuring prompt action if necessary.

- Two-Factor Authentication (2FA): Users are required to enable 2FA for added account protection, making it much harder for unauthorized users to gain access to accounts.

These ongoing security efforts ensure that QLCredit remains a safe and secure platform for users to access financial services.

The Future of Credit: QLCredit’s Vision for 2030

QLCredit isn’t just changing the way we access credit today—it’s shaping the future of finance. With plans to expand globally and innovate further, QLCredit is focused on creating a more inclusive, efficient, and accessible financial system for the future.

Innovation and Technological Advancements

The future of QLCredit is built on continued technological innovation. The platform is constantly evolving to include cutting-edge technologies that push the boundaries of what digital finance can achieve. Some of the innovations we can expect include:

- Next-Generation AI: As AI technology advances, QLCredit will leverage more sophisticated algorithms to predict and manage credit risk, improving the accuracy of loan decisions.

- Machine Learning Algorithms: These will continue to evolve, becoming even more precise in assessing financial behavior, identifying trends, and offering personalized lending solutions.

- Voice and Facial Recognition for Loan Approvals: In the future, users may be able to use voice or facial recognition to approve loans, enhancing security and convenience.

By incorporating the latest technologies, QLCredit will continue to improve the loan approval process, making it even faster and more user-friendly.

Expanding Global Reach

QLCredit has always been focused on breaking down financial barriers for underserved populations. As part of its long-term vision, QLCredit is planning to expand into new global markets. The goal is to reach:

- The unbanked and underbanked populations: People in rural or remote areas who have limited access to traditional banking services will benefit from QLCredit’s mobile-first approach.

- Emerging markets: QLCredit is targeting countries with growing economies, where the demand for accessible credit is on the rise, but traditional banking infrastructure is lacking.

- Global partnerships: To facilitate this expansion, QLCredit is forming partnerships with local financial institutions, governments, and fintech companies to create a seamless, accessible credit ecosystem.

With this global expansion, QLCredit aims to bring its innovative lending solutions to millions of people worldwide who are currently excluded from traditional credit systems.

Financial Inclusion as a Global Goal

At the heart of QLCredit’s mission is financial inclusion. The platform is committed to providing access to credit for individuals and businesses that are typically overlooked by traditional financial systems. Some of the ways QLCredit is advancing financial inclusion include:

- Providing access to underserved communities: By using alternative data sources, QLCredit is able to provide credit to people without traditional credit scores, including gig workers, freelancers, and small business owners.

- Supporting women and minority groups: QLCredit focuses on empowering women and minority groups by offering credit products that help them build a financial future, whether for personal needs or business development.

- Low-cost microloans: QLCredit is exploring the possibility of offering microloans to help people in developing countries start small businesses or cover emergency expenses.

By focusing on financial inclusion, QLCredit is helping to create an equitable financial system where everyone has access to the resources they need to succeed.

Shaping the Future of Digital Finance

QLCredit is at the forefront of the digital finance revolution. The platform’s mobile-first approach, combined with AI-powered credit assessment, is helping to redefine how credit works in the modern world. As digital finance continues to grow, QLCredit aims to:

- Make credit more accessible to people everywhere, especially those who are currently excluded from traditional financial systems.

- Simplify financial services by using technology to remove barriers and make borrowing and lending easier.

- Promote financial literacy to ensure that users understand how to manage credit responsibly and make smart financial decisions.

The vision for QLCredit in 2030 is one where the platform continues to lead in innovation, creating a seamless, transparent, and user-friendly digital finance experience for all.

How to Get Started with QLCredit

Getting started with QLCredit is simple and user-friendly. Whether you’re applying for a personal loan, a small business loan, or simply looking to build your credit, QLCredit makes the process quick and straightforward.

Step-by-Step Guide for New Users

To get started, follow these easy steps:

- Sign Up: Create an account on the QLCredit platform, either through the website or the mobile app.

- Complete Your Profile: Fill in basic details about yourself, such as your financial history, income, and spending habits.

- Submit Your Application: Choose the loan type you need, whether it’s for personal use, a small business, or an investment.

- Get Instant Approval: Thanks to AI-powered credit assessments, you’ll receive an instant loan decision, typically within minutes.

- Receive Funds: Once approved, funds are disbursed quickly, often within hours.

What to Expect During the Loan Process

The loan process with QLCredit is fast and transparent:

- Clear terms: All loan terms, including repayment schedules, interest rates, and fees, are clearly outlined.

- Real-time updates: You’ll be able to track the status of your application and funds in real time through the platform.

- Flexible repayments: Choose from a variety of repayment options that work for your financial situation.

Benefits of Using QLCredit’s Mobile App

The QLCredit mobile app provides users with easy access to their credit, making it simple to:

- Manage loans: Track your loan balance, repayments, and due dates right from your phone.

- Apply for loans: Quickly apply for loans from anywhere, at any time.

- Access financial education: Take advantage of the educational tools provided to improve your financial knowledge and credit score.

With the QLCredit app, managing your finances has never been easier.

Conclusion

Recap of QLCredit’s Impact on Modern Finance

QLCredit is at the forefront of transforming how people access credit. By leveraging technology like AI, blockchain, and mobile-first design, QLCredit offers a more accessible, transparent, and efficient way for individuals and businesses to obtain financial resources. The platform’s commitment to financial inclusion, security, and flexibility makes it a standout in the fintech industry.

The Road Ahead for QLCredit and Financial Inclusion

As QLCredit continues to expand its services globally, it will play a key role in bridging the gap between traditional financial systems and the unbanked populations. The focus on financial inclusion will ensure that more people, regardless of their background, have access to the financial support they need to succeed.

Final Thoughts on the Future of Digital Lending

Looking ahead, QLCredit will continue to drive innovation in the digital finance space, creating a more inclusive and sustainable financial ecosystem. With its focus on ethical lending, AI-powered credit scoring, and financial literacy, QLCredit is helping to shape the future of lending and credit. By making credit more accessible, the platform is not just changing the way we borrow money, but also empowering individuals and businesses to take control of their financial futures.

FAQs

What is QLCredit, and how does it work?

QLCredit is a digital credit platform that uses AI and alternative data to assess creditworthiness. It offers fast, transparent, and accessible loans to individuals and businesses, especially those who may not qualify for traditional credit through conventional banks. By utilizing mobile-first technology and decentralized finance (DeFi), QLCredit ensures quick loan approval and flexible repayment options.

Who can use QLCredit?

Anyone can use QLCredit, especially those who have limited or no traditional credit history. This includes:

- Freelancers and gig economy workers

- Small business owners

- People in rural or underserved areas

- Individuals with poor or no credit scores

If you have access to a smartphone or the internet, you can apply for a loan through the QLCredit platform.

How does QLCredit assess creditworthiness without traditional credit scores?

Unlike traditional credit systems that rely solely on credit scores, QLCredit uses alternative data to assess a person’s financial behavior. This data can include:

- Transaction history

- Social signals (like mobile usage patterns and bill payment behavior)

- Business transaction records

- Other non-traditional data sources that provide a clearer picture of a person’s ability to repay a loan

How long does it take to get approved for a loan through QLCredit?

The approval process on QLCredit is fast, thanks to its use of AI. In most cases, loan approvals are completed within minutes after submitting your application. Funds can also be disbursed quickly, often within hours.

Are there any hidden fees when using QLCredit?

No, QLCredit is committed to transparency. All fees, including interest rates and repayment terms, are clearly outlined before you agree to the loan. There are no hidden fees, and you will always know exactly what you’re paying for.

What types of loans are available through QLCredit?

QLCredit offers a variety of loan options, including:

- Personal loans for individuals in need of financial support

- Small business loans for entrepreneurs and small business owners

- Microloans for underserved communities

- Emergency loans for urgent financial needs

Is QLCredit available worldwide?

Yes, QLCredit is available globally. The platform is designed to serve users from around the world, especially in areas where traditional banking services may be limited. Whether you live in an urban area or a remote location, you can access QLCredit’s services through the mobile app or website.

How does QLCredit ensure data privacy and security?

QLCredit takes data security seriously. The platform uses advanced security measures, including:

- Data encryption to protect user information

- Two-factor authentication (2FA) for extra account security

- Blockchain technology for secure, transparent transactions

Additionally, QLCredit adheres to global privacy standards such as GDPR, ensuring your data is handled with care and transparency.

Can I apply for a loan with QLCredit if I have no credit history?

Yes, QLCredit is specifically designed to provide credit to individuals who may not have a traditional credit history. The platform uses alternative data sources, like transaction history, to assess creditworthiness and approve loans. This makes it easier for people without credit scores to access financial support.

What happens if I can’t repay my loan on time?

QLCredit offers flexible repayment options. If you’re unable to make a payment on time, you can:

- Contact customer support to discuss your situation and explore alternative repayment plans.

- Request an extension if needed, depending on your financial situation.

It’s important to communicate with QLCredit if you foresee any difficulties with repayment. They work with customers to ensure that repayments remain manageable.

How does QLCredit ensure responsible lending?

QLCredit follows ethical lending practices by:

- Assessing creditworthiness fairly through the use of alternative data.

- Providing clear terms with no hidden fees.

- Offering financial education to help users understand their credit, manage their finances, and avoid falling into debt.

The goal is to ensure that users are not overburdened by debt and can make responsible borrowing decisions.

Can I increase my credit limit with QLCredit?

Yes, if you have been using QLCredit responsibly and have been making timely repayments, you may be eligible for a credit limit increase. QLCredit uses AI to evaluate your financial behavior, and as you build your credit history with them, your credit limit can grow.

What makes QLCredit different from traditional banks?

QLCredit is different from traditional banks in several ways:

- Faster approval: Thanks to AI and alternative data, loans are approved in minutes.

- No need for a credit score: It uses alternative data like transaction history, mobile behavior, and business transactions.

- Mobile-first: The platform is designed for easy access via mobile devices, allowing users to apply for loans and manage their finances on the go.

- Global accessibility: QLCredit serves underserved populations worldwide, especially those who don’t have access to traditional banking services.

Is QLCredit suitable for small businesses?

Yes, QLCredit is an excellent option for small businesses. It offers:

- Small business loans to help entrepreneurs grow their businesses.

- Fast access to capital, with no need for lengthy approval processes.

- Flexible terms that can be adjusted to suit the business’s needs.

How can I track my loan status with QLCredit?

Once you’ve applied for a loan, you can easily track its status through the QLCredit app or website. The platform provides real-time updates on the loan approval process, repayment schedule, and any changes to your loan status. You will also receive notifications about due dates and payment reminders.

How does QLCredit handle customer support?

QLCredit provides excellent customer support through:

- 24/7 online support: You can reach customer service at any time through the app or website.

- Dedicated support team: A team of professionals is available to help with any questions, concerns, or issues you may have regarding your loan or account.

Support is always available to ensure a smooth user experience.